MSP Billing Cycle Optimization: Reduce Delays and Accelerate Collections

Profitability for MSPs depends not only on providing excellent service but also on how efficiently you get paid for what’s rendered. According to MSP insights, 70% of MSPs struggle with cash flow issues. These issues may be due to billing cycle inefficiencies, such as delayed or incorrect invoicing, slow payment collection, and increasing accounts receivable (AR) balances.

According to PYMNTS, 42% of businesses have a Days Sales Outstanding (DSO) of over 60 days. Manual billing processes or poorly optimized billing systems can further disrupt MSP billing cycles and impact your financial planning.

Invoicing delays and manual billing errors slow down payment collections, which results in budgeting, forecasting, and scaling challenges for MSPs. Repetitive billing errors and invoicing delays strain client relationships.

In this article, we will discuss how optimizing your MSP billing cycle can turn these challenges around and help collect payments faster. We will also discuss strategies to streamline financial workflows, improve predictability, and maintain a stable cash flow.

{{toc}}

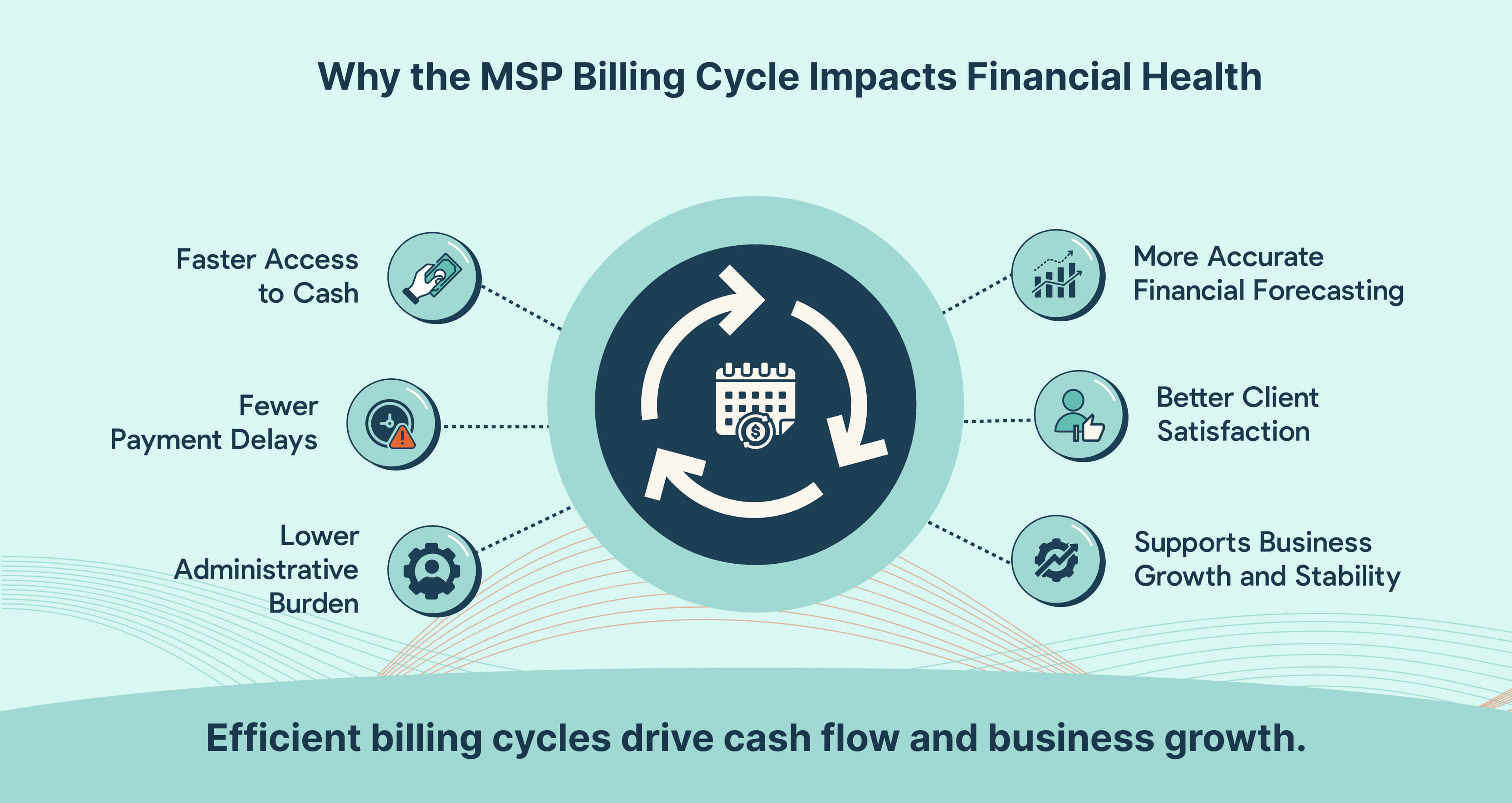

Why the MSP Billing Cycle Impacts Financial Health

The billing cycle for MSPs starts with service delivery, where resources, hours, and outcomes are tracked. Next, those details are used to create invoices for payment collection.

Delays in billing or payment collection force MSPs to dip into reserves to cover their operating expenses. Or worse, some MSPs might have to rely on short-term loans or credit lines to meet business expenses.

Inconsistent billing has a ripple effect throughout the entire MSP organization. Jumbled spreadsheets, manual entries, or disconnected systems may disrupt billing workflows. It can lead to confusion and client payment disputes, which further delays revenue collection.

Slow or inconsistent billing cycles increase administrative workload. You lose resources; and efforts on follow-ups and dispute resolution further disrupt business operations. According to PYMNTS, manual payment processes take 67% longer to follow up on overdue payments, and manual AR has a 30% longer average DSO.

Late or inaccurate invoices result in delayed payments, leaving businesses with aging accounts receivable (AR), dissatisfied clients, and limited working capital.

These snowball into financial uncertainty for MSPs. Unpredictable cash flow hinders reinvestment in tools, staff, or technology needed to stay competitive. Disorganized billing can frustrate clients, leading to distrust and reputational damage.

Optimizing the billing cycle gives MSPs access to cash more quickly.

Billing automation tools minimize human errors, allowing invoices to be issued promptly and accurately. Streamlined payment collection processes reduce aged accounts receivable (AR), ensure consistent cash flow, and improve the client experience.

According to PYMNTS, 73% of companies using AP automation agree that it improves cash flow, and 83% of the companies using AR automation feel it streamlines their processes and improves efficiency.

Automated payment reminders, recurring billing, plus integrations with PSA (Professional Services Automation) systems and accounting tools connections ensure that no billable item is missed and no invoice is sent late.

Additionally, better billing workflows make financial forecasting more accurate, enabling MSPs to make strategic decisions with confidence.

{{ebook-cta}}

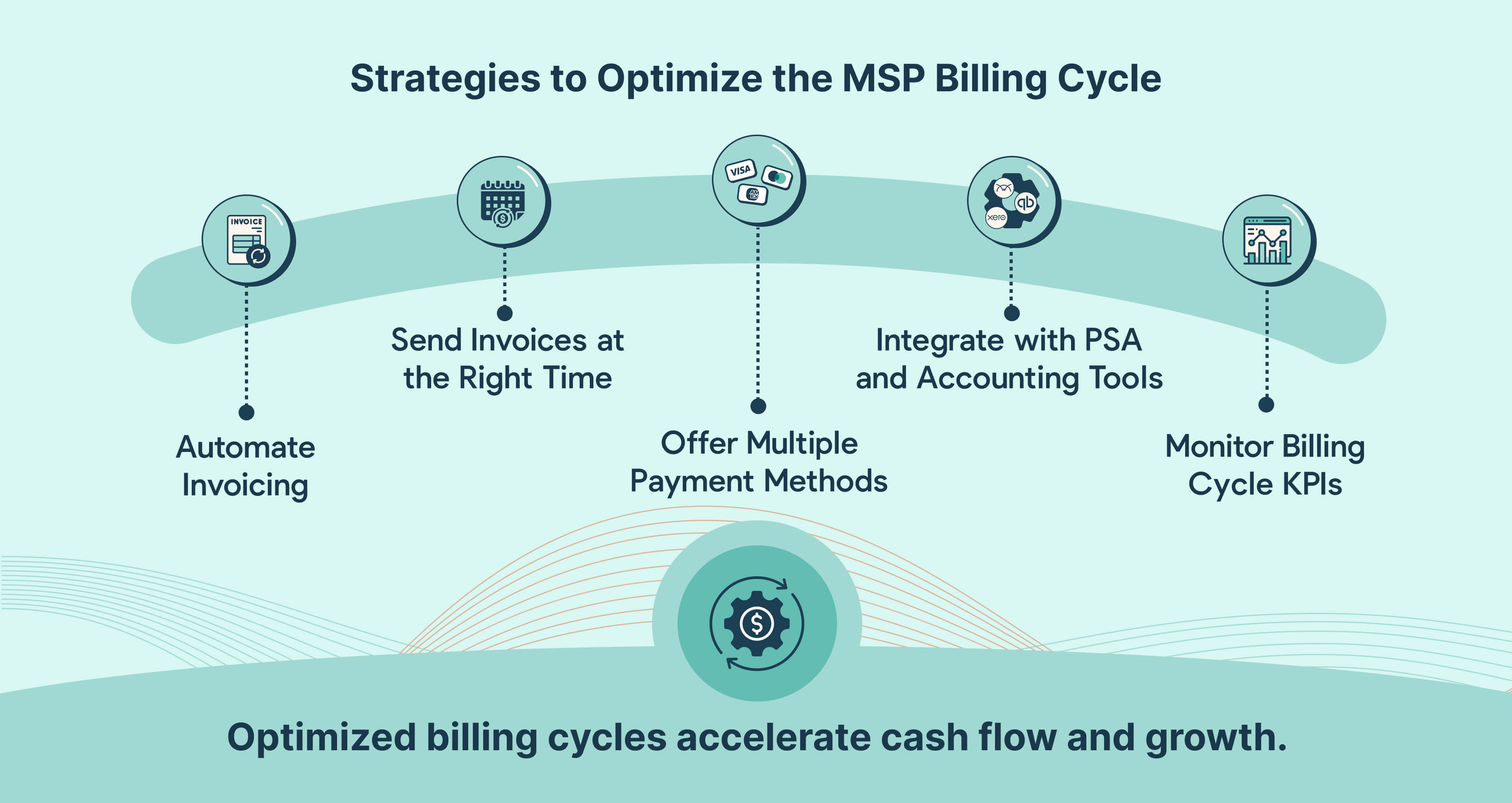

5 Strategies and Best Practices for Optimizing the MSP Billing Cycle

MSPs offer complex service bundles and pricing models that require precise time tracking and the use of disparate offerings. They struggle with late invoicing, inaccurate billing, and prolonged accounts receivable (AR) collections. According to the Creditor Watch survey, delayed payments impact over 80% of businesses.

MSPs can accelerate invoicing and payment collection by minimizing friction points with clients.

Automated invoicing software helps align billing schedules and collect payments faster. It ensures more predictable revenue, fewer overdue invoices, and less time spent chasing payments. According to Ardent Partners, automation processes invoices 81% faster and 79.5% cheaper than manual methods.

Here are five strategies to help MSPs transform billing from a financial drain into a competitive advantage:

1. Automate Invoicing to Eliminate Payment Delays

Manual invoicing is one of the biggest bottlenecks in MSP billing cycles.

According to Ardent Partners, creating invoices by hand takes around 10.1 days and costs $15 to $40 each. It delays invoice generation and increases the chances of errors. Furthermore, a study by FinFloh found that 61% of late invoices are due to process inefficiencies.

Incorrect amounts, missed payment deadlines, and disorganized records slow down payment cycles. They result in frustrated clients, strained business relationships, and growing outstanding payments.

A billing automation platform can eliminate these delays by streamlining the invoicing process. According to PYMNTS, automating 50% of your AR processes reduces DSO (Days Sales Outstanding) by 32%.

Real-time billing automation tools automatically generate and send invoices based on real-time data from service delivery or pre-scheduled dates. Such platforms should also seamlessly integrate with your PSA tools and accounting software for accurate data tracking.

Let’s take the example of Compunet Technologies, an Orange County-based MSP that streamlined its invoicing with FlexPoint. The MSP was searching for an invoicing solution that would integrate with its existing tools.

FlexPoint’s platform automated invoicing without disrupting the MSPs' internal workflows and made invoicing 95% faster by reducing billing time from 5 hours to about 15 minutes per month.

FlexPoint’s AutoPay feature improved the MSPs' cash flow as nearly all clients made payments within 72 hours of invoicing instead of paying sporadically throughout the month.

Switching to FlexPoint resulted in four times faster billing cycles for Compunet Technologies.

2. Send Invoices at the Right Time for Faster Client Response

Timing is crucial when sending invoices and following up on payments. Many MSPs make the mistake of waiting until the end of the month or delaying post-project invoices. It leads to billing lags and interruptions in cash flow.

Late invoicing often results in clients deprioritizing payment as time passes. Poor cash flow forces MSPs to seek expensive financing to cover operational expenses.

As discussed earlier, automated invoicing addresses these gaps by establishing clear and predictable billing schedules. It helps reduce payment friction and keeps cash flow steady.

Weekly, bi-weekly, or milestone-based invoicing ensures that clients are billed promptly and payments align with service cycles.

Automated MSP billing platforms deliver invoices according to the predetermined schedule. Real-time updates help ensure invoice accuracy.

According to Skynova, 49% of businesses involve 2-3 people to approve an invoice. Sending timely invoices expedites client approval processes, and automated reminders further reduce delays.

By prioritizing timely invoicing, MSPs enhance client satisfaction, reduce payment friction, and maintain healthy financial operations.

3. Offer Multiple Payment Methods to Remove Collection Barriers

Restricting clients to just one or two payment methods can lead to slower collections. According to BlueSnap, 48% of businesses estimate revenue losses of up to 10% if their payment processing vendors do not offer suitable payment options.

Limiting payment methods creates unnecessary back-and-forth with clients over payments, which increases your MSP's Days Sales Outstanding (DSO).

By offering multiple payment methods, MSPs can empower clients to pay in a way and at a time that suits them. This streamlines approval processes, which otherwise take three days to two weeks for most businesses, as clients can choose the method that best aligns with their internal workflows.

You should include standard payment methods like ACH (Automated Clearing House), credit cards, and flexible financing options.

This variety can help increase cash flow, as some clients prefer ACH transfers, while others prefer the convenience and speed of credit cards.

Adopting an MSP billing platform like FlexPoint helps MSPs support a wide range of payment methods and flexible payment terms. The platform accommodates clients' preferences to reduce payment friction and encourages financial predictability for MSPs.

For instance, Pro IT, a North Dakota-based MSP, wanted to help its less tech-savvy clients complete transactions using their preferred payment methods.

The MSP switched to FlexPoint's passwordless client portal to collect payments faster while strengthening client relations. It helped the MSP save 160 hours per month spent earlier on resolving client inquiries.

The MSP also improved its profitability by saving 60% in credit card fees by offering alternative payment methods and flexible billing options to its clients.

4. Integrate Billing with PSA and Accounting Tools

Disconnected tools slow down invoicing and require redundant data entry.

Also, disconnected tools and legacy billing systems create a billing bottleneck for managed service providers (MSPs). They work in silos and generate unreliable invoices with issues like unbilled services, unresolved tickets, and untracked hours.

According to BluLogix, MSPs lose 5-15% of their annual revenue due to fragmented systems and outdated workflows. Repetitive tasks, such as manual data entry and resolving payment disputes, slow down your billing cycle by extending payment timelines.

A robust billing platform like FlexPoint integrates with leading PSA (Professional Services Automation) and service management platforms to pull time, project milestones, and usage data directly into invoices.

FlexPoint seamlessly integrates with leading PSA systems like ConnectWise, HaloPSA, SuperOps, Autotask, and Accounting Systems like QuickBooks Online, QuickBooks Desktop, and Xero.

The platform pulls real-time data, such as logged hours, project milestones, and resource usage, to generate accurate invoices. In addition, the bi-directional integration automates payment reconciliation.

WJP Technology Consultants, a Texas-based MSP, wanted a simple yet efficient billing solution like this.

The MSP integrated FlexPoint's billing solution with QuickBooks to automate invoicing and monitor clients. The MSP now collects payments 3 times faster with FlexPoint’s AutoPay feature.

The simple onboarding process encouraged 30% more clients to opt for AutoPay, which helps the MSP save 15% on payment collection costs.

5. Monitor Billing Cycle KPIs to Track and Improve Performance

MSPs must track the right billing key performance indicators (KPIs) to manage and optimize their billing cycles effectively. Metrics such as DSO, average invoice approval time, and payment aging provide insights into bottlenecks and their impact on cash flow.

However, it is impossible for MSPs using legacy software or manual methods to proactively spot delays, inefficiencies, or risks.

Real-time billing and reporting tools monitor these KPIs regularly and flag errors or inefficiencies as they occur. For example, if payment aging trends indicate an increase in overdue invoices, MSPs can revise their credit terms or follow up more aggressively with clients.

Accurate tracking improves forecasting, ensuring that financial obligations such as payroll and vendor payments are met smoothly.

According to Highradius, electronic invoicing and quick payment processing reduce DSO by 3 to 10 days. Additionally, using an AI-driven platform to track billing performance allows you to automate corrective measures. MSPs can track KPIs and trigger actions, such as sending follow-up reminders or offering flexible payment options, to prevent payment delays.

Fort Point IT made this move from chasing payments to a predictable cash flow with FlexPoint. The MSP needed a better billing process as it scaled operations and a platform that could provide real-time insights into crucial billing KPIs at all times.

Switching to FlexPoint helped it automate billing workflows from invoicing to reminders and payment collection. The MSP reduced overdue payments by 65% and saved 80 hours per month spent on bookkeeping. Client queries have reduced as they can pay through the self-serve passwordless payment portal. In addition, automated tracking of overdue invoices has brought past-due receivables to less than 5% today.

Conclusion: Improving Cash Flow Through Faster, Smarter Billing Cycles

The billing cycle is crucial for the efficiency and financial stability of your MSP. Timely and accurate billing keeps cash flow predictable and avoids payment delays.

Automation helps MSPs optimize their billing cycles, maintaining a steady cash flow. It empowers MSPs to streamline invoicing, reduce errors, and improve client satisfaction.

Conversely, manual processes lead to inconsistent invoicing that can cause errors, delays, and unnecessary disputes with clients.

As a fast-growing MSP, you need a billing automation system that matches the speed and accuracy of your service delivery. FlexPoint modernizes your billing with real-time invoicing, automated reminders, AutoPay, and multiple payment options like ACH, credit cards, and installment plans.

The platform seamlessly integrates with your PSA and accounting tools to deliver accurate invoices based on real-time service data.

FlexPoint's branded client portal keeps clients informed of their payment status, past and current invoice history, payment methods, etc..

In addition, for MSPs, FlexPoint’s unified dashboard with KPI tracking and automated reporting helps your team with insights to forecast revenue and improve billing performance.

Shorten your MSP's billing cycle and accelerate cash flow with FlexPoint.

Automate invoicing, speed up collections, and gain real-time visibility into your financial operations.

Schedule a demo to see how FlexPoint streamlines your entire billing process.

{{demo-cta}}

Additional FAQs: MSP Billing Cycle Optimization

{{faq-section}}