The Benefits of Same-Day ACH for MSPs

The financial side of an MSP means juggling a lot of responsibilities – cash flow, payroll, vendor payments, and client billing, just to name a few. With everything moving so quickly, waiting days for payments to process feels like a major roadblock.

That’s where Same-Day ACH comes in.

Same-Day ACH gives you the speed and flexibility to receive funds in the same business day, which keeps your business running smoothly. Let’s break down how it can make a difference for your MSP.

{{toc}}

What Makes Same-Day ACH so Important?

You’ve probably used ACH (Automated Clearing House) for payments before. These type of payments account for nearly half of all B2B transaction value, according to EMARKETER.

While standard ACH transactions often take 3-5 business days to settle, this timeline can potentially slow operations down for MSPs that need money to move fast.

Same-Day ACH allows you to receive client payments within the same business day. That means faster cash flow, quicker resolutions to payment issues, and more control over your finances.

Deciding Between Same-Day ACH vs. Standard ACH

Why choose Same-Day ACH over standard ACH? It’s simple: speed and flexibility.

Standard ACH transfers can take up to five days to process. That might work for non-urgent payments, but it’s not ideal when time is of the essence. Same-Day ACH gives you the power to move money faster, helping you stay agile and competitive in a fast-paced industry.

{{ebook-cta}}

Why MSPs Should Care About Same-Day ACH

Same-Day ACH is a powerful tool that helps MSPs tackle day-to-day financial challenges head-on. Let’s take a closer look at the main ways it can transform your business.

Take Control of Your Cash Flow

Cash flow is one of the most critical aspects of running an MSP. The ability to move funds quickly and efficiently can mean the difference between taking advantage of a growth opportunity or falling behind. Same-Day ACH gives you more control over when receivables come in, helping you maintain a clear picture of your finances.

Faster payment processing means funds from your clients land in your account sooner, helping you maintain liquidity and plan ahead with confidence.

Minimize Payment Delays

If you don’t have tools like AutoPay set up for recurring client payments, you could experience unpredictability in your cashflow. Delayed client payments can leave you short on funds to cover your own obligations, which could lead to late payroll (which obviously upsets employees), and overdue vendor payments that can strain relationships.

Same-Day ACH eliminates these bottlenecks by significantly shortening the time it takes to move money. Whether it’s making sure an important vendor is paid on time or avoiding late fees for a bill, Same-Day ACH ensures payments are processed quickly and efficiently. This speed gives you the confidence that your financial commitments are met without unnecessary delays or disruptions.

Solve Billing Issues Faster

Late payments from clients can cause a ripple effect on your business, from delaying your own vendor payments to impacting your ability to reinvest in growth. These delays can also create tension in client relationships, especially if they lead to service interruptions.

Same-Day ACH allows you to resolve billing issues quickly by enabling faster payment collection. Whether a client needs to catch up on an overdue invoice to reinstate a service or resolve a dispute, Same-Day ACH ensures the funds hit your account the same day (before the 4 pm ET cutoff time). This capability not only reduces friction in client relationships but also keeps your operations running smoothly without unnecessary interruptions.

Handle Emergencies with Ease

Running an MSP means dealing with the unexpected. Maybe you need to cover the cost of emergency repairs, pay a vendor on short notice, or manage a last-minute request from a client. Traditional payment methods aren’t built for these situations, often leaving you scrambling to find a workaround.

With Same-Day ACH, you can respond to emergencies quickly and confidently. This ability to pivot and act fast keeps your business resilient, even when the unexpected happens.

Put Your Money to Work Sooner

Delayed access to funds can slow down your business growth. Every day of delay is a day you’re unable to reinvest in your business. Same-Day ACH changes that by giving you faster access to your money, allowing you to act on opportunities without hesitation.

With funds in your account sooner, you can upgrade your technology, train your staff, or even earn interest with a high-yield savings account. You’ll also be in a better position to seize unexpected opportunities, such as securing a deal on new equipment or starting a project ahead of schedule. In short, Same-Day ACH lets you focus on growing your MSP instead of waiting for payments to process.

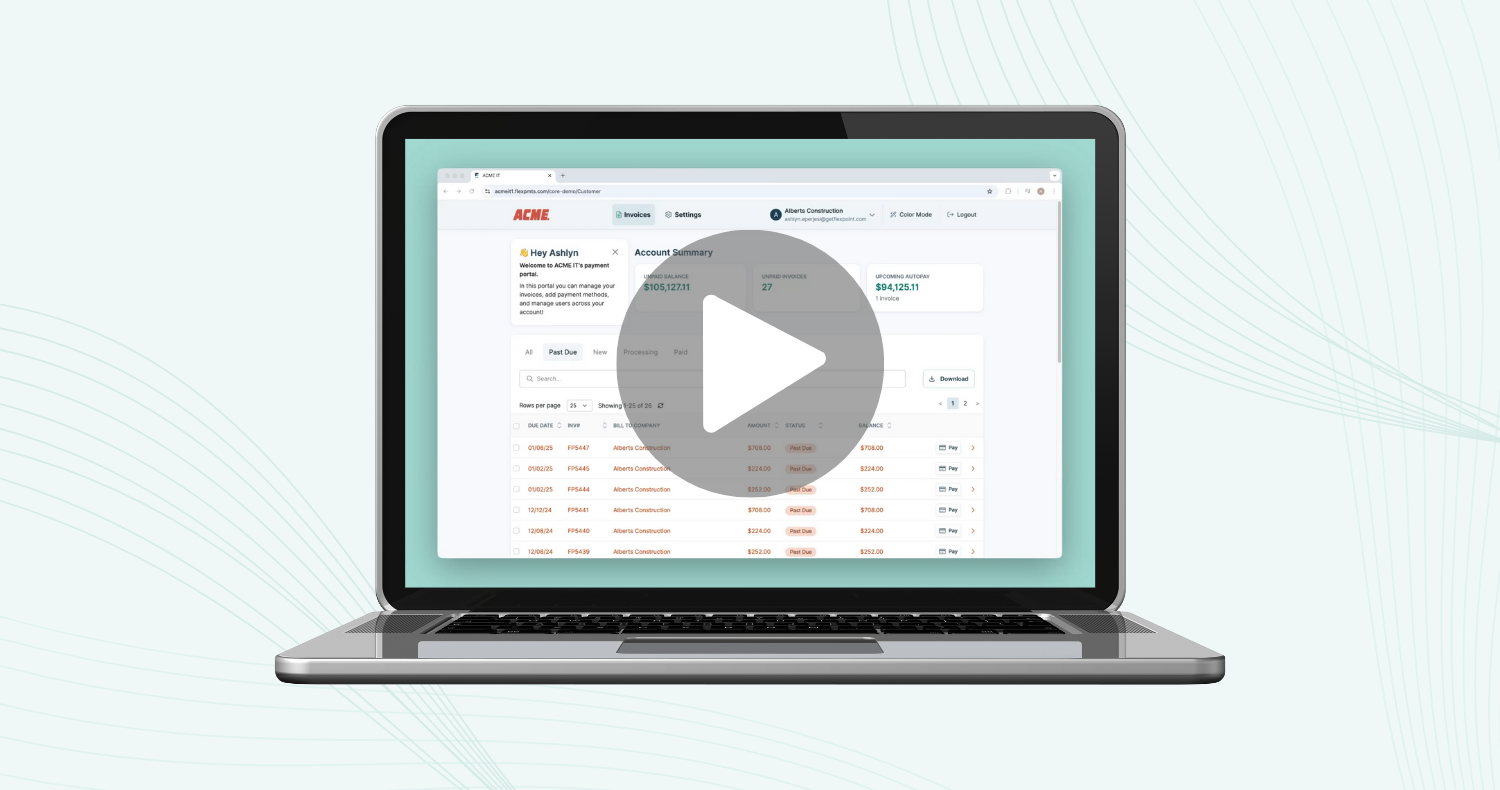

Streamline Same-Day ACH Payments with FlexPoint

While Same-Day ACH is incredibly useful, it’s even better with the right tools.

FlexPoint is a payments automation platform purpose-built for MSPs to make managing invoicing and payments (including Same-Day ACH) a breeze. It integrates seamlessly into your existing workflows, automates repetitive tasks, and gives you real-time insights into your payment activity.

For IT support providers like Tomorrow’s Technology Today, FlexPoint helps save over 30 minutes of work on every invoice.

Ready to take your payments to the next level? Contact us today for a personalized demo and see how FlexPoint can simplify your payment processes and help your MSP thrive.

.jpg)

.avif)