Optimizing Recurring Payments for MSPs: Enhancing Collection Efficiency and Reliability

According to data from Persistence Market Research, the global recurring payments market will expand from US$160.3 billion in 2024 to US$247.5 billion in 2031, representing a CAGR of 6.4%.

Recurring payments, also known as automatic payments or recurring billing, are standard in subscription business models, which most MSPs use.

A report from WiFiTalents found that 87% of B2B businesses in the U.S. have adopted subscription-based offerings.

A few things can explain this high rate of adoption.

WiFi Talents found that subscription-based businesses grew revenue five times faster than S&P 500 company revenues.

Additionally, subscription businesses generate a 100% increase in customer lifetime value (CLTV) compared to traditional businesses.

Considering these impressive metrics, it's no surprise that more and more MSPs are shifting towards subscription-based models.

However, MSPs must optimize recurring payments to ensure a smooth and efficient process for their clients and to stabilize their own cash flow.

In this article, you will learn 11 actionable strategies for setting up recurring payment systems and why it is so important to do so.

{{toc}}

Importance of Recurring Payments for MSPs: 4 Key Benefits

Recurring payments serve a critical purpose in the managed services industry. MSP business models are particularly suited to subscription-based pricing, and below, you’ll learn why:

1. Continuous Service Delivery

Managed services providers usually provide ongoing IT support, monitoring, maintenance, and other services that require continuous engagement.

Subscription-based billing is a good fit for continuous delivery because it offers predictable, regular billing for ongoing services.

2. Predictable Revenue Streams

The subscription pricing model allows MSPs to generate reliable recurring revenue streams and maintain a stable cash flow.

With a reliable source of revenue, MSPs can plan for growth with greater certainty and confidently invest in resources, technology, and staff.

3. Scalability

Subscription-based pricing allows MSPs to quickly scale payments up or down according to the client's changing needs.

For example, if a client goes from needing ten users of support to a 20-user subscription, the MSP can adjust their recurring plan.

4. Client Retention

Client retention is critically important for MSPs. The happier your clients are with your services, the more likely they will continue using them.

According to Customer Gauge, the average churn rate for IT services B2B companies is 12%. Client churn is the rate at which clients cancel services with your business in a given timeframe.

However, churn rates are significantly lower for B2B companies that use subscription-based pricing.

According to data from Recurly, the average churn rate for subscription services in the B2B markets is 3.36% (voluntary churn) and 1.19% (involuntary churn).

Voluntary churn refers to the clients who actively cancel their services, while involuntary churn refers to clients whose services are canceled due to payment failure.

Losing clients can harm your cash flow, so retaining your clients is essential.

Statistics from Outbound Engine also show that acquiring a new client costs five times more than retaining an existing client.

Considering the lower churn rate for businesses that use subscription-based pricing and recurring payments, this is a strategic way for MSPs to improve client retention rates.

After outlining the benefits and importance of recurring revenue for MSPs, we will move on to practical strategies for implementing effective recurring payment systems.

{{ebook-cta}}

Setting Up Effective Recurring Payment Systems

Any services that you automatically charge clients for on a regularly scheduled basis are a type of recurring payment.

Recurring payments include weekly, monthly, quarterly, and annual plans.

However, some recurring payment systems are more effective than others.

Problems such as failed payments, invoice errors, or customer dissatisfaction with a rigid payment system could arise.

To ensure your recurring payments are set up for your success, consider the following 11 best practices.

1. Integration with Accounting Software:

Integrating recurring payment systems with your accounting software, including QuickBooks Online, QuickBooks Desktop and Xero, is crucial for maintaining accurate financial records.

With these systems integrated, you can minimize data entry errors and ensure your financial records are recorded accurately and instantaneously.

If these systems are synced, the revenue you collect through recurring billing will appear in your accounting software in real time.

This reduces human error and the need to reconcile anything at the end of the month because everything is already up to date.

For example, when integrated, your accounting software will record a transaction after a recurring payment is processed. This payment is automatically reflected in your bank account, accounting reports, and other financial statements.

This integration is also beneficial for tax purposes. All your transactions are tracked and categorized so you can create profit and loss statements, balance sheets, and other financial reports at the click of a button.

As we will discuss later in this article, MSP payment automation saves significant time and other resources.

2. Integration with Your PSA:

Integrating your recurring payment systems with your accounting software and Professional Services Automation (PSA) systems eliminates duplicate data entry.

This is just one reason to ensure your recurring payment system integrates with your PSA, whether it's ConnectWise, Autotask, HaloPSA, SuperOps or another platform.

PSA and recurring payment systems integration allow you to manage customer contracts, bills, and service tickets from one place.

For example, you can generate an invoice from a PSA such as ConnectWise, which will sync the invoice to your payment automation system and accounting software.

When you can access and measure all client interactions with your integrated PSA, you can track recurring service issues and trends, improve the service experience, stave off churn, and improve customer service.

Eliminating the need to manage multiple systems simplifies the organization, reduces the potential for errors, and streamlines the entire service and billing workflow.

You’ll be able to access and measure all client interactions with your integrated PSA This enables you to track recurring service issues and trends, improve the service experience, reduce churn, and improve customer service.

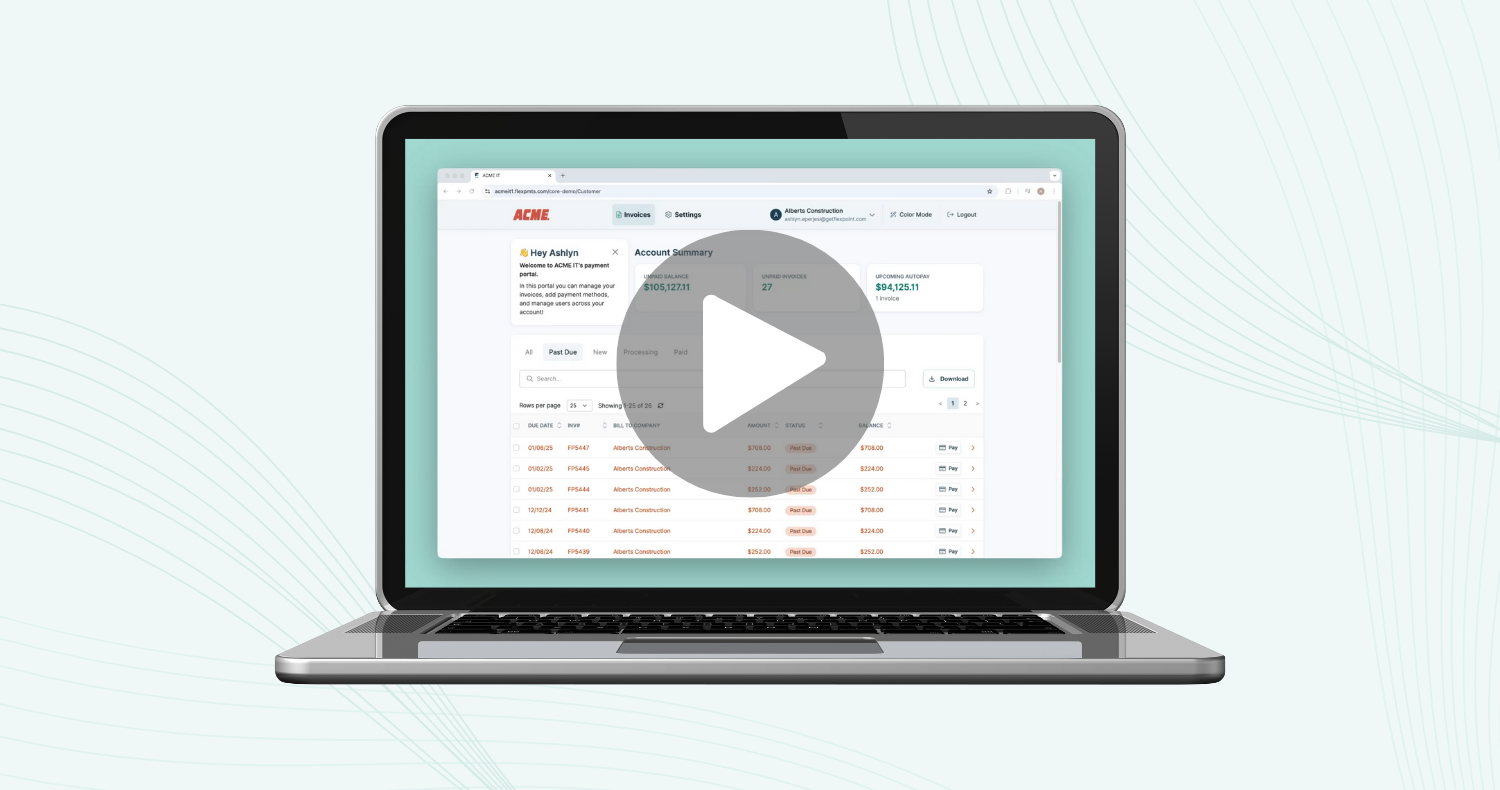

3. Client Portal Setup:

LLCBuddy data reports that businesses see revenue rise by 10% to 15% when they use personalized client portals.

Client portals allow users to add, delete, or modify payment methods for future transactions, check transaction history, download invoices, and update billing information.

A well-designed client portal can also minimize payment friction and support requests.

For example, a client can log in to their custom payment portal to update their billing information before it is set to expire.

Rather than contacting customer support to find out how to do this, the client can easily handle this task independently through their payment portal.

4. Automated Billing:

Automated billing systems generate and send invoices to clients at specified intervals and collect recurring payments on time.

Instead of manually processing invoices with your payment system, you can automate the process and spend this time on other tasks.

Consider Compunet Technologies, a California-based MSP, for example.

When the IT services company added payment automation with FlexPoint’s AutoPay feature, this move resulted in 95% faster invoicing and a 4x faster billing cycle overall.

Compunet Technologies’ faster invoicing isn’t an outlier, either.

Ardent Partners’ research reports that switching from manual to automated invoices can reduce invoice processing time by 81%.

Time isn’t the only resource you save with automated billing.

Switching from manual to automated invoicing also saves MSPs money.

According to research from the Institute of Finance & Management (IOFM), processing a manual invoice costs an average of $16. For automated invoices, the average cost drops to $3.

5. Custom Pricing Options:

According to insights from a CapChase survey of 500 US-based B2B leaders, 81.2% reported that an inability to offer flexible payment options hinders deals from closing.

Furthermore, 85% believe offering clients more flexible payment options could significantly reduce churn rates.

Offer clients payment schedule options to bolster their confidence in financial commitments and demonstrate your commitment to meeting their needs.

This value proposition of being client-centric and offering customizable pricing is a powerful differentiator in the market.

For example, a small startup with highly variable revenues might appreciate an annual payment option that discounts the upfront payment and avoids the hassle of monthly invoicing (or chasing invoices).

Meanwhile, a larger enterprise with steady revenue might prefer the predictability of monthly billing to align with its operating budget cycles.

These alternative payment options can expand the MSP’s appeal across different company sizes and sectors.

Furthermore, flexibility over the payment schedule can help negotiate the sale: a prospective client concerned that payment terms tie up existing cash flow might be more inclined to sign up if the payment schedule is flexible.

This flexibility can increase the percentage of successful sales and decrease the sales cycle length.

The CapChase survey also found that payment terms negotiations add an extra 16.2 days to the sales cycle.

Implementing flexible payment scheduling is a strategic move that benefits you and your clients. It will improve your client service and experience and stabilize your revenue.

6. Security Measures:

Storing your clients’ credit card information for automated recurring payments significantly streamlines the payment process. However, security measures must also be considered when storing this information.

For example, PCI-DSS compliance.

The Payment Card Industry Security Standards Council (PCI DSS) sets security standards for businesses that store, process, or transmit cardholder data.

These businesses must adhere to PCI standards or risk financial penalties and other consequences.

The standards they must adhere to vary depending on the number of transactions a business processes annually. The length of the violation will also determine the financial penalty.

For example, a Level 1 business processes six million or more transactions annually. These businesses must adhere to the most stringent standards, including requiring an on-site audit, which costs between $30,000 and $40,000.

Level 4 businesses process 20,000 or fewer transactions annually, and many MSPs fit this category. They have the least stringent requirements, and small MSPs will likely pay about $500 for annual Level 4 self-validated PCI compliance.

According to information from Sprinto about PCI non-compliance fines, a small business with a low transaction volume could face penalties of $5,000 per month for one to three months of non-compliance.

A larger business that violates PCI standards for the same length of time could face a monthly penalty of $10,000.

If the small business is in violation for seven or more months, the resulting penalties could be $50,000 per month.

The larger business could be fined $100,000 or more per month.

Considering these extensive costs, PCI compliance is a top priority for MSPs.

Knowing your business complies with PCI standards protects client data and avoids these fees.

If client cardholder data isn’t stored correctly, it exposes your clients and your business to data breaches, identity theft, and financial loss.

Choose PCI-compliant MSP payment automation software to take the burden of adhering to these standards off your plate.

7. Flexible Payment Scheduling:

Some clients' incomes fluctuate significantly depending on the time of year. Creating payment plans tailored to the customer’s preferences effectively meets their needs while securing consistent revenue for your business.

Customizing their payment plan to meet slower and busier times of year helps them meet their financial obligations.

Flexible financing, including Buy Now Pay Later (BNPL), is one option to consider, and it is becoming increasingly popular.

According to Fortune Business Insights, the global B2B BNPL market value is expected to grow from USD 37.19 billion in 2024 to USD 167.58 billion by 2032, or a CAGR of 20.7%.

This growth reflects the rising prevalence of flexible financing to ensure consistent cash flow and repeat business.

Offering your clients fast access to flexible financing options is an effective way to ensure consistent revenue for your business. It allows clients to access financing (as quickly as a few clicks), removing financial barriers to recurring payments.

You can create offerings that meet your clients' financial needs by adding custom pricing and flexible finance options.

In turn, you can secure recurring revenue and help your business weather changing market and client circumstances.

8. Proactive Communication:

Proactive communication about recurring payments includes reminding your clients about upcoming payments. Giving them notice lets them ensure the funds are available or notify you in advance if they cannot pay.

For example, you might configure automated email reminders to clients three days before payment is due. This kind of alert can include the dollar amount that will be charged, the date of the payment, and further details of the services being billed.

According to research from MSP Insights, 81% of managed services providers aren’t paid on time, and late payments take an average of 60 days to receive.

These automated reminders can speed up the payment cycle and save significant time and resources without chasing late payments.

In addition to upcoming payment reminders, you can prevent payment problems from arising by proactively reaching out to clients.

You might also set up automated reminders when client credit cards are about to expire. These emails can include a call to action to update payment information so service won’t be interrupted.

Not only can this prevent billing issues, but it will also convey to your clients that you are monitoring their accounts and actively taking care of things on their behalf.

9. Diverse Payment Methods:

Accepting a selection of MSP payment methods benefits you and your clients.

In a 2022 Balance Payments, Inc. survey of over 400 B2B buyers, around 83% of participants identified a seamless payment and checkout experience as their top priority.

Offering their preferred payment method selection is one way to create this seamless process.

It also benefits client retention. Buyers also indicated that the absence of their preferred payment method at checkout is the primary reason they would switch to a different company.

Your clients will appreciate having the ability to choose their preferred payment method.

A 2023 PYMNTS Intelligence research study in collaboration with Ingo Money reports that businesses offering multiple instant payment methods get higher customer satisfaction scores.

According to the study, businesses that offer six or more instant payment methods earn the highest Customer Satisfaction Index Scores.

10. Easy Payment Modifications:

Clients occasionally must update their payment methods, frequency, and service plan.

Making it easy for clients to update these things quickly – for example, through an online client payment portal – can improve client satisfaction.

Likewise, if a client wants to change the frequency of their payments, doing so without contacting the customer support team saves time and effort for you and your clients.

By empowering clients to choose their mode of payment autonomously, you can reduce the volume of support inquiries for payments-related matters and ensure more successful payments.

11. Error Handling and Retries:

A report from PYMNTS found that subscription businesses lose 9% of their revenue to failed payments without an effective error-handling system.

These payment errors and failures can lead to significant revenue loss, client dissatisfaction, and increased churn.

With an effective error handling and payment retry system in place, you can avoid the frustration and revenue loss from failed payments.

For example, if a payment fails because of an expired credit card or insufficient funds, you can set your payment system to automatically notify the client and even retry the payment after a specific interval.

By proactively dealing with failed payments, you can maintain your cash flow, improve client relationships, and reclaim some of the time you would otherwise lose to payment recovery.

Leveraging FlexPoint for Recurring Payment Success

Recurring payments significantly benefit MSPs, including predictable revenue streams and higher client retention rates.

However, without implementing strategies for a successful recurring payment system, you will not be able to realize the full potential of these benefits.

With proactive payment communication, flexible payment terms, custom pricing, and other strategies discussed in this article, you can optimize and automate your recurring payment process.

When you do so, you can experience benefits like the ones WJP Technology Consultants did.

WJP is a Texas-based MSP that switched to FlexPoint to improve its payment processes and solve the problems associated with its previous billing solution.

FlexPoint provided WJP with a custom-branded payment portal that is fully integrated with their clients' accounts. Clients can set up an account with a few clicks when they receive their first invoice.

From there, they can add payment methods, make payments, and set up AutoPay to make recurring payments easier than ever. The result is dependable, secure payments that improve cash flow and make it easy for clients to pay.

With FlexPoint, WJP gained access to:

- An intuitive interface for client monitoring

- Automated payments so WJP’s clients can securely store payment methods and set payment dates.

- Seamless integration with Quickbooks and other tools.

- A consolidated view of upcoming payments and recurring invoices.

With access to MSP-specific payment automation software, WJP saw:

- A 30% increase in clients using AutoPay for recurring payments

- 3x faster payment processing

- 15% cost savings

You can also transform your MSP's recurring payment processes with FlexPoint.

Experience seamless integration, enhanced reliability, and superior management capabilities.

Visit our website or schedule a demo today to see how FlexPoint can revolutionize your payment systems.

Additional FAQs: Optimizing Recurring Payments For MSPs

{{faq-section}}

.avif)