How Real-Time Billing Transforms Client Engagement and Revenue for MSPs

According to PYMNTS, 40% of B2B payments in the US are still made using checks, while 6 out of 10 firms use legacy payment methods, like cash payments.

Outdated billing processes involve delayed processing and payment reconciliation, which lead to missed invoices, payment delays, untracked pending payments, inconsistent cash flow, and revenue leakage.

Traditional billing methods impact your MSP's bottom line and make scaling difficult. Billing problems disrupt operations and strain client relationships due to service interruptions and potential payment disputes. If you and your team are spending time chasing payments or resolving billing disputes, you are losing resources that could help drive growth.

Real-time billing transforms revenue management for MSPs. It calculates service charges instantly and allows clients to pay right away. Automating invoicing and real-time financial tracking improves cash flow and enhances client experience.

In this article, we will explain how real-time billing helps your MSP overcome challenges such as inaccurate billing, missed invoices, and delayed payments. We will also look at strategies to automate invoicing and implement real-time financial reporting to improve your MSP's financial health.

{{toc}}

The Importance of Real-Time Billing in MSP Financial Management

Real-time billing is a dynamic invoicing system that tracks, calculates, and processes charges as services are provided. It eliminates the traditional invoicing processes involving manual data entry, batch invoicing, scheduled reconciliation, and estimated reporting.

Real-time billing ensures accurate invoices, faster payment processing, automated payment reconciliation, and real-time financial tracking. It helps MSPs address billing errors, missed invoices, payment delays, revenue leakages, and inaccurate financial reporting.

In addition, real-time billing improves cash flow by eliminating revenue bottlenecks and reducing billing errors.

According to PYMNTS, 34% of B2B buyers struggle with slow payment systems, and 71% of accounting professionals expect automated B2B payment.

Real-time billing eliminates the lag between service delivery and payment requests. It ensures charges are calculated accurately based on real-time usage, reducing potential disputes and lost revenue.

Real-time tracking helps MSPs reduce administrative overhead while enabling precise usage-based pricing. Clients are charged precisely for the services they consume. Clear and detailed invoices build client trust and reduce payment delays.

Integrating an automated billing system with accounting and PSA tools allows MSPs to reconcile payments in real time.

Automated bidirectional syncing between billing platforms and financial software gives MSPs instant visibility into outstanding invoices. It helps schedule follow-ups, optimize cash flow, and reduce receivables.

Regularly monitoring revenue inflows helps with data-driven decision-making, such as identifying high-value clients, adjusting pricing models, and offering new services.

{{ebook-cta}}

5 Strategies for Implementing Real-Time MSP Billing

According to Balance, traditional invoicing takes about 10 days to process a single invoice, extending payment timelines to around 40.3 days. The delay impacts your MSP's cash flow and operational growth.

Real-time billing addresses these challenges by enabling immediate invoicing upon service delivery. It helps reduce payment delays and makes revenue more predictable. This method ensures charges are calculated correctly and on time, reducing disputes and building client trust.

Deloitte predicts that real-time payments could drive B2B payments in the US by 2028 and replace $18.9 trillion in payments made by legacy methods, such as checks. Implementing real-time billing gives your MSP a strategic advantage over competitors. You must integrate your accounting and PSA tools with automated billing systems capable of tracking service usage in real-time to generate instant invoices and collect payments.

Here are five strategies for implementing real-time MSP billing effectively:

1. Automating Invoicing for Instant Payment Processing:

Manual invoicing is inefficient and causes payment delays and revenue issues.

According to Ascend, manually processing an invoice costs $15, including paper, printing, postage, and labor. In contrast, electronic invoicing costs just $2.36.

MSPs using manual invoicing spend much more time on the same task and are at risk of billing errors, missed invoices, or payment delays.

Automated invoicing ensures instant invoice delivery and payment processing, saving time and resources while speeding up payment cycles. It accelerates cash flow and minimizes human errors associated with manual data entry.

According to PYMNTS, companies with 50% AR automation report a 32% reduction in DSO (Days Sales Outstanding).

Additionally, automated invoicing solutions reduce your MSP's administrative costs and improve client satisfaction through timely and accurate billing. By automatically calculating charges based on the actual consumption of services, usage-based pricing is easier to support.

These systems provide real-time updates on invoice status, payment receipts, and overdue invoices, allowing you to monitor key metrics of your MSP on a unified dashboard and generate custom reports.

2. Reducing Revenue Leakage with Usage-Based Pricing:

MSPs that depend on email chains, spreadsheets, or outdated help desk tools face revenue leakage due to inaccurate tracking of billable hours and services. According to BluLogix, fragmented systems and outdated workflows result in 5–15% of annual revenue losses.

Using unreliable methods of tracking billable time or invoicing recurring contracts can lead to costly errors, such as unbilled services, unresolved tickets, and untracked payments.

MSPs implementing usage-based pricing models can effectively address these challenges by avoiding underbilling while ensuring clients are charged accurately for the services. Transparent invoicing reduces billing disputes and improves client trust. Automating usage tracking helps MSPs minimize revenue leakage efficiently.

Real-time billing solutions ensure accurate and real-time metering of service usage. They send instant alerts when services are consumed and invoice the calculated charges. MSPs can benefit from billing by the minute or hour to offer competitive pricing for their services while getting paid instantly.

3. Improving Cash Flow with On-Demand Billing Adjustments:

MSPs need to deal with on-demand billing adjustments caused by invoicing errors, service usage changes, or the need to account for actual usage. Traditional billing methods require manual verification and rectification of discrepancies.

According to Regpack, fixing billing errors takes between three and seven days. It can lead to cash flow interruptions and hurt your MSP's bottom line.

Real-time billing solutions enable MSPs to make immediate adjustments to invoices based on actual service consumption. These ensure precise pricing that reflects clients' usage. The dynamic approach minimizes billing errors and strengthens client relationships.

According to PYMNTS, companies with manual payment processes have a 30% longer DSO and spend 67% more time chasing overdue payments. Immediate invoice corrections encourage clients to pay right away.

Additionally, integrating billing, notifications, and payment processing into a single automated system can reduce DSO, thereby enhancing cash flow.

4. Enhancing Client Trust Through Transparent and Accurate Billing:

According to PYMNTS, 89% of companies offering real-time payments report better relationships. Transparent billing practices help MSPs build trust and reduce disputes as clients receive timely and precise invoices.

Real-time billing systems help MSPs proactively address billing issues, preventing long standing disputes and improving client experience.

Accurate billing also improves operational efficiency by reducing the time spent resolving billing-related concerns.

5. Leveraging Real-Time Financial Insights for Smarter Decision-Making:

Real-time financial tracking provides MSPs with up-to-date insights into revenue and expenses to evaluate financial health.

By continuously monitoring revenue and costs, MSPs can spot trends, predict cash flow, and make more accurate data-driven decisions.

Real-time visibility enables MSPs to forecast revenue more effectively and set realistic financial goals.

Identifying seasonal trends allows them to prepare for potential service demand fluctuations. You can allocate resources strategically to maintain a competitive edge.

Conclusion: Strengthening MSP Revenue and Client Relationships with Real-Time Billing

Real-time billing helps MSPs stay financially stable, streamline revenue collection, and build client trust. By offering usage-based pricing models, you can invoice for services used when they are delivered.

An automated billing system eliminates billing errors and reduces disputes. Generating invoices promptly and tracking payment statuses as they occur helps improve cash flow and prevent payment delays. Transparent billing strengthens client relationships.

Real-time billing systems enhance visibility into your MSP's cash flow, allowing you to identify outstanding payments and take proactive measures to maintain finances. Efficient cash flow management supports the long-term success of your MSP.

By automating labor-intensive billing processes and ensuring compliance with industry standards, FlexPoint enhances the client payment experience. It offers:

- Automated Invoice Generation: Automatically creates detailed invoices with clear service breakdowns. It ensures transparency and reduces manual workload.

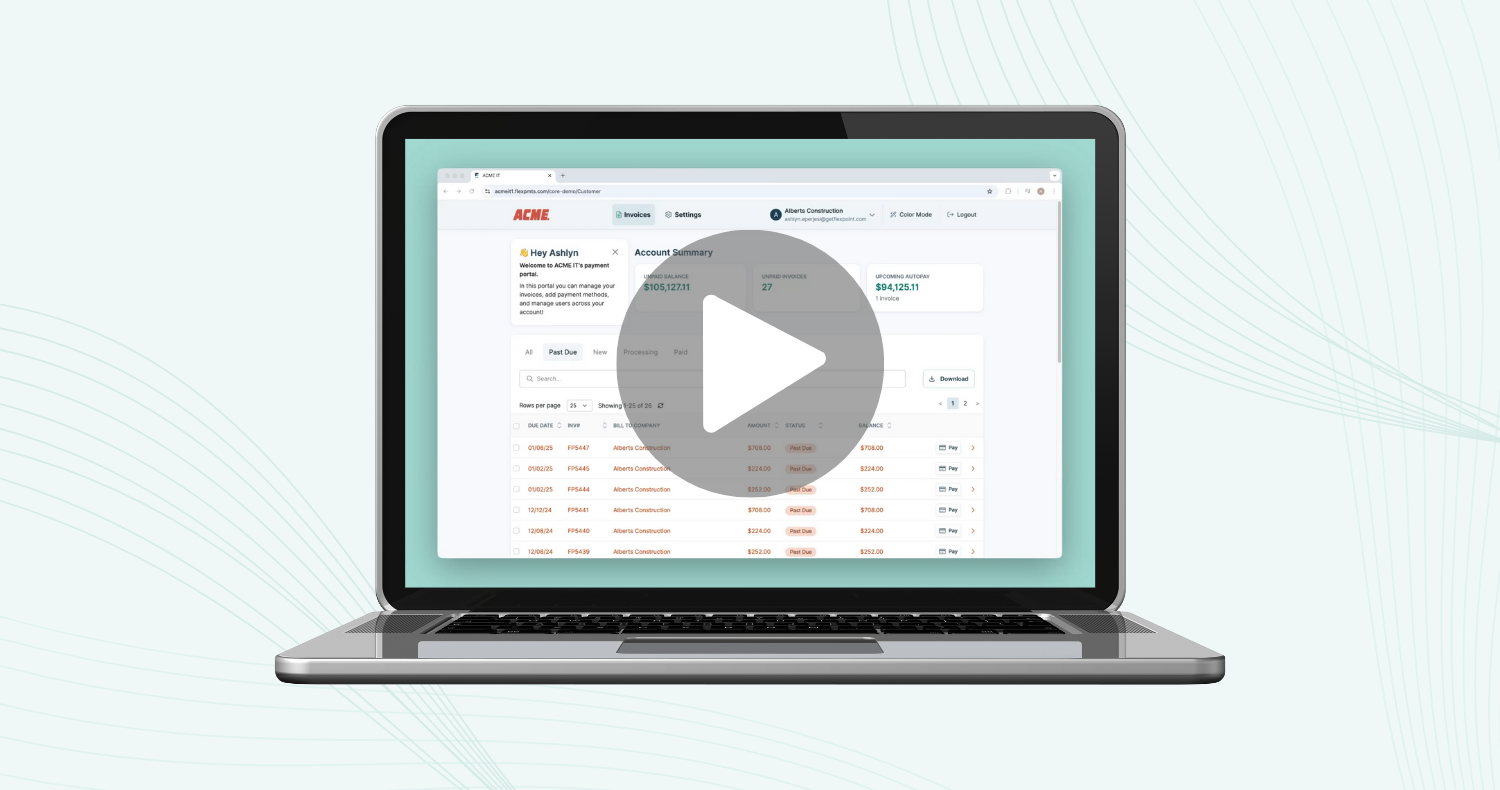

- Branded Client Portal: This customizable and secure portal allows clients to view invoices, make payments, and manage their transactions seamlessly.

- Flexible Payment Options: We offer payment options such as credit cards, ACH, and FlexLine Financing to allow clients to pay using their preferred methods. This helps increase customer satisfaction and retention.

- Real-Time Payment Reconciliation: Automates the matching of incoming payments with corresponding invoices. Real-time payment reconciliation prevents service interruptions and provides up-to-date financial data for accurate cash flow management.

- Unified Client Dashboard: Delivers a comprehensive view of all client interactions, invoices, and payment statuses in one centralized location. It streamlines account management and improves cash flow management.

- Financial Reporting: Generates customizable financial reports to track income, expenses, and profit margins. It offers a comprehensive overview of your MSP's financial health and helps in decision-making.

Optimize your MSP's financial operations with FlexPoint's real-time billing solutions.

Improve cash flow, increase accuracy, and enhance client satisfaction today.

Schedule a demo to see how FlexPoint can transform your billing processes.

{{demo-cta}}

Additional FAQs: MSP Real-Time Billing

{{faq-section}}