How Data Analytics Can Revolutionize Billing Processes for MSPs

Billing is an ongoing business challenge for MSPs since invoicing delays and billing errors can lead to potential revenue leakage and dissatisfied clients. In addition, manual billing lacks real-time insights, leading to unpredictable cash flow, disrupted client service, and missed growth opportunities.

According to McKinsey, B2B companies using analytics are 1.5 times more likely to outperform competitors. MSP billing processes create a rich dataset that can be used to make smarter business decisions.

Data analytics can turn MSP billing from a tedious and error-prone process to a strategic advantage. With dashboards and automated reports, you can track key billing metrics like Days Sales Outstanding (DSO), gross margins, and billing trends.

Analyzing these over time helps you improve billing accuracy, save costs, and adjust pricing. You can use the analytics to make smarter business decisions to improve financial performance.

In this article, we will explore how MSPs can use data analytics to improve billing, make smarter financial decisions, and confidently forecast revenue trends.

We will also discuss how solutions like FlexPoint help MSPs use real-time analytics and data reporting to boost efficiency and profitability.

{{toc}}

What is MSP Billing Data Analytics?

According to Scribe, MSPs bill around 122 clients monthly, with an average of 150 users. The varying subscription details, usage metrics, pricing adjustments, and payment records result in large volumes of billing data.

When analyzed properly, the MSP billing data can offer valuable insights into efficiency, customer behavior, and revenue trends.

MSP billing analytics transforms raw billing data into actionable insights. It consolidates data from Professional Services Automation (PSA) tools (ConnectWise, Autotask, SuperOps, HaloPSA), Remote Monitoring and Management (RMM) platforms, accounting software (QuickBooks Online, QuickBooks Desktop, Xero), and client portals to provide a unified view of financial performance. These systems independently track service delivery, SLA compliance, ticket resolution times, and resource utilization.

By aggregating data from these sources, MSPs can monitor billing cycles, invoice accuracy, DSO, and revenue trends. With real-time and historical data, MSPs can enhance invoice accuracy, reduce billing errors, and improve revenue forecasting.

Understanding client payment habits and operational metrics enables you to adjust credit policies and optimize client payment terms to improve your cash flow.

Advanced MSP billing systems use automation functions, artificial intelligence (AI) tools, machine learning (ML) algorithms, and predictive analytics to identify data patterns and accurately predict future trends.

Automating data collection and analytics simplifies routine tasks like invoice generation, reminders, payment tracking, and follow-ups.

Machine learning algorithms help with predictive billing and financial reporting.

AI detects anomalies in financial reports to detect errors and identify payment patterns, while predictive analytics flags potential issues early and forecasts payment trends.

Billing data analytics identifies bottlenecks in invoice processing and payment cycles, helping MSPs improve DSO and cash flow. It also analyzes customer interactions, contract details, and historical payment behavior data from CRM systems and client portals. Analytics of these datasets helps MSPs analyze customer satisfaction and tailor payment terms based on past performance.

Additionally, data analytics-driven demand forecasting allows MSPs to allocate resources efficiently.

By examining past service requests, incident volumes, and client usage patterns, MSPs can identify trends and evaluate seasonal demand. For example, an MSP might notice increased cybersecurity support requests during the holiday season due to higher phishing attempts. It helps MSPs determine staffing needs to prevent over- or underutilization and drives cost savings.

{{ebook-cta}}

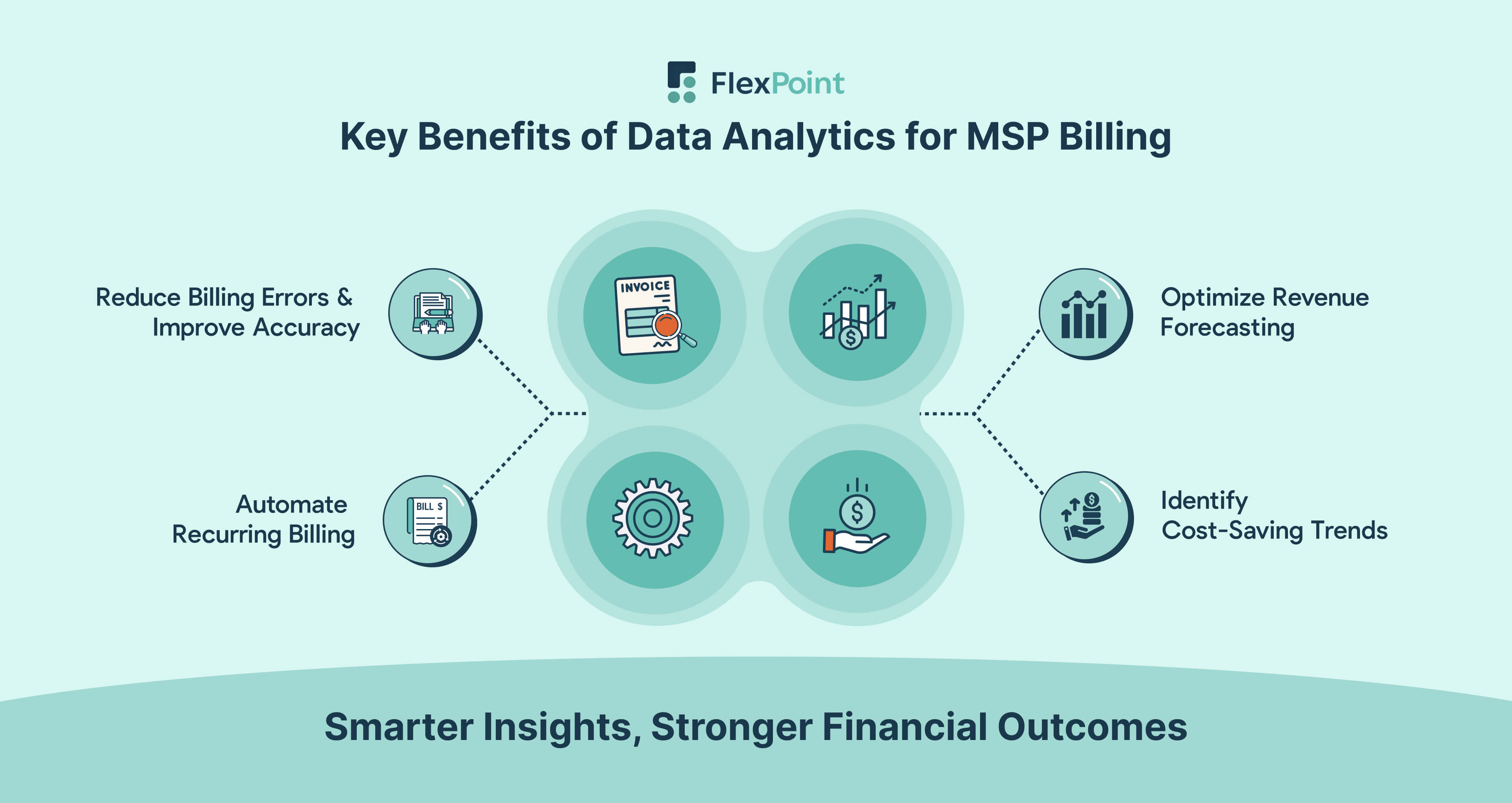

3 Key Benefits of Data Analytics for MSP Billing

According to Gartner, 65% of B2B companies will shift from intuition-based to data-driven decision-making by 2026. They will use technology that combines workflow, data, and analytics.

MSPs can gain a competitive advantage by using data analytics to improve their billing.

MSP billing data analytics helps you tailor payment strategies, reduce churn, and improve overall profitability. You can use the insights to optimize resource allocation, forecast service demand, and achieve long-term financial stability.

Here are the key benefits of data analytics for MSP billing:

1. Reducing Billing Errors and Enhancing Accuracy:

Billing errors cause revenue loss, payment disputes, and payment delays.

MSP billing data analytics helps detect and resolve errors by identifying inconsistencies in usage data, contract terms, and invoice calculations before they impact cash flow.

Advanced analytics, such as automated anomaly detection and cross-verification algorithms, identify billing problems such as overcharges, underbilling, and mismatched service logs.

Real-time alerts flag discrepancies, allowing MSPs to correct errors before sending invoices.

Automated validation checks reconcile invoices with payments, while pre-configured workflows auto-correct common mistakes, such as incorrect tax rates or expired discounts.

Predictive analytics, a subset of AI and data analytics, enhances accuracy by analyzing historical billing data to forecast discrepancies and service consumption patterns.

Dynamic pricing models align invoices with real-time usage data, reducing disputes and improving billing transparency.

2. Optimizing Revenue Forecasting and Financial Decision-making:

Accurate revenue forecasting improves cash flow stability, growth planning, and risk management. MSP billing data analytics enables real-time insights into revenue trends, helping finance teams make informed decisions.

Data analytics track recurring revenue, contract values, and billing cycles to identify financial trends. It can help detect unexpected revenue fluctuations, helping MSPs mitigate risks like client churn, late payments, and pricing inconsistencies.

In addition, predictive models can analyze service demand, seasonal variations, and client payment behavior to simulate multiple revenue scenarios, improving forecasting accuracy.

Comprehensive financial dashboards consolidate key metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rate, and DSO for real-time financial insights. Linking demand trends with financial performance lets you plan service pricing and cost control strategies.

Automated KPI tracking alerts MSPs to make proactive adjustments based on cash flow and payment pattern changes. You can use these insights to refine pricing strategies, allocate resources efficiently, negotiate better payment terms, and offer flexible payment options.

3. Automating Recurring Billing and Identifying Cost-saving Trends:

Data analytics improves recurring billing by automating invoicing, payment collection, and reconciliation. MSPs can automate invoice generation more accurately by analyzing past transactions, subscription patterns, and service agreements. Validation tools flag billing discrepancies by comparing invoices with service logs and contract terms.

Integrated payment gateways such as FlexPoint include AutoPay features that can auto-charge clients, send reminders for overdue invoices, and apply late fees, improving cash flow management.

Analyzing historical billing data helps MSPs identify pricing inefficiencies and uncover cost-saving opportunities. Tracking service consumption patterns allows MSPs to refine pricing models. For example, you can offer discounts for high-volume users or adjust rates for underutilized services.

Data analytics highlight underperforming service packages, high-maintenance clients, or unprofitable contracts, enabling you to restructure offerings for better margins.

In addition, predictive analytics tools help with revenue forecasting by anticipating payment collection trends and identifying revenue fluctuations. MSPs can use these insights for smarter financial planning and cost management.

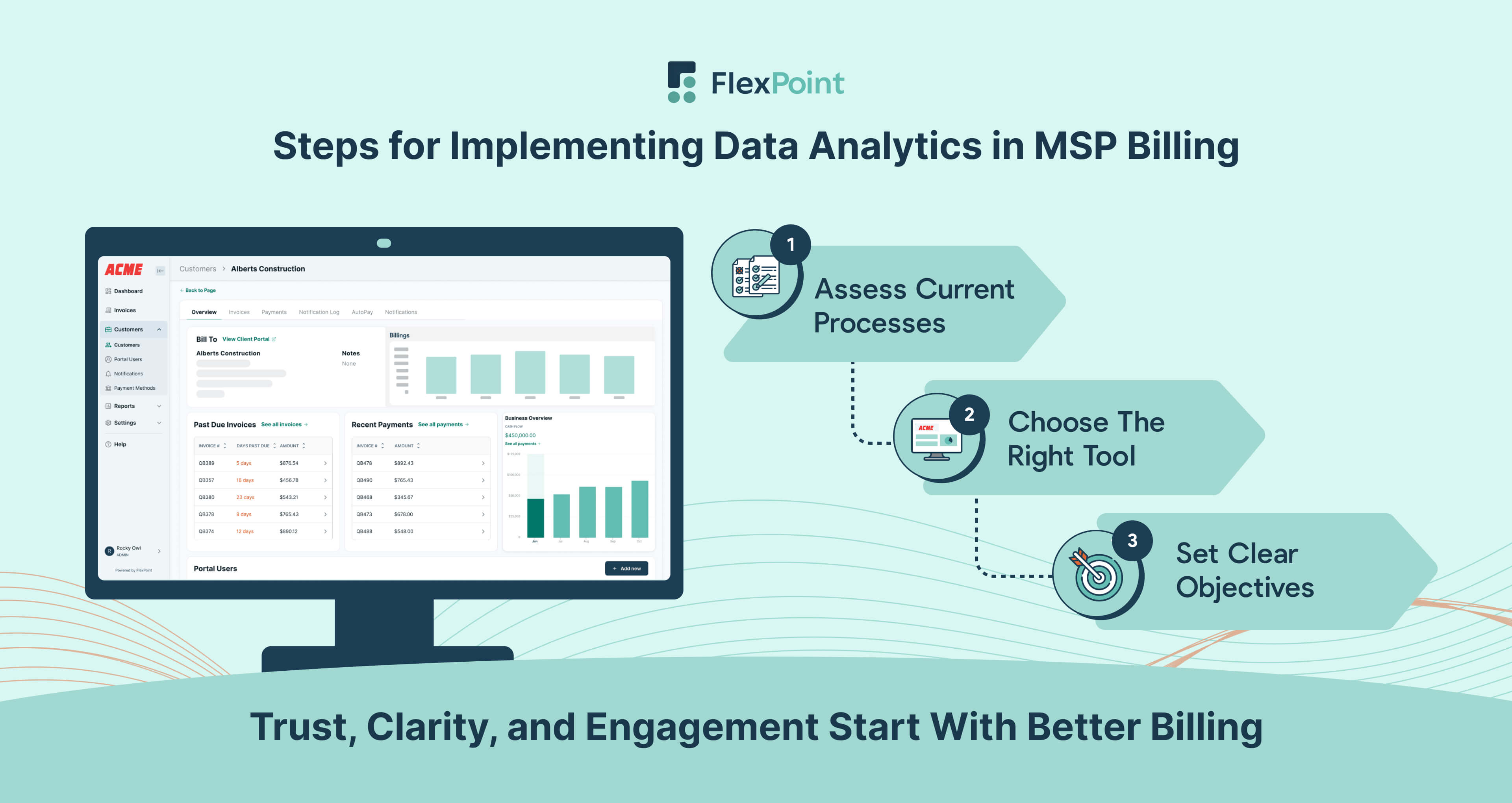

3 Steps for Implementing Data Analytics in MSP Billing Processes

According to PYMNTS, payment uncertainty costs companies an average of over $20 million. Real-time visibility in B2B payments data helps unlock value across the invoice-to-cash experience.

MSPs can leverage data analytics to gain insights into their billing processes, make informed pricing decisions, speed up payment collections, and improve revenue forecasting.

Integrating data analytics tools into MSP billing processes requires careful consideration of the following:

1. Data Collection and Integration for Billing Insights:

MSPs can achieve complete revenue visibility by centralizing billing data from multiple sources, such as PSA tools, RMM platforms, and accounting software.

A unified data repository eliminates silos, ensuring accurate and real-time financial insights.

- PSA tools help track billable hours, contract terms, and service delivery, ensuring accurate invoicing.

- RMM tools provide insights into resource usage and performance, which can help MSPs tie operational metrics to billing processes.

- Integrating accounting software allows MSPs to streamline financial reporting, monitor cash flow, and manage accounts receivable seamlessly.

These combined data analytics give MSPs a 360-degree view of revenue trends, invoice accuracy, and cash flow. You can spot billing issues, prevent underbilling, and ensure contract compliance. This overview also helps you track trends, assess profitability for each client, and refine pricing strategies with real-time data.

2. Choosing the Right Analytics Tools for MSP Billing:

According to PYMNTS, tailored payment solutions can be strategic differentiators as they enhance customer experiences and improve revenue. MSPs must carefully select the right analytics tools to maximize profits and deliver value.

When selecting an MSP-friendly data analytics platform, look for these features:

- Scalability: The platform should scale quickly to handle varying client numbers and datasets, growing with your business needs.

- Automation: Automated data collection and reporting save time and reduce human error.

- Customizable Reporting: Look for customization options to tailor dashboards and reports to stakeholder needs.

- Integration Capabilities: Integration with PSA and accounting tools centralizes data.

- Security Protocols: Strong security measures are needed to protect sensitive client and financial data.

- User-Friendly Interface: An intuitive interface improves navigation and boosts daily efficiency.

- Multi-Client Support: Managing and separating data for multiple clients on one platform is essential for streamlining billing operations.

- Alert and Notification Systems: Built-in alerts for KPIs enable proactive decision-making.

- Historical Data Analysis: Historical performance data helps MSPs track trends and measure the impact of pricing strategies over time.

- Cloud-Based Financial Dashboards: Ensure the platform offers cloud-based financial analytics with live data access and real-time insights into cash flow, budgets, and profitability.

3. Leveraging AI and Automation for Smarter Financial Management:

AI enhances real-time financial reporting by quickly analyzing vast billing datasets. It improves billing efficiency and accuracy by identifying anomalies and detecting fraud, like duplicate invoices or unauthorized charges.

ML models predict payment collection based on historical trends. They are helpful for efficient cash flow management.

According to BlueSnap, automated billing systems improve invoice accuracy, make payment collection more effortless, and help collect late payments. These systems create and send invoices based on each client’s contract terms and payment cycle, helping MSPs avoid missed invoices and ensure timely payments.

Conclusion: Driving MSP Financial Success with Data-driven Billing

Traditional MSP billing tools rely on static pricing, manual invoicing, and siloed financial data. These inefficiencies cause MSPs to suffer revenue loss and cash flow issues.

Adopting a data-driven approach to financial management enables MSPs to proactively identify revenue opportunities, optimize pricing strategies, and enhance customer satisfaction.

Data analytics streamlines MSP billing with greater accuracy, automation, and real-time insights. It reduces errors, improves cash flow, and supports smarter decisions.

FlexPoint is designed to help MSPs streamline billing, forecast revenue, and minimize financial risks. The billing platform offers automation, a unified dashboard, and robust data insights to help you make well-informed decisions for your MSP's growth and long-term success.

FlexPoint streamlines MSP billing by automating revenue tracking, optimizing pricing strategies, and minimizing billing errors through advanced data analytics. The platform unifies billing data from PSA and accounting tools on a centralized dashboard, giving you a real-time, unified view of revenue and cash flow trends.

FlexPoint eliminates manual reconciliation by automatically matching invoices with service usage logs and contract terms. It ensures billing accuracy while preventing revenue leakage and reducing administrative workload.

FlexPoint’s data analytics and reporting tools analyze historical billing data, overdue invoices, preferred payment methods, client payment history, and more. The platform’s modular and cloud-based architecture scales effortlessly to support MSPs as they expand into new services and pricing models.

Let’s take the example of Pileus Technologies, a Kansas-based MSP, which struggled with inconsistent revenue due to billing discrepancies and slow growth due to a lack of alternative payment methods.

FlexPoint helped the MSP gain a competitive advantage with predictable revenue and strategic growth. After using FlexPoint’s Billing Software, the MSP automated recurring invoice payments and now processes payments 80% faster.

In addition, FlexPoint’s one-click financing also helped optimize pricing, leading to a 5% increase in new customers. FlexPoint’s data analytics capabilities provided real-time insights into cash flow and payment trends, enabling growth-focused decisions.

Optimize your MSP’s billing operations with FlexPoint’s data-driven billing solutions. Leverage automation and real-time analytics for more intelligent billing today.

Schedule a demo today to see how FlexPoint can transform your billing processes.

{{demo-cta}}

Additional FAQs: MSP Billing Data Analytics

{{faq-section}}