Building Trust and Clarity: A Guide to Transparent MSP Payment Policies for Clients

According to PYMNTS, electronic payments help reduce DSO by 30%. To maintain a low DSO (Days Sales Outstanding) as an MSP, you must balance aggressive payment policies with flexible payment options.

These could include offering multiple payment methods, installment plans, or grace periods to maintain customer satisfaction while improving DSO.

A well-defined payment policy outlines the procedures for managing financial transactions within a business, detailing how payments are accepted, processed, and recorded and the terms of service.

A robust payment policy helps establish and maintain client trust by demonstrating transparency, reliability, and a commitment to customer satisfaction. This, in turn, can lead to increased client retention, positive word-of-mouth, and ultimately sustained business success.

This article will address the common challenges MSPs encounter with payment policies and offer practical strategies to overcome these issues.

We will discuss how to effectively craft payment policies that prevent delays and promote transparent, timely communication with clients.

{{toc}}

11 Common MSP Payment Policy Challenges

This section discusses typical challenges MSPs face when setting up payment policies, such as lack of clarity, inconsistency across clients, and difficulty in enforcement.

Here are some of the most common payment policy challenges that MSPs encounter.

1. Accepting Check Payments

According to research by PYMNTS in 2023, 62% of businesses prefer paper checks as a means of payment.

However, processing checks for client payments can be cumbersome and prone to payment errors, such as misdated or incorrectly written amounts, which can delay payment processing and create discrepancies in financial records.

Here are some of the common challenges when accepting checks as a mode of payment:

- Delays: Checks can slow down payment processing due to manual handling and disrupting cash flow.

- Loss or Theft: Checks can be lost in the mail or stolen, leading to missed payments and security concerns. A CBS News report highlights this issue, revealing a dramatic increase in mail theft complaints from fewer than 60,000 in 2018 to over 250,000 in 2023.

- Errors: Manual check processing increases the risk of billing mistakes, such as incorrect payment amounts or misapplied payments.

- Fraud: Checks are vulnerable to fraud, including forgery and alteration, which can result in financial losses.

2. Lack of Clarity

The American Bar Association found that 60% of contract disputes come from unclear terms.

Ambiguous payment terms make financial management harder for you and your clients. When payment terms are unclear or not well-communicated, clients often need clarification on how much to pay.

As a result, clients might miss payment deadlines or pay the wrong amounts, causing cash flow problems for you. This confusion can lead to misunderstandings and disagreements, hurting trust and damaging your professional relationship.

For instance, if a client is unsure if they should pay monthly or quarterly or if additional charges apply based on service usage, this uncertainty can lead to missed payment deadlines or incorrect amounts being paid.

The resulting misunderstandings can erode trust between both parties, disrupt smooth business operations, and further complicate budgeting and forecasting for both parties.

3. Inconsistency Across Contracts

Inconsistency in payment terms for your clients will severely hinder policy enforcement. When terms are standardized, applying payment policies uniformly across all clients becomes more accessible.

For example, If Client A is billed $5,000 monthly, Client B is billed $15,000 quarterly, and Client C has a different payment schedule with additional fees, managing these diverse terms becomes complex.

This inconsistency can lead to frequent disputes over payment schedules, create administrative headaches, and increase the risk of financial losses.

A lack of consistency can also lead to frequent payment disputes, increased administrative burdens, and potential financial losses, undermining the overall effectiveness of payment policies.

4. Enforcement Difficulties

Lack of clarity on the penalties associated with a breach of payment policy can lead to misunderstandings and potential disputes, ultimately impacting client satisfaction and business operations.

However, you have to apply payment policies consistently, which makes them easier to enforce.

For example, if your contract lacks explicit terms on late fees, a client who misses a payment might argue that they were unaware of any penalties, leading to disputes and delays.

This ambiguity can make it challenging to enforce consistent payment practices, potentially resulting in prolonged cash flow issues and administrative burdens.

5. Compliance with Regulations

Your payment policies must comply with financial regulations and data security standards, which can be challenging.

Managing payment policies that comply with financial regulations and data security standards can significantly challenge managed service providers (MSPs).

Adhering to complex laws like the Payment Card Industry Data Security Standard (PCI DSS) is crucial, as non-compliance can lead to severe repercussions, such as legal penalties, reputational damage, and client loss.

For instance, an MSP might implement robust security measures but still face challenges in maintaining compliance due to frequent changes in PCI DSS standards.

This struggle is evident when an MSP's security system fails to meet the latest encryption standards, leading to potential vulnerabilities.

Such lapses can result in hefty fines and damage to the MSP's reputation, as clients expect the highest level of data protection.

6. Integration with Billing Systems

Integrating payment policies with billing and accounting software (such as QuickBooks Desktop, QuickBooks Online, Xero) is essential to streamlining financial management and improving customer relationships.

However, this process comes with challenges, such as data synchronization issues, compatibility problems between different software systems, and security concerns related to handling sensitive data.

These issues can lead to discrepancies, errors, and potential data breaches, impacting financial accuracy and trust.

Take, for example, an MSP that might need to help sync payment terms with its billing system, which can lead to data discrepancies and errors.

Compatibility issues between different software systems (such as payment software, PSA, and accounting software) can result in incorrect billing amounts or missed payments, while security concerns about handling sensitive financial data can heighten the risk of data breaches.

Lack of proper integration impacts financial accuracy, strains customer relationships, and erodes trust.

7. Client Pushback

If you introduce rigid payment policies without adequately explaining them, clients might view these terms as inflexible, which can erode trust and strain relationships.

For instance, you might need to invest extra resources in managing disputes or negotiating terms.

When rigid payment policies are implemented without clear communication, clients may perceive these terms as inflexible, leading to significant pushback.

This perception can undermine trust, strain client relationships, and potentially lead to disputes.

As a result, MSPs may face disruptions in cash flow and increased administrative burdens as they handle these conflicts.

Poorly defined or communicated payment terms can also impact client satisfaction.

Clients may feel their needs need to be considered, leading to decreased loyalty and potential loss of business.

8. Adapting to Payment Method Preferences

Clients may prefer various payment methods, from traditional checks to modern digital options like credit cards or ACH.

However, you must find a way to navigate these preferences while ensuring security and convenience, which adds complexity to financial management and increases administrative overhead.

For instance, an MSP might prefer payment via bank transfer due to its simplicity, but some clients may favor digital payment methods like credit cards or digital wallets for convenience.

Balancing these preferences can be complex, as accommodating a variety of payment methods requires integrating different systems and ensuring compatibility.

Ensure that you align payment methods with client preferences to avoid delays, payment disputes, and dissatisfaction.

9. Updating Policies

You need to update your payment policies regularly to reflect changes in your business, the market, or legal requirements.

Regular updates of payment policies are vital for staying aligned with evolving business models, market conditions, and legal requirements.

For instance, if an MSP shifts to a subscription-based model or updates its payment policies to match new regulatory requirements, outdated payment policies can lead to compliance issues, financial mismanagement, and client frustration.

Failure to adjust policies in response to these changes can result in billing errors, legal penalties, and disrupted cash flow.

If policies are not updated and communicated clearly, clients may experience inconsistencies or confusion, damaging trust and satisfaction.

10. Training Staff

According to Seismic, a strong training program equips your staff with the necessary skills and can improve customer experience by 90%.

When introducing new payment terms or procedures, all team members must be trained to apply these policies consistently.

Without proper training, staff may struggle understanding payment processes, leading to inconsistent client interactions and potential disputes.

When payment policies are not clearly communicated or fully understood by staff, inconsistencies in client interactions can occur, which can erode trust, disrupt cash flow, and complicate financial management.

Poorly defined or poorly communicated policies can also lead to billing errors and payment delays.

11. Monitoring and Auditing

You must review the effectiveness of its payment policies consistently to avoid signs of revenue leakage or inefficiencies.

According to Ernst & Young, 1 to 5% of a company's EBIDTA (earnings before interest, taxes, depreciation, and amortization) is lost due to poor monitoring and auditing.

Thorough audits of payment processes help identify and fix financial issues, protecting revenue and ensuring accuracy.

Inadequate monitoring can lead to undetected billing errors, missed payments, or discrepancies between recorded and actual revenue, severely impacting cash flow and financial stability.

Also, poorly defined or communicated policies exacerbate these issues, leading to client confusion and payment disputes. This lack of oversight undermines trust and complicates financial management, as resolving discrepancies can be resource-intensive.

{{ebook-cta}}

10 Effective Strategies for Developing MSP Payment Policies

We've identified common payment policy problems like delayed payments, client issues, and cash flow problems.

This section will discuss strategies your MSP team can use to create effective payment policies to solve these problems.

1. Stakeholder Involvement

When creating payment policies, involve both team members and critical clients.

Include their perspectives to ensure the policies are widely accepted. Early involvement helps identify and resolve potential issues before implementation.

Suppose you have standardized NET 30 payment terms and 5% payment for late payments after 30 days — ensure that this is clearly explained in your client contracts or during onboarding.

If you notice that your client is giving you a lot of pushback for this term, it’s a sign that you should revisit and redesign this.

In addition, research if there are any specific accounts receivable.

This inclusive approach results in smoother policy implementation and fosters a sense of ownership among stakeholders. When people feel their opinions matter, they are more likely to follow the policies.

This collaboration improves compliance, builds stronger relationships, and creates a more supportive and effective work environment.

2. Transparency on Payment Terms

Clearly stating your payment terms is crucial. Use simple language so clients understand their payment obligations and avoid confusion.

Avoid technical jargon and use plain words to build trust and inform clients about the payment process.

Be transparent from the start. Include clear payment terms in the contract, detail them in invoices, and discuss them upfront.

For example, instead of saying, "Payment is due within 30 days of receipt," say, "Payment is due 30 days from the invoice date." This clarity helps clients understand their responsibilities.

If you have incentivized terms for early payments or payments via ACH, mention that to the clients so they can decide whether to use that method.

When payment policies are clear, transactions go smoothly, and disputes are less likely.

Clients who understand the rules are more likely to follow them, strengthening client relationships and improving business operations.

3. Flexible Payment Options

Offering different payment options can improve client satisfaction and cash flow. Matching payment methods to client preferences encourages timely payments and strengthens relationships.

Options like credit cards, bank transfers, and flexible financing let clients choose what works best for them, ensuring smoother transactions.

Flexible payment policies show your commitment to client convenience, helping you stand out and handle larger clients.

For example, Loud and Clear, a veteran-owned MSP based in Indiana, was trying to attract enterprise-level clients but needed help due to its limited and unpredictable cash flow.

Loud and Clear faced challenges when clients were unwilling to pay upfront. To address the issue, their payment software now offers a solution that gives them access to necessary capital, resolving their immediate problems.

Additionally, it allows for flexible payment options for their clients. This, in turn, allows the invoices to be settled within 24 hours. This efficiency makes it easier for Loud and Clear to work with large clients, enhancing their overall business operations.

A flexible payment plan helps build client loyalty and satisfaction, showing that you care about meeting client needs.

4. Automated Reminders and Penalties

You can effortlessly set automated reminders to track late payments. This reduces the workload and helps ensure clients pay on time. Automated reminders and penalties are crucial to getting payments on time for your business.

Setting clear penalties for late payments (as discussed above) shows how important it is to follow payment terms, helping to stabilize your cash flow.

Skycamp, an Ohio-based MSP, stabilized its cash flow and increased payment from late clients by 30% by using automated reminders to remind clients to pay on time.

Integrating auto-reminders into your payment policies makes monitoring and enforcing rules easy and lets you know which clients haven’t paid.

Using an MSP payment automation software allows you to send reminders effortlessly and also ensures that you get paid on time.

You can set reminders to match your payment schedule, ensuring clients are notified on time.

Clear penalties for late payments motivate clients to pay their bills promptly. Automation helps you run smoothly and keeps your finances healthy.

5. Regular Policy Reviews

A report by the Ethics & Compliance Policy Management Benchmark showed that 47% of organizations need help to keep up with changing regulations.

Regular reviews of your payment policies will help you spot and fix issues, stay updated with financial rules and industry standards, and update them when the business needs to change. This is crucial for smooth operations and client trust.

Regular reviews also help you adapt to new technologies, follow market trends, and understand customer preferences. This makes transactions more efficient, strengthens financial health, and keeps the business competitive.

6. Transparency in Invoicing

Good business practice is to list all charges and explain the services' costs to help your clients understand what they're paying for, reduce disagreements, and build trust.

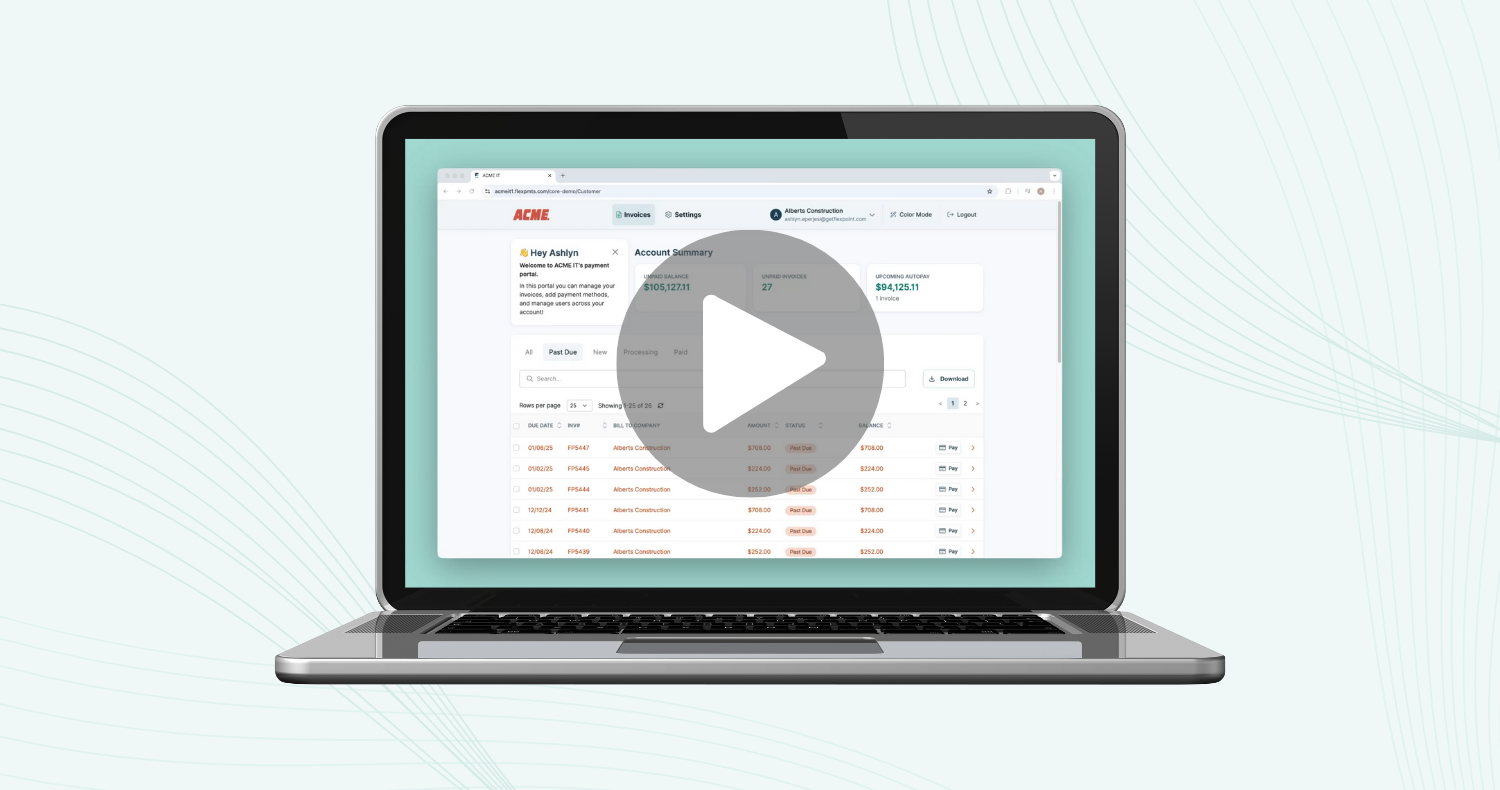

You could use a client portal to show your clients both previous and upcoming invoices, making you look professional and transparent, rather than manually sending emails that can be lost in the client’s inbox.

For instance, Excellent Networks, an MSP based in Texas, used ConnectWise to send invoices and collected most payments via check, which sometimes got lost in the mail.

For those who paid by credit card, the processing was done manually through QuickBooks, which incurred additional fees and lacked real-time visibility.

This lack of transparency made it difficult for Excellent Networks to track invoice statuses, monitor payment timelines, and manage financial records efficiently.

As a result, Excellent Networks' president, Mark Luna, sought a solution to enhance visibility and streamline the invoicing process.

With the help of their new transparent payment system, they have a client portal that allows their clients to view their invoices in real-time, eliminating the risk of lost checks, invoice statuses, and payment histories.

By using payment software with an integrated client portal to view their invoices, your clients can see that you are open with them and have nothing to hide, increasing their trust in you when developing a payment policy.

7. Training Programs

A 2023 Navex report found that the biggest challenge businesses face when developing policies is getting employees to follow them, with 42% of businesses struggling with this issue.

To address this, it is important to train your staff regularly on your revised payment policies.

Ongoing training, especially for the accounting and bookkeeping teams, ensures everyone understands the updated payment rules and knows how to apply them correctly.

Regular training reduces mistakes, improves efficiency, and keeps clients satisfied. When staff are well-trained, they can handle payment situations smoothly, leading to better client interactions and showing your commitment to reliable payment practices.

8. Clear Communication and Efficiency

Clear communication and transparency are key to effectively enforcing payment policies. When setting up payment terms with new clients, it’s important to ensure that the process is straightforward and that clients fully understand their obligations.

One way to enhance this process is by scheduling a Zoom call to discuss contract details with new clients.

During this call, you can walk them through the digital contract, highlighting key payment terms and conditions while addressing any questions they may have. This real-time interaction makes the process more transparent and allows for immediate adjustments if any part of the contract needs modification.

Using digital contracts and e-signatures, which are now standard practice for most MSPs, ensures a secure and legally binding agreement.

This approach speeds up the contract process, allowing services and payments to start without delays. It also builds trust by demonstrating your commitment to clear and reliable business practices.

Focusing on transparency and ease of use makes it easier for clients to understand and adhere to payment policies, ultimately leading to smoother transactions and consistent cash flow.

9. Security Standards

To build trust in your clients, you must protect their information. Research indicates that 91.1% of businesses prioritize data privacy when it directly impacts customer trust.

To implement a payment policy, you must also implement strong security measures. Use strict protocols to protect client information, comply with regulations, and keep data safe.

For instance, tekRESCUE, a Texas-based MSP, improved its industry trustworthiness due to the enhanced security features of its payment software provider.

tekRESCUE has created various technology experiences, so it needed a secure payment system to scale its business. The team relied on QuickBooks for billing and spreadsheets to manually enter client payments and payment methods.

However, after moving to a payment system with more secure features, their clients could store their credit card and banking information securely, without any human interference, and ensure that their client's data is safe.

This saved the tekRescue team 20 hours per month on manual tasks.

10. Feedback Mechanisms

According to the Microsoft State of Global Customer Service Report, 77% of customers are loyal to brands that ask and accept customer feedback.

Establishing robust feedback systems is essential for refining your payment policies. You should also actively seek your clients' input to understand their invoicing & payment-related pain points and any areas needing improvement.

For instance, you could discuss payment policies with each client during their renewal or when you notice a series of late payments from a specific client.

Further analyzing this feedback lets you quickly identify and address issues, ensuring smoother operations. By prioritizing client feedback, you are committed to continuous improvement and client-centric solutions.

Conclusion: Establishing Trust with Effective Payment Policies

This article covered how to enhance client trust by establishing clear payment policies, offering flexible options, ensuring transparent invoicing, and regularly reviewing these guidelines for effectiveness.

We have also addressed common challenges like outdated payment methods, inconsistent terms, and regulatory compliance with strategies for developing policies.

Transparent payment policies are crucial in building client trust by ensuring accurate, timely, and secure transactions.

FlexPoint is a robust solution for effectively implementing and managing these payment policies.

With features that automate payment processes, facilitate seamless data synchronization, and enhance client communication, FlexPoint helps MSPs like Excellent Networks streamline payment operations to improve overall efficiency.

By adopting FlexPoint, Excellent Networks reduced invoice turnaround time from 25 to 5 days while enhancing client relations through transparent and reliable payment practices.

See how FlexPoint can transform your payment management by visiting our MSP Payment Page or scheduling a demo.

Automate your MSP payment policies with FlexPoint. Visit our website to learn how our solutions can simplify payments and build client trust. Schedule a demo today to find out more.

Additional FAQs: MSP Payment Policies

{{faq-section}}

.avif)