Resources built for MSPs

Subscribe to our stories

How MSPs Can Reduce Credit Card Chargebacks: Practical Strategies for MSP Financial Teams

Credit card chargebacks can drain MSP revenue and disrupt cash flow. This guide explains why MSPs are vulnerable to disputes and shares seven proven strategies to prevent chargebacks before they happen—ensuring smoother, more secure payments.

What Happened to Wise-Sync? A Look at WisePay’s Evolution

Curious about what happened to Wise-Sync? This article explores the evolution of WisePay, what changed after the rebrand, and how it compares to modern MSP payment platforms. Learn what MSPs need to know before choosing their next payment solution.

Streamlining MSP Payment Operations: A Guide to MSP Payment and PSA Software Integration

Integrating PSA software with your MSP payment system can transform your billing operations. This guide explains the benefits of seamless PSA integration, including improved accuracy, reduced manual work, and faster payment cycles.

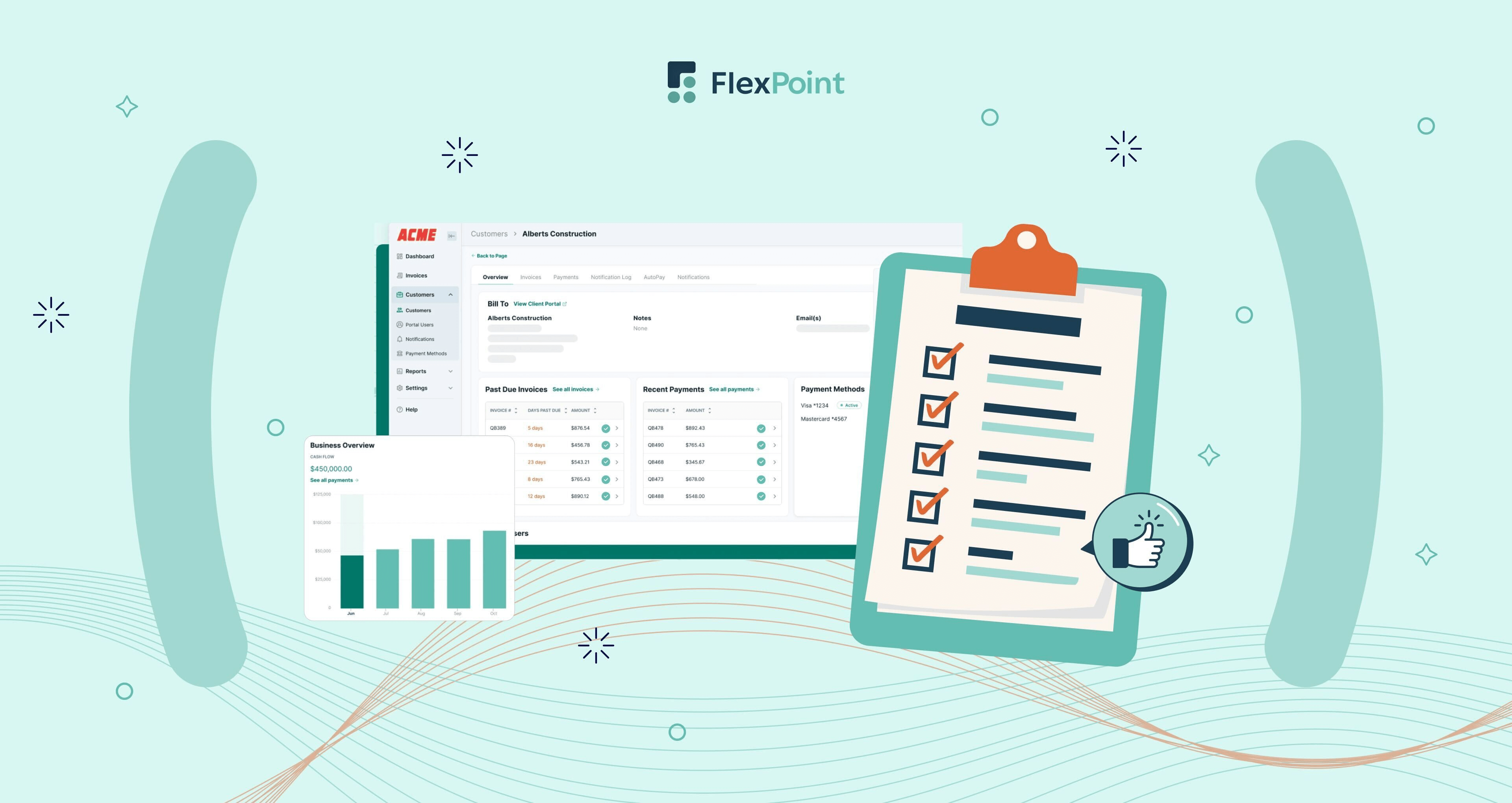

The Ultimate Guide to MSP Payment Best Practices: Ensuring Smooth and Secure Transactions

Discover the best practices for MSP payment processes, from setting clear policies to automating billing and integrating software. This guide offers actionable tips to streamline collections, reduce errors, and improve cash flow.

What is a Credit Card Surcharge? Understanding Costs and Benefits for MSPs

Considering credit card surcharging for your MSP? This guide explains how customer surcharges work, their legal considerations, and how they can help you offset processing fees while maintaining transparency and trust with clients.

Tackling MSP Late Payments: Effective Strategies to Minimize Delays and Enhance Cash Flow

Struggling with late payments from MSP clients? This article explores root causes and offers proven strategies—like automated reminders, flexible payment options, and clear terms—to reduce delays and improve cash flow consistency.

How to Resolve Payment Errors: A Guide for Managed Service Providers

Avoid costly mistakes in your MSP’s payment process. This guide highlights common billing and reconciliation errors and offers practical tips to improve accuracy, reduce chargebacks, and streamline financial operations.

MSP Guide to Payments Security: How to Safeguard Your Transactions and Maintain Client Confidence

Ensure secure payment processing for your MSP with best practices in data protection and compliance. This article covers key security threats, prevention strategies, and tools to safeguard client data and maintain trust.

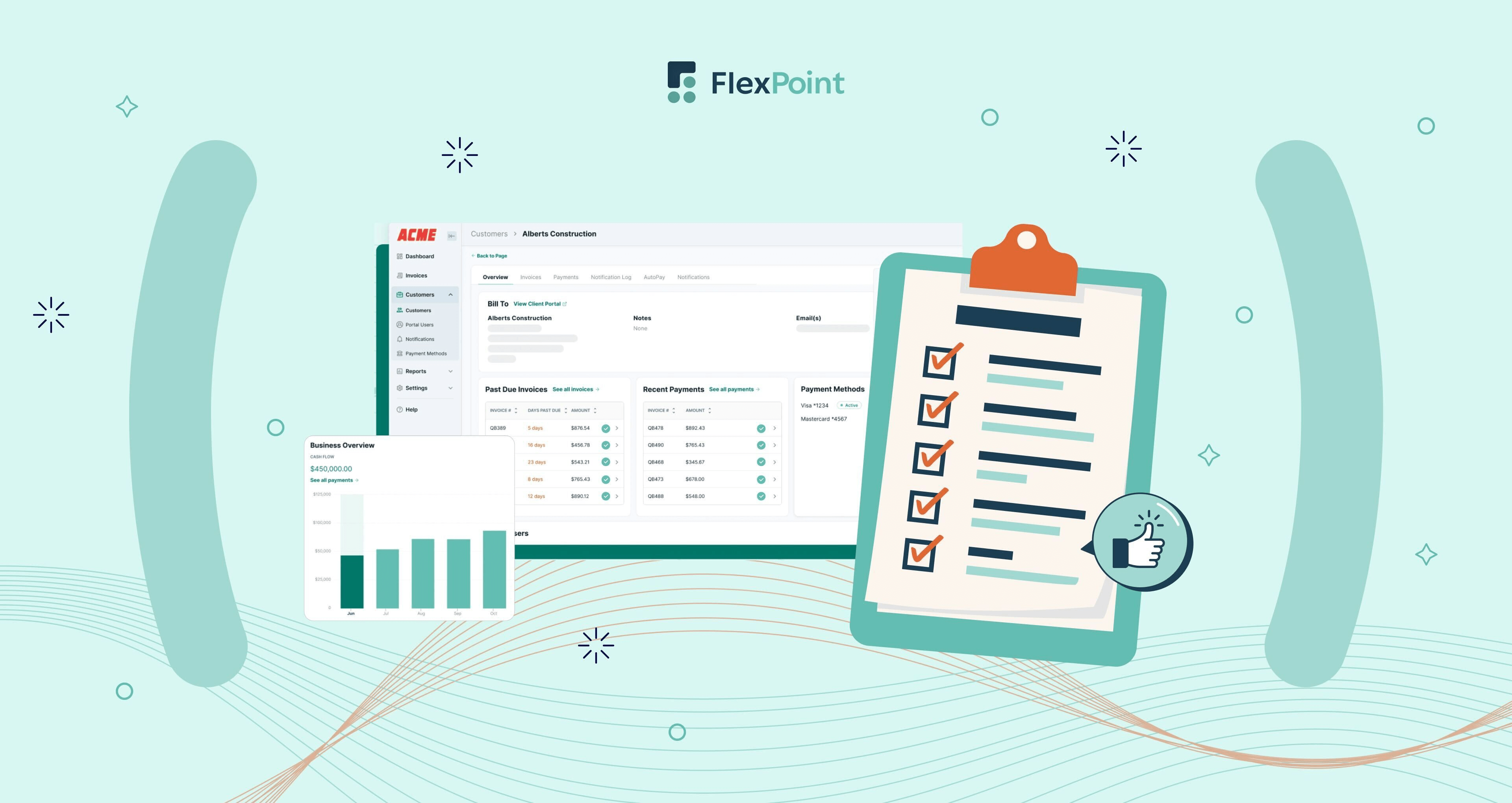

MSP Success Stories: The FlexPoint Advantage in Automated MSP Payments

See how leading MSPs are transforming their billing operations with payment software. This collection of success stories highlights real-world results, including faster collections, reduced costs, and improved client satisfaction.

How to Enhance Client Onboarding with Streamlined MSP Payment Processes

Streamline client onboarding and set the stage for smooth payments from day one. This guide covers onboarding best practices for MSPs, including contract clarity, payment setup, and client education to reduce friction and ensure long-term success.

Understanding MSP Payment Regulations: A Guide to Compliance and Best Practices

Stay compliant and secure with this guide to MSP payment regulations. Learn the key rules, industry standards, and best practices to help your business avoid penalties, protect client data, and build trust through transparent financial operations.

The Benefits of Same-Day ACH for MSPs

Explore the benefits of Same-Day ACH for MSPs, including faster payments, improved cash flow, and enhanced client satisfaction. This article explains how Same-Day ACH works and how it can give your business a competitive edge.

FlexPoint vs. Traditional Payment Methods: A Comparative Analysis for MSPs

Compare FlexPoint with traditional MSP payment methods and discover how automation, integration, and client-focused features can streamline billing, reduce costs, and enhance financial operations.

Everything You Should Know About Same-Day ACH

Same-Day ACH payments offer MSPs faster transaction times and improved cash flow. This guide explains how they work, the benefits for your billing process, and what to consider when implementing them for your clients.

Adapting to Change: Key MSP Payment Trends and How to Leverage Them for Growth

Stay ahead with the latest MSP payment trends shaping the industry in 2025. This article explores automation, AI, flexible payment options, and compliance updates to help your MSP adapt and thrive in a rapidly evolving landscape.

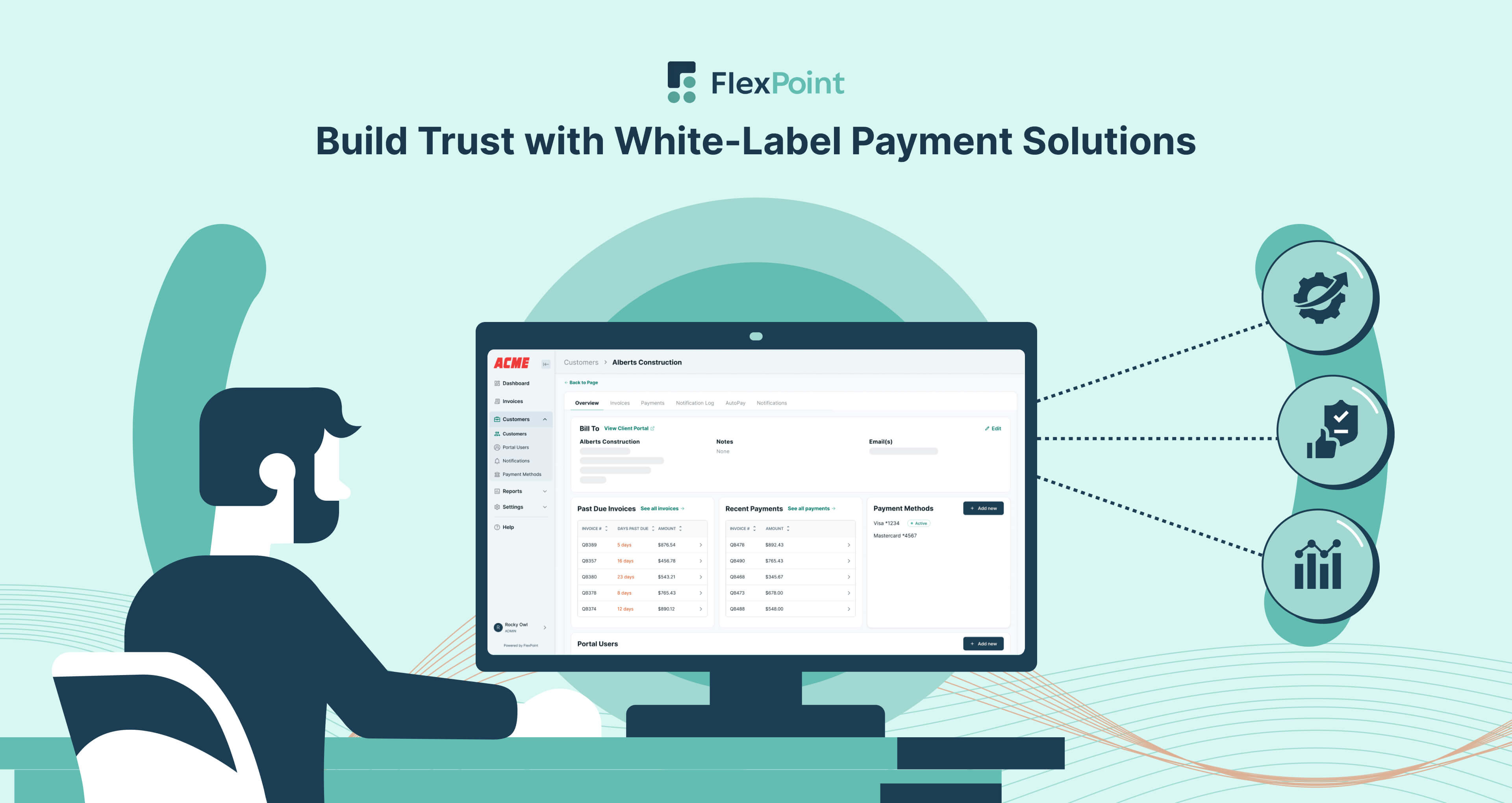

How FlexPoint Transforms MSP Payment Automation: Streamlining Financial Operations

Discover why FlexPoint is the leading choice for MSPs seeking efficient payment automation. This guide outlines FlexPoint’s comprehensive features, including automated invoicing, seamless integration, enhanced security, and client-focused payment solutions that streamline financial operations and boost productivity.

How MSPs Can Improve Client Relationships by Personalizing Payment Solutions

Personalized payment experiences can strengthen client relationships and boost retention for MSPs. This article shares strategies for tailoring payment options, communications, and workflows to meet client preferences and enhance satisfaction.

Mastering MSP Payment Reconciliation: A Comprehensive Guide for Seamless Financial Management

Master the essentials of MSP payment reconciliation to ensure seamless financial management. This comprehensive guide covers the importance of accurate reconciliation, common challenges, and practical solutions, helping MSPs maintain financial health and regulatory compliance.

Unlocking Insights with Payment Analytics: A Guide for MSPs on Leveraging Payment Software Analytics

Unlock the power of payment analytics for MSPs with insights into data collection, processing, and actionable trends. This guide explores how analytics can enhance cash flow, improve client retention, and streamline financial operations.

Mastering MSP Payment Reporting: Essential Tools and Tips for Accurate Financial Insights

Master accurate payment reporting for MSPs with essential tools and strategies. This guide addresses common challenges, from manual entry to compliance, and offers tips on using automation and integration for reliable financial insights and improved cash flow management.

How AI Transforms Payment Processing for Managed Service Providers

Explore how AI transforms payment processing for MSPs, from automating routine tasks to enhancing fraud detection. This guide covers the benefits of AI-driven tools, helping MSPs improve accuracy, efficiency, and client satisfaction in their financial operations.

MSP Payment Automation: Combining Efficiency with a Personalized Approach

Learn how MSP payment automation combines efficiency with a personalized approach. This guide explains the benefits of automating payments, from reducing errors and saving time to enhancing client retention by offering flexible, client-focused billing options.

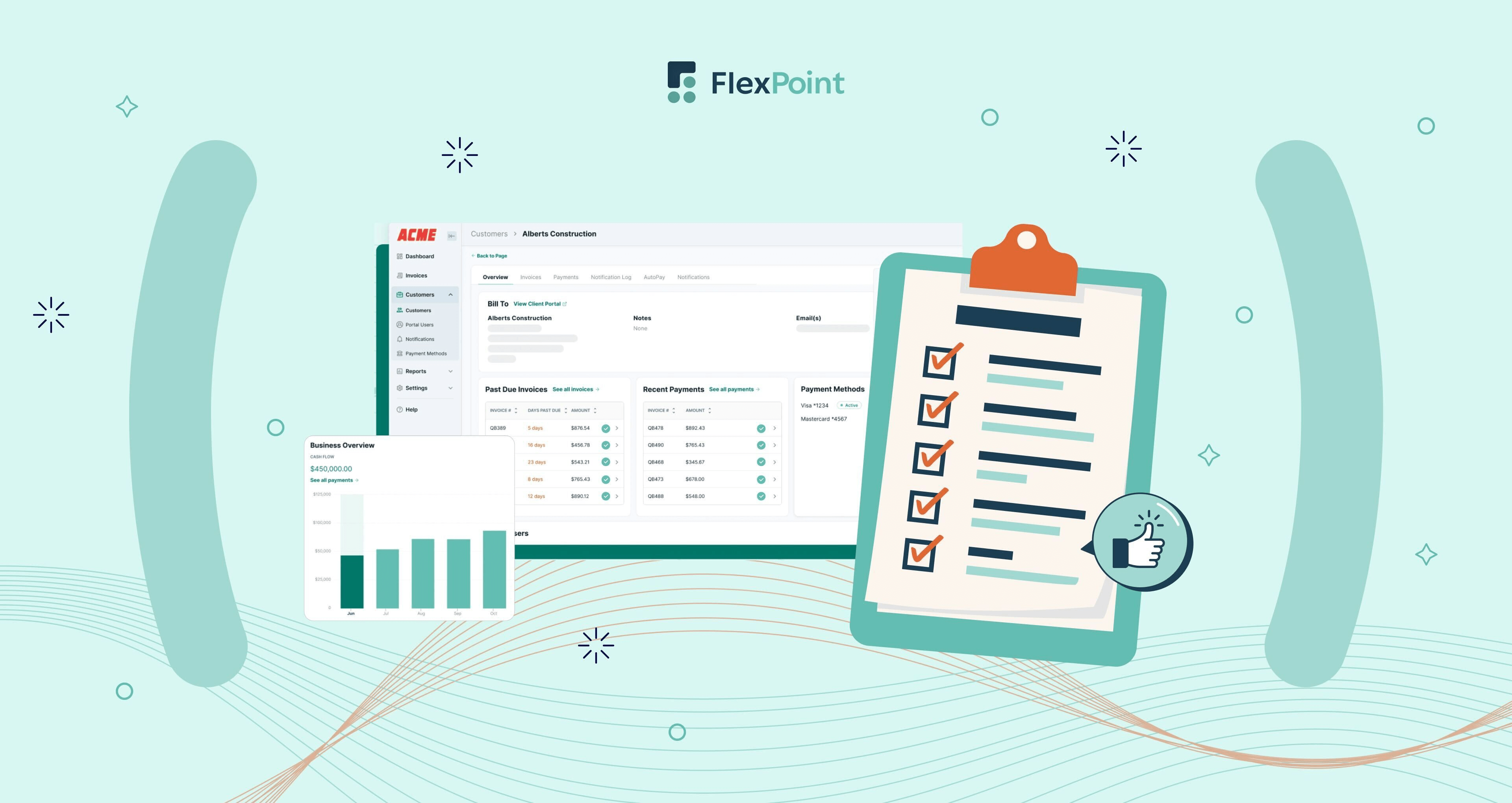

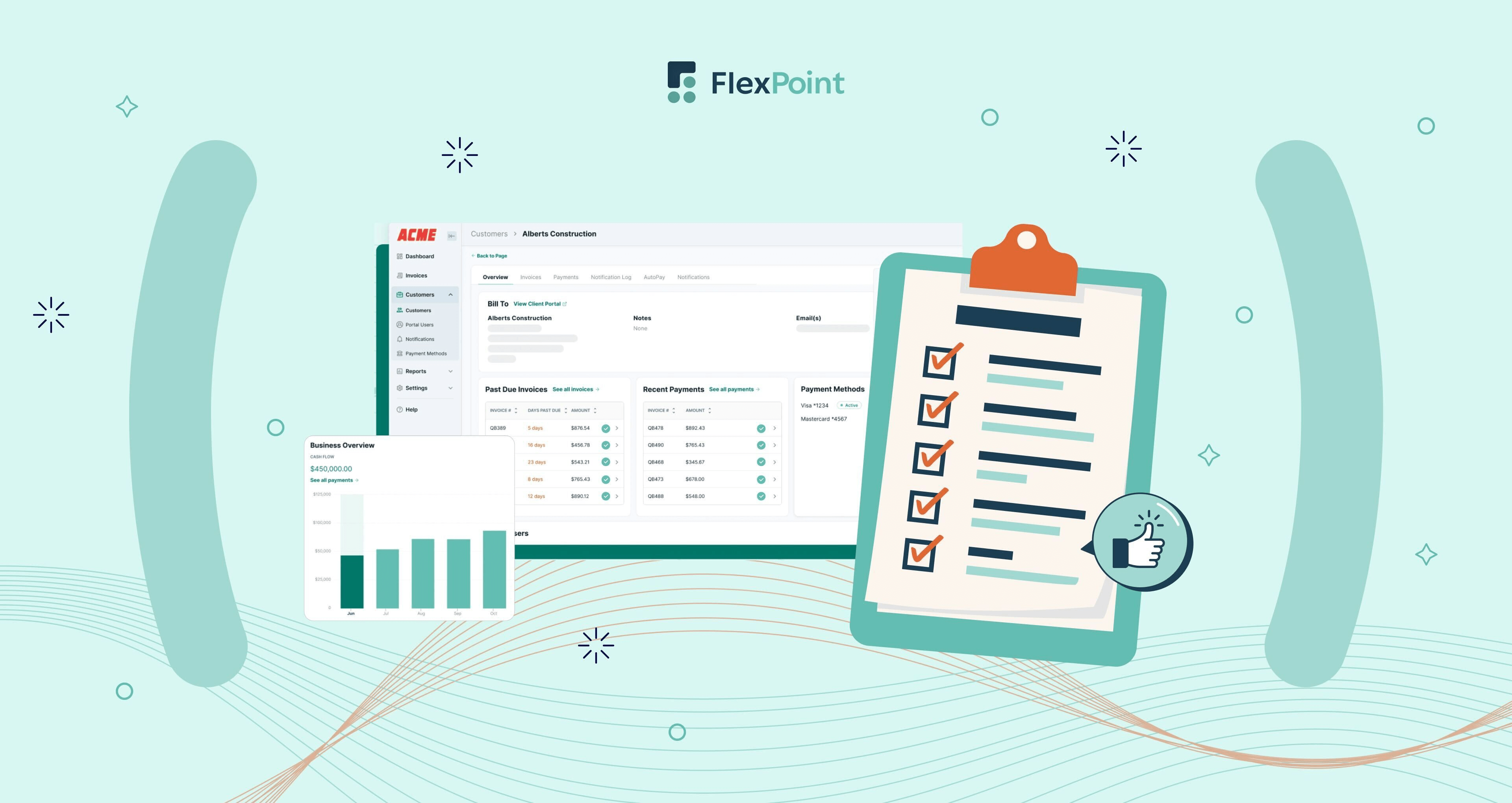

Mastering MSP Payments Audit: A Comprehensive Guide to Streamlining Your Financial Checks

Master the art of MSP payment audits with this comprehensive guide. Learn how audits can help you identify revenue leaks, improve risk management, ensure regulatory compliance, and enhance financial transparency, safeguarding your MSP’s financial health.

Optimizing Recurring Payments for MSPs: Enhancing Collection Efficiency and Reliability

Optimize recurring payments for your MSP with proven strategies to enhance collection efficiency and reliability. This guide covers essential best practices, from automated billing and flexible payment options to proactive communication and error handling, ensuring smooth operations and client satisfaction.

Unlocking Payment Flexibility: Best MSP Payment Options for Enhanced Client Satisfaction

Explore the best MSP payment options and methods to enhance client satisfaction and streamline your billing processes. This guide covers traditional and modern payment methods, highlighting the advantages of flexible options like ACH transfers, digital wallets, and Buy Now, Pay Later, to improve cash flow and operational efficiency.

Understanding Interchange Fees: A Comprehensive Guide for MSPs

Understand the complexities of credit card interchange fees and their impact on MSP profitability. This guide explains what interchange fees are, why they matter for MSPs, and effective strategies to manage and minimize these costs, helping improve cash flow and client relations.

How to Reduce Payment Friction for MSPs: Key Techniques for Smoother Financial Operations

Learn techniques to reduce payment friction for MSPs and improve cash flow. This guide identifies common challenges like outdated infrastructure and complex procedures, providing actionable strategies to streamline payments and enhance client satisfaction.

Mastering ACH Payments: Essential Strategies for MSPs to Optimize Financial Transactions

Master the essentials of ACH payments for your MSP. This guide explains how ACH can improve cash flow, reduce transaction costs, and enhance payment reliability. Learn best practices and strategies for implementing ACH to benefit your financial operations and client relationships.

Navigating MSP Payment Terms: Best Practices for Client-Focused Solutions

Establish client-focused MSP payment terms with best practices for clarity, flexibility, and enforcement. This guide offers strategies to prevent disputes, improve cash flow, and strengthen client relationships by setting clear payment expectations.

Building Trust and Clarity: A Guide to Transparent MSP Payment Policies for Clients

Establish transparent MSP payment policies that build client trust and improve cash flow. This guide covers best practices, common challenges, and effective strategies for implementing clear and consistent payment terms to enhance satisfaction and financial stability.

Streamlining MSP Payment Cycles: A Guide to Quicker Client Payments

Optimize your MSP’s cash flow by streamlining payment cycles. This guide covers challenges like inconsistent billing and manual invoicing and offers strategies for automating payments, enhancing client relationships, and boosting operational efficiency.

Understanding ACH vs. Credit Card Payments for MSPs: A Comprehensive Guide

Understand the key differences between ACH and credit card payments for MSPs. This guide compares cost-effectiveness, security, processing speed, and client preferences to help you make the best payment decision for your business and clients.

Streamline MSP Payment Operations: Accounting Software Integration for Enhanced Efficiency

Streamline your MSP’s financial operations by integrating payment and accounting software. This guide explores the benefits, including improved billing accuracy, reduced manual work, and enhanced security, ensuring better financial management and client satisfaction.

Navigating MSP Client Payment Refunds: A Step-by-Step Guide for Efficient Processing

Learn how to efficiently manage MSP client payment refunds with a step-by-step guide. This article covers best practices for handling refunds, improving client satisfaction, and avoiding costly disputes, ensuring your refund process is smooth and compliant.

MSP Payment Challenges: Common Issues and How to Overcome Them

MSPs face several payment challenges, from delayed payments to complex billing cycles. This guide outlines the top issues MSPs encounter and offers actionable strategies to overcome them, helping improve cash flow, enhance client relationships, and boost operational efficiency.

Elevating MSP Payment Experiences: Enhancing Client Satisfaction and Efficiency

Discover how to enhance client satisfaction by improving MSP payment experiences. This guide explores common challenges, such as billing errors and outdated payment systems, and offers proven strategies to optimize efficiency, communication, and transparency in your billing process.

Navigating MSP Client Payment Disputes: Effective Strategies for Quick Resolution

Learn effective strategies to quickly resolve MSP client payment disputes. This guide explores common challenges like billing errors and contractual misunderstandings while offering solutions to prevent costly chargebacks and maintain strong client relationships.

Streamlining MSP Payment Times: Strategies to Enhance Client Communication and Satisfaction

Learn strategies to improve MSP payment times and enhance client satisfaction. This guide covers common issues causing delays and offers practical solutions, such as automated invoicing, efficient payment gateways, and clear communication to streamline billing processes and boost cash flow.

How MSPs Can Save on Credit Card Processing Fees?

Discover how MSPs can save on credit card processing fees with effective strategies and tools. This guide explores methods to reduce costs, improve cash flow, and enhance financial efficiency, ensuring your MSP benefits from significant savings.

Navigating Payment Gateway Options for MSPs: How to Make the Right Choice

Choosing the right payment gateway is crucial for MSPs. This guide explores key factors like security, fees, and integration capabilities to help you make an informed decision. Compare popular gateways such as Stripe, PayPal, and Square to find the best fit for your business needs.

10 Signs That You Need to Change Your MSP Payment Management Platform

Considering switching your payment platform? This guide outlines key factors to consider, including cost, integration, and features, to ensure a smooth transition. Discover how to choose the best platform to optimize your MSP's billing process and improve client satisfaction.

The Essential Guide to Choosing MSP Payments Software: Streamlining Your Business Operations

Learn how to choose the best payment software for your MSP. This guide covers essential features, integration options, and cost considerations to help you make an informed decision. Optimize your billing process and enhance financial management with the right software.

Essential Features of MSP Payments Software for 2024

Explore essential features of MSP payment software for 2024. This guide highlights key functionalities such as automated billing, integrated payment processing, and security tools, ensuring efficient financial management and improved client satisfaction.

Streamline Your MSP Revenue: Make A Shift From Manual To Automated Payments

Transition from manual to automated MSP payments with ease. This guide highlights the benefits of automation, including increased accuracy, efficiency, and cost savings. Learn how automated payment systems can streamline billing processes and improve client satisfaction for your MSP.

Maximizing Efficiency: How Payment Automation Tools Boost ROI for MSPs

Maximize your MSP's ROI with payment automation tools. This guide explains how automation enhances efficiency, reduces costs, and improves cash flow. Learn key benefits, evaluation metrics, and how to leverage these tools for optimal financial management.

What is MSP Payment Automation Software? A Complete Guide

Learn about MSP payment automation software and its benefits for managing complex billing processes. This guide covers key features, integration options, and how automation can improve accuracy and efficiency, helping MSPs enhance their financial operations and client satisfaction.

5 Leading MSP Payment Reconciliation Software Tools to Streamline Your Billing

Discover the top five MSP payment reconciliation software tools to streamline your billing process. This guide highlights key features, benefits, and integration options, helping you choose the best solution to reduce errors and improve financial accuracy for your MSP.

MSP PCI Compliance Simplified: Understanding and Achieving Payment Security Standards

PCI compliance, encapsulated by the Payment Card Industry Data Security Standard (PCI DSS), stands as a linchpin for any managed services business. It serves as a comprehensive framework devised by the Payment Card Industry Security Standards Council (PCI SSC), aiming to fortify the defenses of businesses against potential data breaches, which can have severe financial ramifications.

Top MSP Payments Software in 2024: Streamline Your Billing Process Efficiently.

Explore the best MSP payment software for 2024 to streamline your billing process. This guide reviews top MSP payment tools, highlighting their benefits and key features to enhance your MSP's efficiency and profitability.

Mastering SAQ A Compliance for MSPs: A Comprehensive Guide to PCI DSS Requirements

Trying to better understand what your MSP is required to do for PCI Compliance?

The Ultimate Guide to Push and Pull Payments: Optimizing Cash Flow for Managed Service Providers

Will FedNow transform the way MSPs get paid? Not just yet. Push and pull payments are key concepts in payments.

Navigating U.S. Bank Holidays: A Practical Guide for MSP Owners

U.S. bank holidays can quietly delay MSP payments and disrupt cash flow. This guide breaks down every federal bank holiday, explains how ACH processing is affected, and shows how automation and tools like FlexPoint help MSPs stay ahead year-round.

Business Expenses Every MSP Should Track in 2026 (and What’s Tax-Deductible)

A practical guide to the business expenses MSPs should track in 2026, including how costs impact margins, pricing, cash flow, and which expenses are typically tax-deductible.

Key Tax Concepts Every MSP Owner Should Know

A clear, practical guide to the tax concepts MSP owners need to understand in 2026, from business structure and cash flow timing to credits, deductions, and growth planning.

Top Tax Mistakes MSPs Make Under 2026 Laws

Learn the most common mistakes MSPs make so you can make the most of your tax year.

New Tax Credits & Deductions MSPs Can Claim in 2026

Learn which tax credits and deductions MSPs can claim in 2026, what changed under the OBBBA, and how to plan ahead to avoid missing valuable incentives.

1099 Reporting for MSPs After the Big Beautiful Bill: What Changed

How the Big Beautiful Bill affects 1099 reporting for MSPs and what growing service businesses should do differently now.

An MSP’s Guide to the R&D Tax Credit After the Big Beautiful Bill

The R&D tax credit isn’t just for manufacturers. Learn how the OBBBA changed the rules, why many MSPs now qualify, and how to think about credits, deductions, and payroll offsets heading into 2026.

Making QBI (199A) Eligibility Easy to Understand for MSPs After the New Trump Tax Law

Learn how MSP owners can maximize the Qualified Business Income (QBI) deduction under the OBBBA, with practical tips on income thresholds, W-2 wages, depreciation, and long-term tax planning for 2026 and beyond.

100% Bonus Depreciation Under the OBBBA: What MSPs Need to Know for 2026

Learn how the return of 100% bonus depreciation under the OBBBA affects MSP capital planning, cash flow, and infrastructure upgrades—and how to use it intentionally instead of reactively.

OBBBA Timeline: Key Dates MSPs Need to Know

Learn how the OBBBA’s phased tax changes impact MSPs over time, and how to plan depreciation, deductions, and strategy with confidence instead of reacting at filing season.

How the OBBBA Impacts MSPs & IT Companies in 2026

Concerned, curious, or overwhelmed by the tax changes under the One Big Beautiful Bill Act? We’ve broken down the 2026 updates that matter most for MSPs and IT companies, so you can understand the impact and capture every available tax advantage.

%20(1)%20(1).jpg)

Is Your MSP's Recurring Revenue Actually Recurring?

If your clients are consistently paying your invoices late, is your recurring revenue actually recurring?

%20(1)%20(1).jpg)

The Essential Guide to A/R Reports: Understanding Aging A/R and Its Impact on Your MSP Business

Learn how to decode A/R aging reports for MSPs, streamline collections, and improve cash flow for more effective financial management.

Early Adoption Incentives That Make Clients Embrace New Payment Platforms

Show clients the value of switching to digital payments. Learn how to boost ACH adoption, reduce check fraud, and improve cash flow with smart incentives.

Are You Growing Your MSP Out of Business?

Why cash flow is so important for a growing MSP

Best ConnectWise Integration for MSPs: Streamline Operations and Billing

ConnectWise PSA is powerful, but its real value comes from how well it integrates with your billing and finance stack. This article breaks down the must-have integration features, compares top solutions, and shows how FlexPoint streamlines invoicing, payments, and reconciliation for MSPs.

Best Autotask Integration for MSPs: Simplifying Service Delivery and Billing

Autotask PSA is powerful, but its real value comes from how well it integrates with your billing and finance stack. This article breaks down the must-have integration features, compares top Autotask integration options, and shows how FlexPoint streamlines invoicing, payments, and reconciliation for MSPs.

Best HaloPSA Integrations for MSPs: Streamline Your Operations and Billing

HaloPSA is a rapidly growing PSA, but its real value comes from how well it integrates with your billing and finance stack. This article breaks down the must-have integration features, reviews top HaloPSA integration options, and shows how FlexPoint streamlines invoicing, payments, and reconciliation for MSPs.

Top Alternative Payments Alternatives for MSPs: Finding the Right Fit for Your Billing Needs

Alternative Payments can be a solid starting point for collecting online payments, but many MSPs outgrow it as billing gets more complex and manual reconciliation work adds up. This article explains why MSPs switch, what features to prioritize in a replacement, and compares top Alternative Payments alternatives, including how FlexPoint improves automation, integrations, and the client payment experience.

.png)

MSP Overbilling: How to Identify and Prevent Costly Mistakes

MSP overbilling is rarely intentional, but it can damage trust fast and trigger disputes, refunds, or even legal risk. This article explains what overbilling is, why it happens, how to spot it early, and the practical steps MSPs can take to prevent costly billing mistakes with clearer processes and automation.

.png)

The Hidden Cost of MSP Underbilling: Strategies to Avoid Lost Revenue

MSP underbilling is one of the fastest ways to lose revenue without realizing it. This article explains what underbilling looks like in real MSP workflows, why it happens, and the practical steps you can take to catch it early, close the gaps, and protect long-term profitability.

Benji Pays Alternatives: Top MSP-Focused Solutions to Consider

Benji Pays can be a helpful starting point for MSPs collecting online payments, but many teams outgrow it as billing becomes more complex and manual work creeps back in. This article breaks down the common limitations that prompt a switch and compares top Benji Pays alternatives, including how FlexPoint delivers deeper automation, stronger integrations, and a better client payment experience.

Best Xero Integration for MSPs: Simplify Accounting and Billing Processes

Xero is a powerful accounting platform, but its real value comes from how well it integrates with your billing and PSA stack. This article breaks down the must-have integration features, compares top Xero integration options, and shows how FlexPoint streamlines invoicing, payments, and reconciliation for MSPs.

Best SuperOps Integrations for MSPs: Enhance Your PSA and Billing Efficiency

SuperOps is a modern PSA, but its real value comes from how well it integrates with the rest of your MSP stack. This article breaks down why integrations matter, the key features to prioritize, and the best SuperOps integration options, including how FlexPoint streamlines invoicing, payments, and reconciliation.

Top ConnectBooster Alternatives for MSPs: Smarter Billing and Payment Solutions

ConnectBooster can be a familiar option for MSP billing, but many teams outgrow it as they need deeper integrations, stronger automation, and a more modern client payment experience. This article explains why MSPs switch, what features to prioritize in a replacement, and compares top ConnectBooster alternatives, including how FlexPoint improves branding, real-time syncing, and reconciliation.

Best QuickBooks Alternatives for MSPs: Smarter Accounting and Billing Solutions

QuickBooks is often an MSP’s first choice for accounting and invoicing, but many teams outgrow it as billing gets more complex and integrations become harder to manage. This article explains why MSPs switch, what features to prioritize, and compares top QuickBooks alternatives, including options built to streamline invoicing, payments, and reconciliation.

Top WisePay Alternatives for MSP Billing

WisePay can work well for MSPs early on, but many teams outgrow it when they need stronger automation, broader payment options, and a more modern client experience. This article covers what to look for in a WisePay replacement and compares top WisePay alternatives, including how FlexPoint streamlines billing, payments, and reconciliation.

Top PayPal Alternatives for MSPs: Better Billing and Payment Solutions

PayPal is widely recognized, but many MSPs outgrow it once high transaction fees, weak PSA integrations, and generic billing workflows start creating manual work and reconciliation headaches. This article breaks down why MSPs switch, what features to prioritize in a replacement, and compares top PayPal alternatives, including how FlexPoint improves automation, client experience, and real-time syncing.

Top 5 FlexPoint Integrations MSPs Ask About Before Booking a Product Tour

FlexPoint can only deliver end-to-end billing automation if it connects cleanly with the tools MSPs rely on every day. This article breaks down the top FlexPoint integrations MSPs ask about before booking a product tour, including key PSA and accounting connections, and explains how these integrations reduce manual work, improve accuracy, and speed up reconciliation.

Best PSA Software for MSPs: Top Picks for Every Stage of Growth

Running a successful MSP takes more than ticketing. You need a PSA that ties together service delivery, projects, time tracking, and billing in one scalable system. This article reviews the top PSA software options for MSPs, compares key features and best-fit use cases, and explains why seamless billing and payment integration is critical as you grow.

MSP Project-Based Billing: When to Use It and How It Works

Project-based pricing can help MSPs win larger one-time engagements by giving clients clear deliverables, predictable costs, and milestone-based payment options. This article explains what project-based billing is, when it makes sense versus recurring contracts, and best practices for scoping, invoicing, and protecting margins with automation.

MSP Tiered Pricing Model: How to Structure Service Levels for Profit and Clarity

Tiered pricing helps MSPs package services into clear, scalable levels that clients can understand and compare. This article explains how to structure profitable service tiers, avoid scope creep, and standardize billing so you can forecast revenue more accurately and reduce billing friction as you grow.

MSP Hybrid Pricing Model: Combining Flexibility with Predictable Revenue

Hybrid pricing gives MSPs the best of both worlds: predictable recurring revenue plus flexible usage-based charges when client needs change. This article explains how hybrid pricing works, the most common structures MSPs use, and best practices for implementing it without creating billing confusion or manual work.

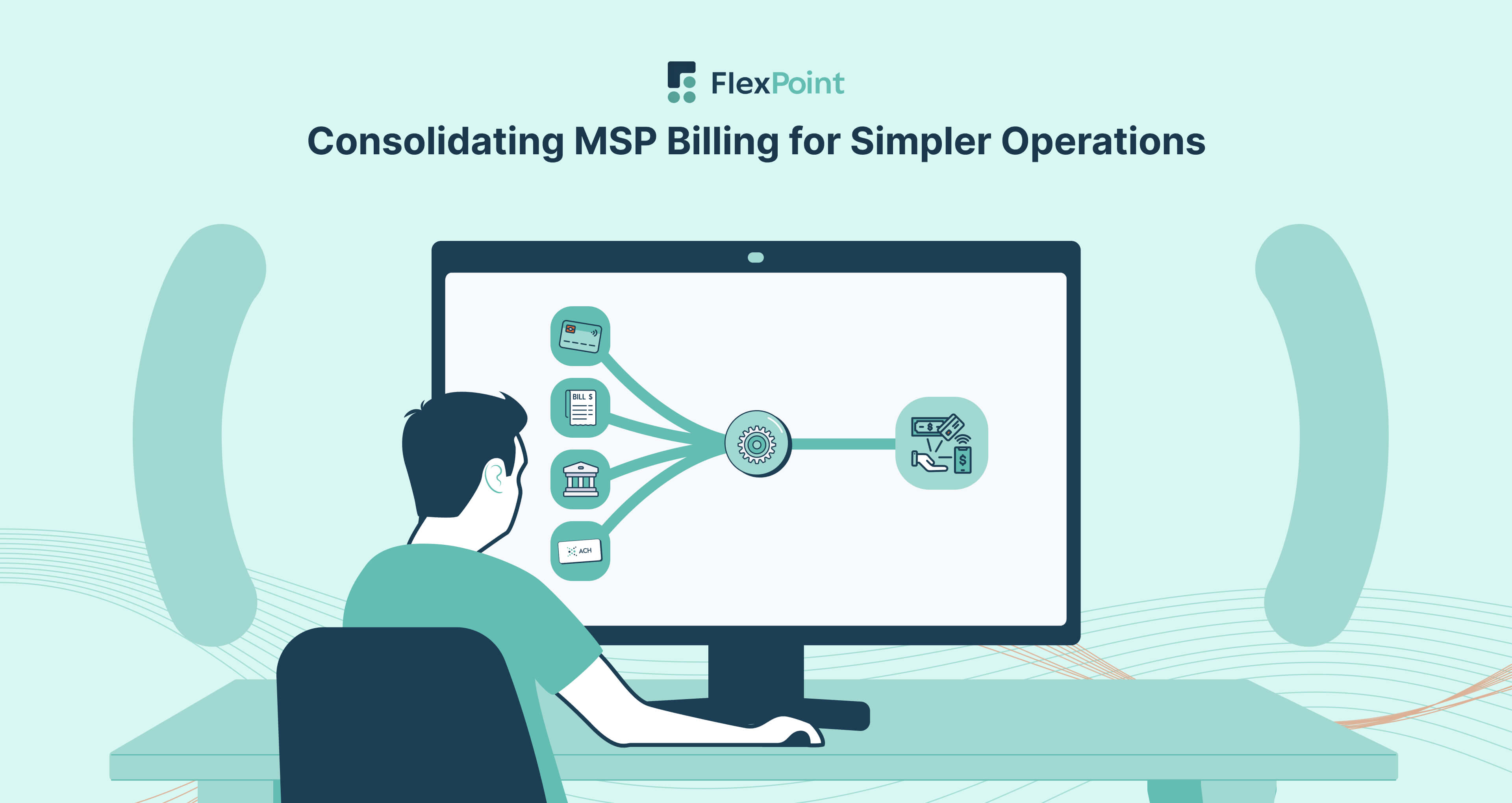

Consolidated Billing for MSPs: A Strategy for Simplifying Client Payments and Enhancing Service

Outdated, fragmented billing tools can slow collections and create extra reconciliation work for MSPs. This article explains why merging billing, invoicing, and payments into one unified workflow reduces errors, improves cash flow predictability, and creates a smoother client payment experience.

Achieving Billing Accuracy with Automated MSP Solutions

Invoicing mistakes can lead to payment delays, disputes, and revenue leakage for MSPs. This article explains why billing accuracy matters and shares practical, automation-first strategies to reduce errors, speed up billing cycles, and strengthen client trust.

Achieving Operational Excellence in MSP Billing: Strategies for Efficiency and Accuracy

Billing should never be the monthly fire drill that drains your team’s time and delays cash flow. This article explains what operational excellence looks like in MSP billing and shares five practical strategies to improve efficiency and accuracy, including standardization, clean data flow, and automation.

The Crucial Link Between Efficient MSP Billing and Financial Health

MSP financial health is directly tied to how efficiently you invoice, collect, and reconcile payments. This article explains why delayed invoices, billing errors, and inconsistent billing cycles create cash flow instability, then outlines practical strategies MSPs can use to tighten billing operations and improve predictability.

MSP Billing and Tax Management: Strategies for Accuracy and Compliance

Manual tax handling can quietly create big risk for MSPs, from miscalculations to missed jurisdiction changes that trigger penalties, disputes, or audit headaches. This article breaks down why tax management matters in MSP billing and shares practical strategies to improve accuracy, compliance, and reporting through smarter, more automated workflows.

.jpg)

How FlexPoint Solves Billing Pain Points by Role (Owner, Operations, Finance)

Billing pain points look different depending on who owns the problem. Owners worry about cash flow and revenue leakage, ops teams fight workflow bottlenecks between the PSA and invoicing, and finance teams get buried in manual reconciliation and aging receivables. This article breaks down those role-specific challenges and explains how FlexPoint solves them with automation, real-time visibility, and integrated billing workflows that keep every department aligned.

The Importance of Integrating MSP Billing with Project Management

Disconnected project tracking and billing systems can quietly cost MSPs real money through missed billable hours, delayed invoices, and avoidable revenue leakage. This article explains why integrating project management with billing matters, the operational risks of siloed workflows, and five practical strategies to improve invoicing accuracy, cash flow, and visibility as you scale.

From Manual to Digital: How to Transform Your MSP Billing

Manual billing might feel manageable at first, but spreadsheets, time logs, and disconnected tools quickly lead to errors, disputes, and delayed cash flow as you scale. This article explains the hidden costs of manual billing and shares practical strategies for moving to digital workflows, including automation, PSA integrations, and smoother payment collection.

MSP A La Carte Pricing: Flexibility or Complexity?

À la carte pricing gives MSP clients more control by letting them choose only the services they need, instead of locking into a bundled plan. This article explains when à la carte pricing makes sense, where it can create billing and margin complexity, and how to structure and bill for it cleanly with the right automation.

MSP Billing Compliance: Why It Matters and How to Get It Right

Billing compliance mistakes can create revenue leakage, trigger disputes, and put your MSP at risk of audits or legal issues. This article breaks down what MSP billing compliance actually includes (contracts, taxes, PCI DSS, documentation), plus five practical strategies to stay audit-ready as you scale.

MSP Hourly Break-Fix Pricing Explained: When It Works — and When It Doesn’t

Hourly break-fix pricing used to be the default for MSPs, but it can create revenue uncertainty and reactive, crisis-driven operations as you scale. This article explains when hourly pricing still makes sense, where it falls short, and how to transition toward more predictable billing models without disrupting client relationships.

MSP Monitoring-Only Pricing Explained: When and Why to Offer It

Monitoring-only pricing can be a smart entry-level offer for MSPs that want to serve budget-conscious clients or support co-managed IT environments without committing to full remediation. This article explains when monitoring-only plans work best, the pros and cons to watch for, and how to structure and bill them clearly so the model stays profitable.

MSP Per User Pricing: A Scalable Model for Growing Managed Service Providers

Per-user pricing is a simple way for MSPs to build predictable, scalable revenue by charging a flat monthly rate per supported user instead of tracking devices or hours. This article explains how per-user pricing works, when it’s the right fit, and how to implement it without creating billing confusion as client headcount changes.

MSP Flat Rate All-Inclusive Pricing: A Simpler Model for Service and Billing

Flat-rate all-inclusive pricing can simplify MSP billing by turning IT into a predictable subscription with clear scope and stable monthly revenue. This article explains how the model works, the pros and risks to watch for (like scope creep), and best practices for packaging, billing, and automating recurring invoices as you scale.

MSP Value-Based Pricing: Aligning Pricing with Client Outcomes

Value-based pricing helps MSPs charge based on client outcomes, not hours or device counts. This article explains why more MSPs are making the shift, how to structure outcome-based packages and SLAs, and best practices for implementing value-based pricing without adding billing complexity.

MSP Per Device Pricing: Is It Still the Right Model for Today’s Market?

Per-device pricing has been a go-to MSP model for years because it feels simple and predictable. But with hybrid work, BYOD, and more complex environments, that simplicity can break down fast. This article explains what per-device pricing is, where it still works, when it starts to hurt margins or client trust, and the best alternative pricing models to consider as you scale.

MSP Usage-Based Pricing: A Flexible Model for Modern Service Delivery

Usage-based pricing helps MSPs align revenue with actual consumption, making it easier to serve clients whose needs fluctuate month to month. This article explains common usage-based MSP models, what to measure, and best practices for tracking, invoicing, and collecting variable charges without creating manual billing headaches.

Strategic Pricing Models for MSP Billing Success

Choosing the right pricing model is one of the highest-leverage decisions an MSP can make. This article breaks down the most common MSP pricing models, explains the pros and cons of each, and shows how to evaluate the best fit for your services, clients, and growth goals so billing stays profitable and predictable.

Why Time Tracking Integration is Crucial for MSP Billing Efficiency

Time tracking only works for MSP billing if it connects cleanly to your invoicing workflow. This article explains why disconnected time logs lead to missed billable hours, delayed invoices, and underbilling, then shares practical strategies for integrating time tracking with billing automation so every approved hour turns into revenue.

How Smarter Billing Drives MSP Profitability

Manual billing mistakes and slow collections quietly chip away at MSP profitability. This article explains how smarter billing improves margins by reducing underbilling, speeding up invoicing and collections, and cutting reconciliation time through automation, real-time visibility, and better payment workflows.

MSP Customizable Billing Plans: Flexibility to Fit Every Client’s Needs

Standard billing packages do not work for every MSP client, especially when needs vary by size, industry, and co-managed IT setup. This article explains what customizable billing plans are, why MSPs are moving beyond rigid tiered packages, and how to offer flexibility without losing control of margins or operations using structured plan design and automation.

How Data Analytics Can Revolutionize Billing Processes for MSPs

Billing data is one of the most underused growth levers inside an MSP. This article explains how billing analytics helps you spot revenue leakage, reduce invoicing errors, improve forecasting, and make smarter pricing decisions by tracking metrics like DSO, margins, and billing trends, all with real-time dashboards and reporting.

How Transparent Billing Strengthens MSP Client Relationships

Transparent billing is not just a finance function. It is a trust function. This article explains how unclear invoices and surprise charges create friction, then shares practical strategies like itemized invoicing, automated billing, flexible payment options, and proactive communication to strengthen MSP client relationships and speed up payments.

Simplifying Billing for MSPs: How to Eliminate Complexity and Save Time

Complex MSP billing quickly turns into a maze of spreadsheets, service tiers, prorations, and variable usage charges that create errors and delay cash flow. This article explains why billing gets complicated so fast, the hidden costs of inefficiency, and five proven strategies to simplify your workflow so you can save time, improve accuracy, and get paid faster.

How Flexible Billing Solutions Transform Client Engagement for MSP

Flexible billing is not just a pricing decision. It is a client experience lever. This article explains why rigid billing creates friction for MSPs, then shares practical strategies like scalable pricing models, automated invoicing, multiple payment options, and clearer communication to improve cash flow and strengthen client loyalty.

Optimizing MSP Billing Operations: Benefits of Advanced Billing Software Integration

Billing software only improves MSP operations when it actually connects the dots between service delivery, invoicing, payments, and accounting. This article explains why billing integrations matter, the problems caused by manual data entry and disconnected systems, and the key PSA and accounting integrations MSPs need to streamline workflows, reduce errors, and improve cash flow visibility.

Developing an Effective MSP Billing Policy: A Guide for Managed Service Providers

Outdated billing practices can quickly become a bottleneck for growing MSPs, leading to late payments, cash flow disruptions, and avoidable disputes. This article breaks down what an effective MSP billing policy should include (payment terms, invoicing schedules, dispute workflows, and compliance), plus practical steps to build and roll out a policy that scales with your business.

MSP Billing Automation: How to Streamline Processes and Reduce Errors

Billing automation is one of the fastest ways to reduce invoicing errors, speed up collections, and stop reconciliation from turning into a monthly fire drill. This article breaks down why MSPs automate billing, the key features to look for (invoicing, reminders, integrations, reporting), and the step-by-step process to implement automation without disrupting clients.

How Proactive Billing Practices Transform MSP Financial Operations

Proactive billing helps MSPs get ahead of late payments, revenue leakage, and client disputes before they turn into cash flow problems. This article breaks down what proactive billing looks like in practice and shares five strategies, including automation, real-time monitoring, clear payment policies, and predictive analytics.

The Role of MSP Billing in Achieving Scalable Growth

Scaling an MSP is exciting until billing becomes the bottleneck. Manual invoices, missed billables, and slow collections create cash flow gaps that limit hiring, service expansion, and long-term profitability. This article explains how optimized MSP billing supports scalable growth, with five practical strategies to automate workflows, stabilize recurring revenue, and improve visibility as your client base expands.

Why MSP Financial Planning Should Start with Smarter Billing

MSP financial planning breaks down fast when billing is inconsistent, delayed, or full of errors. This article explains why smarter, more predictable billing is the foundation for accurate forecasting and cash flow stability, then shares five practical strategies like automated invoicing, real-time billing data, and integrated reporting to plan and scale with confidence.

MSP Billing Errors: Common Issues and Strategies for Reducing Mistakes

MSP billing errors are more than small mistakes. They can delay payments, trigger disputes, and quietly drain profitability over time. This article breaks down the most common billing errors MSPs make, why they happen, and five practical strategies to reduce mistakes using clearer policies, standardized workflows, and billing automation.

The Impact of Billing on MSP Service Value Perception

Billing is not just how you get paid. It’s how clients judge the value of your MSP. This article explains how unclear invoices, surprise charges, and poor billing communication erode trust, then shares practical strategies like itemized invoicing, value-based pricing, bundled services, and flexible payment options to strengthen service value perception.

How Real-Time Billing Transforms Client Engagement and Revenue for MSPs

Real-time billing helps MSPs close the gap between service delivery and getting paid by calculating charges instantly, sending accurate invoices, and tracking payments as they happen. This article explains why real-time billing improves cash flow and client trust, plus five practical strategies to implement it through automation, integrations, and real-time reporting.

The Best MSP Billing Software in 2025: Streamline Your Managed Services Billing

As your MSP grows, billing quickly becomes more complex with recurring subscriptions, different pricing models, and higher risk of errors and delayed payments. This article reviews the best MSP billing software options in 2025, what features to prioritize, and how purpose-built tools help streamline invoicing, payments, and reconciliation.

How to Select the Best Billing Software for MSPs: Key Features to Consider

Autopilot billing tools do not work for MSPs managing recurring invoices, complex service structures, and client-specific terms. This article breaks down how to choose the best MSP billing software by outlining the must-have features, the PSA and accounting integrations to prioritize, and the evaluation steps that help you reduce manual work, improve accuracy, and scale confidently.

How FlexPoint's MSP Billing Solution Drives Client Satisfaction and Loyalty

FlexPoint is built to help MSPs turn billing into a smoother client experience, not a monthly fire drill. This article explains how FlexPoint automates invoicing and recurring billing, improves client communication with self-service portals, and keeps payments, reconciliation, and reporting in sync through PSA and accounting integrations.

Calculating ROI: The Impact of Billing Software on MSP Financial Operations

Understanding ROI is critical when you invest in MSP billing software that changes how you invoice, collect, and reconcile payments. This article explains how to calculate billing software ROI beyond direct cost savings, covering factors like improved cash flow, fewer billing errors, client satisfaction, and scalability as your MSP grows.

5 Billing Strategies That Improve Cash Flow Management for MSPs

Billing is one of the biggest levers MSPs can pull to improve cash flow, but delayed invoices, billing errors, and inconsistent follow-up often create avoidable payment gaps. This article breaks down five practical billing strategies to speed up collections, reduce disputes, and build more predictable cash flow as you scale.

AI in MSP Billing: How Artificial Intelligence Transforms Financial Management

AI can take a lot of the manual work out of MSP billing, from invoice creation to spotting discrepancies and forecasting cash flow. This article explains the key benefits of AI in billing, practical workflow applications, and how MSPs can use automation and better insights to reduce errors and scale with confidence.

Why MSPs Should Switch to Cloud-Based Billing: Efficiency and Scalability Unlocked

Cloud-based billing helps MSPs reduce manual work, improve invoicing accuracy, and scale without adding more back-office overhead. This article breaks down the biggest benefits of switching to cloud-based billing, the key features to look for, and how the right platform streamlines invoicing, payments, and integrations as you grow.

7 MSP Billing Trends to Watch: Key Changes and Innovations for 2025

MSP billing is changing fast as automation, usage-based pricing, and integrated billing workflows become the new standard. This article breaks down the top MSP billing trends for 2025 and the practical steps you can take to adapt, improve cash flow, and reduce revenue leakage as you scale.

How Predictive Analytics Can Transform MSP Billing Operations

Predictive analytics helps MSPs stop reacting to billing issues after they hit cash flow. This article explains how forecasting tools use historical billing and payment data to predict late payments, reduce invoicing errors, improve revenue planning, and strengthen client retention with more proactive billing decisions.

MSP Billing Success Stories: How FlexPoint Delivers on the Promise of Enhanced MSP Billing Operations

Manual billing can quietly drain MSP time and profit, especially as invoice volume grows. This article shares real-world MSP billing success stories and the measurable results teams achieved after switching to FlexPoint, including faster invoicing, fewer errors, and smoother payment collection through automation and integrations.

Exploring Key Features of MSP Billing Software: A Comprehensive Guide for Managed Service Providers

For MSPs, billing software is more than an invoicing tool. It’s a growth lever. This article breaks down the must-have features MSPs should prioritize, from automated recurring billing and PSA plus accounting integrations to client portals, reporting, and security, so you can reduce manual work, improve accuracy, and get paid faster

What Are MSP Billing KPIs? 10 Key Performance Indicators Every MSP Should Monitor

Billing KPIs help MSPs spot payment delays, reduce revenue leakage, and make smarter decisions about pricing, collections, and client retention. This article explains what MSP billing KPIs are, why they matter, and the 10 metrics every MSP should monitor to improve cash flow and operational efficiency.

What is MSP Billing Management? Understanding the Basics for Better Financial Control

MSP billing management is the structured process of handling invoicing, payments, reconciliation, and compliance without relying on error-prone manual work. This article explains the core components of billing management, the benefits for cash flow and client trust, and the best practices MSPs can use to gain better financial control as they scale.

Overcoming MSP Billing Challenges: Best Practices for Streamlined Invoicing and Payments

MSPs that rely on manual billing and disconnected tools often run into cash flow bottlenecks, invoice errors, and avoidable client disputes. This article breaks down the five most common MSP billing challenges and shares practical strategies to streamline invoicing, integrate your PSA and accounting stack, and speed up payment collection.

Mastering DSO KPIs: How MSPs Can Leverage Days Sales Outstanding for Better Cash Flow

Days Sales Outstanding (DSO) is one of the most important KPIs for MSP cash flow, showing how long it takes to collect payment after invoicing. This article explains how to calculate DSO, why it matters for forecasting and financial health, and practical ways to lower DSO by improving invoicing, collections, and payment workflows.

Exceptional Client Service: Why Billing and Payments Should Not Be an Exception

Exceptional client service should not stop at service delivery. It should extend to billing, invoices, and payments too. This article explains why MSPs need consistent invoicing, flexible payment methods, and a centralized client portal, plus how FlexPoint helps clients pay faster with autopay, reminders, and a simple payment experience.

.png)

Announcing the Future of Partner Led Payments and our $12M Series A

We're excited to share our Series A funding round of $12 million. And that's only the beginning of our rapid growth.

How Secure Are Your Payments?

MSPs are critical to protecting SMBs from cyber crime, but when it comes to handling payments, many are exposing themselves to security risk.

Autopay Doesn't Have to Be Awkward

Whether it's new clients or existing clients, getting your clients on autopay doesn't have to be awkward.

Why Passwordless Authentication Offers Your Clients a Secure and Convenient Way to Pay

Passwordless authentication is a great balance between security and convenience.

Getting Started With Payments Software Doesn't Have to Be Painful

Have you been thinking about adopting payments software for your MSP, but worried it takes too much time and resources? Learn more how FlexPoint can help you accelerate your time to value.

%20(1)%20(1).jpg)

%20(1).jpg)

%20(1)%20(1).jpg)

%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

%20(1).jpg)

%20(1)%20(1).jpg)

.png)

.png)

.svg)

.png)