.png)

A move to QuickBooks Online is not a simple software update. When MSPs make this shift, they are moving to a different platform with a distinct data structure and feature set. A successful migration from QuickBooks Desktop (QBD) to QuickBooks Online (QBO) depends on thorough preparation and asking the right questions upfront.

Rushed or done while uninformed, the migration can lead to serious data errors and workflow disruptions. As well as billing issues that affect an MSP’s financial ops and cash flow.

In this article, we will provide a comprehensive checklist of questions and considerations for MSP business owners, finance managers, and bookkeepers to address before migrating from QuickBooks Desktop to QuickBooks Online.

When you plan carefully, audit your data and processes, and involve the right stakeholders, you avoid common pitfalls such as lost records, duplicate entries, or billing interruptions.

We will also discuss how proper preparation prevents migration headaches and how tools such as FlexPoint’s integration with QuickBooks support your billing workflow both pre-migration and post-migration.

Use this guide to ensure you have covered all the bases and can move to QuickBooks Online confidently and with minimal disruption to your MSP’s financial operations.

{{toc}}

5 Key Considerations: Why Proper Planning Prevents Migration Headaches

Migrating from QuickBooks Desktop to QBO is a substantial operational change for an MSP, not just a routine upgrade.

QuickBooks Desktop and QBO are fundamentally different products: QBO isn’t simply QBD in a web browser format.

Data is organized differently in QuickBooks Online. Some Desktop features and reports have no direct equivalent, and the user experience itself is new. Without proper planning, MSPs risk serious challenges.

Here are five key considerations to keep in mind when you are preparing to migrate from QBD to QBO:

1. Data Integrity:

Poor preparation can result in lost, duplicated, or corrupted records during the migration process. If the data isn’t cleaned and mapped correctly, transactions might not align.

For example, MSPs that migrate without sufficient checks might end up with duplicate entries and messy books that take dozens of hours to fix.

Ensuring data integrity involves auditing your records beforehand. You will also use Intuit’s tools carefully to ensure that your financial statements post-migration match the originals (e.g., balance sheet, profit and loss, trial balance).

2. Workflow Disruption:

Your established billing and accounting workflows may be interrupted if you don’t map them to QuickBooks Online’s capabilities. Processes such as invoicing, approvals, and reconciliation will likely need adjustments to fit QBO’s system.

Unplanned workflow changes can delay billing or payments. Conversely, proactive planning helps avoid interruptions in service to clients.

This includes proactive scheduling of the cutover after a billing cycle and training staff on new QBO procedures.

3. Feature Gaps and Differences:

Identify any critical features or customizations in Desktop that might not exist or that function differently in QBO. QuickBooks Online has fewer built-in features in some areas. Intuit provides a helpful list of features that do and do not move from QBD to QBO.

In terms of the features that do not move to QBO, Intuit lists:

- Budgets: Data transfer and budgets aren’t recreated in QBO due to mapping differences

- Inventory: Units of measure

- Multi-Currency: Transactions with three different currency types and any transactions that use currencies in QBD that do not exist in QBO

- Online Banking: Bank feeds setup

- QuickBooks Time: Timesheet data, pay item mappings, and settings and preferences

- Price Levels

- Write Letters

- Mileage Tracking: Mileage

If your MSP relies on advanced job costing, industry-specific reports, or custom fields in QBD, determine how you will handle those in QBO (through workarounds or third-party apps).

Understanding these differences ahead of time prevents unpleasant surprises, such as discovering after migration that a needed report or field is missing.

4. Integration Risks:

Consider all the existing software integrations connected to your QuickBooks Desktop.

These might include your:

- PSA (Professional Services Automation) tools

- Billing software and payment processors/gateways

- Reporting add-ons

When you migrate from QBD to QBO, those integrations may break or require reconfiguration, since the connection details and data format often change.

For example, if your MSP uses a PSA integration that syncs with QuickBooks Desktop, you will need to ensure it can connect to QuickBooks Online or have an alternative solution ready.

Failing to plan for integration updates can result in data not flowing between systems, billing automation failing, or duplicate manual work.

5. Stakeholder Involvement:

Finance, operations, and IT decision-makers in the MSP team should be involved early in the migration planning. These stakeholders can identify hidden dependencies or special requirements that may not be apparent to others.

For example, your operations manager might know of custom Excel exports used for reporting that pull from the Desktop file. Or, your finance officer might have concerns about timing the migration around year-end reporting.

Engaging all relevant team members helps surface these issues ahead of time. It also ensures everyone agrees on the migration timeline, downtime (if any), and responsibilities.

Moving to QuickBooks Online without a plan is dangerous. But with careful upfront planning and awareness of key differences, you can prevent data loss, avoid workflow breakdowns, and smoothly carry on with billing and financial operations during the switch

Top Questions to Ask Before Migrating from QuickBooks Desktop to QuickBooks Online

To guide your migration preparation, use this checklist of essential questions.

For each question, consider the answer thoroughly before you begin the QuickBooks migration process:

1. What Data Do We Need To Migrate, And What Can Be Archived?

Not every piece of historical information has to move into QuickBooks Online. Migrating only the necessary data will simplify the process and reduce the chance of migration errors.

Focus on active clients, open invoices, and recent financial transactions that will support day-to-day operations and reporting.

Older records, such as transactions from many years back, can often be archived or backed up instead. This reduces file size, avoids exceeding Intuit’s migration limits, and keeps QuickBooks Online running efficiently.

2. Are There Differences In Features Or Reporting Between Desktop And Online That Impact Our Workflows?

QuickBooks Online is not a direct equivalent of QuickBooks Desktop. Several features are either absent or handled differently. For example, price level lists, certain job costing tools, or advanced reporting options may not transfer.

If your MSP relies on these, you will need to evaluate add-ons or upgraded plans such as QuickBooks Online Advanced. Understanding gaps in advance helps your team adapt without productivity loss.

But overall, QuickBooks Online offers 500+ more app integrations to users than QuickBooks Desktop. Meaning you may actually gain functionality in the switch even if previous features you once relied on are no longer supported.

3. How Will Our Current Integrations Be Affected By The Change To QBO?

Integrations that worked with QB Desktop (such as PSA tools, payment gateways, and reporting systems) may require reconfiguration or even replacement. Some vendors offer dedicated QuickBooks Online connectors, while others require a new setup.

Document every integration and confirm compatibility before migration. Coordinating these updates avoids broken data flows or billing interruptions during the transition.

4. What Is Our Plan For Verifying Data Accuracy Post-Migration?

A successful migration is only proven once the data matches. Plan to run core financial reports such as the trial balance, profit and loss, and balance sheet in both systems and confirm they align. Accounts receivable and accounts payable aging reports should also be checked closely.

Assign specific team members to validate and resolve discrepancies early to ensure the integrity of your financial records.

5. Who Will Be Responsible For Managing The Migration Process And Timeline?

Without clear ownership, migrations risk delays and overlooked tasks.

Assign a project lead, such as a finance manager, operations director, or outside advisor, to manage milestones, testing, and communication. This person should have the authority to make decisions about timing, resources, and adjustments.

Treating the migration as a structured project provides accountability and keeps everyone aligned.

6. How Will User Permissions And Access Need To Change In QuickBooks Online?

QuickBooks Online uses a role-based system with individual Intuit logins, unlike the shared access model in Desktop.

Review how many users your subscription tier supports and map each employee to the correct role. This is also an opportunity to clean up inactive accounts and refine access controls.

Planning permissions in advance reduces confusion on day one and ensures sensitive financial data stays protected.

7. What Is Our Contingency Plan If Issues Arise During Or After Migration?

Even the best-planned migration can encounter challenges. Run a trial conversion to spot errors before the official cutover and keep a full Desktop backup for reference.

Schedule the migration during a period of lower activity to reduce pressure if troubleshooting is needed.

Having backup plans in place enables your team to remain calm and quickly address issues without disrupting operations.

8. How Do We Train Our Team To Adapt To QuickBooks Online?

A new interface and different workflows frustrate users if they are not prepared. Provide training materials such as tutorials, practice sessions in a demo company, or role-specific guides.

Anticipate a learning curve for long-time Desktop users, and designate someone to handle questions during the first weeks. Training ensures staff can transition smoothly without slowing down daily tasks.

9. How Can We Maintain Uninterrupted Billing And Collections During The Transition?

For MSPs, billing and collections must continue without pause. Align your migration with billing cycles to avoid mid-cycle disruptions, and recreate recurring invoices in QuickBooks Online before the next cycle starts.

Confirm that stored payment methods and automated collections continue working as expected. Using MSP-specific billing automation tools, such as FlexPoint, helps ensure that invoicing and payments remain consistent even when the accounting system changes.

10. What Support And Resources Do We Need To Ensure Success?

Some migrations require more expertise than an internal team can provide. Consider engaging a QuickBooks ProAdvisor or leveraging Intuit’s migration resources for additional guidance.

Confirm all licenses, credentials, and QuickBooks Online subscriptions are ready before cutover.

By securing the right support, technical, financial, and operational challenges can be handled quickly and effectively.

Use these ten questions as a planning checklist. Document your answers and action items for each question. This exercise will highlight what needs to be done before you migrate and will guide your project plan.

How to Evaluate Migration Readiness: Data, Processes, and Integrations

Before you set a firm QBO migration date, evaluate your MSP’s readiness. A thorough readiness assessment uncovers any gaps in your preparation regarding data, processes, or integrations.

Below are the key areas to review and steps to take to ensure you are truly prepared for the switch to QuickBooks Online:

• Data Audit:

Conduct a detailed audit of the financial data you plan to migrate.

Start by listing all data categories in your QuickBooks Desktop file:

- Client lists

- Vendor lists

- Chart of accounts

- Open invoices

- Past transactions

- Payroll data

- Custom fields

Verify the accuracy of this data in QuickBooks Desktop (clean up duplicates, correct errors, and reconcile accounts). Identify what subset of data will be migrated.

For example, you may choose to bring over all active customers and open balances, but archive old inactive clients or years-old transactions. This audit should also note any data that QBO cannot import directly.

For instance, QuickBooks Online will not import certain attachments over 30 MB or some details like custom templates; knowing this lets you plan to save those separately.

• Process Mapping:

Map out all current accounting and billing processes in your organization. Outline each workflow step-by-step from generating an invoice in your PSA, to syncing it to QuickBooks, to collecting payment, to reconciling the deposit.

By visualizing these processes, you can spot which steps involve QuickBooks Desktop and how they might change in QuickBooks Online.

Identify any process that relies on a specific QBD feature or a manual workaround that might not apply in QBO.

For example, if your staff used to create billing reports by exporting data from QuickBooks Desktop to Excel, determine how you will obtain those reports in QBO (perhaps using QBO’s reporting or an alternative method).

For each workflow (invoicing, payment collection, bank reconciliation, monthly close, etc.), define the equivalent process in QBO. This exercise ensures nothing is overlooked.

• Customization Review:

Review any custom elements in your QuickBooks Desktop setup. This includes custom fields on transactions, personalized invoice templates, memorized reports, and any scripting or macros in use.

Check which of these customizations can be replicated in QuickBooks Online.

QBO, especially the Advanced tier, offers custom fields and custom report features. However, they are not identical to QBD.

Make a list of all critical customizations and note whether QBO supports them natively. For those that it doesn’t support, plan an alternative solution. You could use an add-on app from the QuickBooks Appstore or marketplace, or adjust your process to eliminate the need for customization.

For example, if you used a Desktop custom field for “Technician Name” on invoices, you might use a workaround in QBO, such as the “Service field” or track it in your PSA instead.

• Integration Inventory:

Inventory all integrations and linked systems. Just as in the question checklist, make sure you have a complete list of software that exchanges data with QuickBooks.

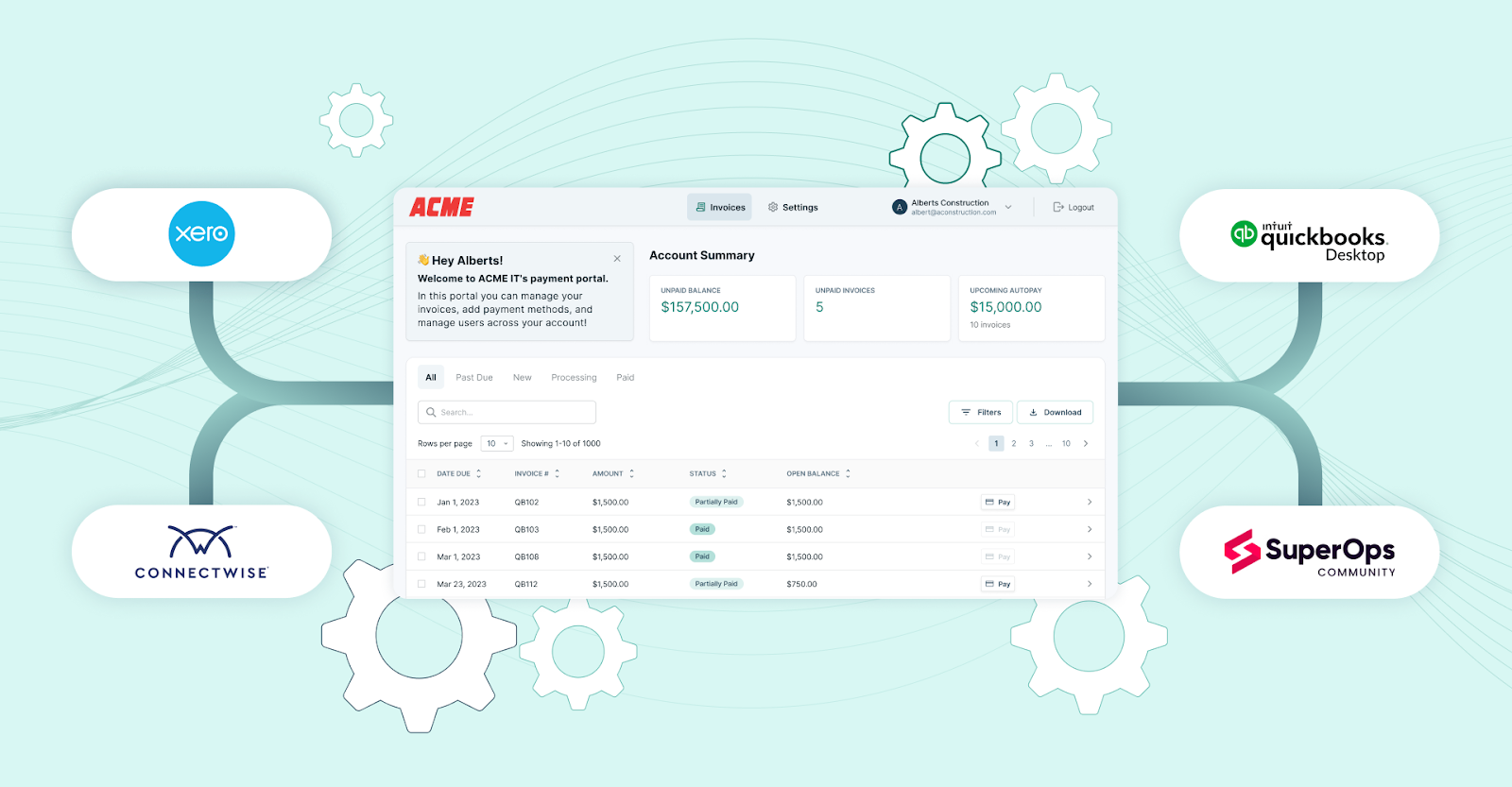

Common ones for MSPs include PSA platforms (e.g., ConnectWise, Autotask, SuperOps, HaloPSA), payment processors or billing portals, time tracking systems, expense management tools, and reporting dashboards.

For each integration, confirm its compatibility with QBO. Some integrations might require installing a new connector or app specifically for QBO. Others might require you to generate new API keys or authentication since your QBO company is cloud-based.

Create a plan for each step, such as “After migrating, reconnect ConnectWise to QBO using the vendor’s QBO integration module” or “Reconfigure our billing automation tool (FlexPoint, etc.) to point to the QBO file instead of the Desktop file.”

Where possible, test these integrations in a sandbox or trial QBO company beforehand. This inventory and plan will reduce downtime. You can quickly relink systems right after the migration, maintaining continuity.

According to the Association of Chartered Certified System Accountants (ACCSA), about 21% of SMBs have integrated their accounting software with payment/invoicing solutions to reduce manual work and errors. Your MSP likely relies on similar integrations, so they must be addressed proactively during a platform change.

• Team Readiness:

Assign specific roles for the migration project, including:

- Who will execute the data export from QBD and import it to QBO

- Who will review the data for accuracy

- Who will update any process documentation

If you have an internal IT specialist or an external consultant helping, clarify their responsibilities and availability. Make sure end-users (accountants, bookkeepers, managers who use QuickBooks data) are informed of the plan and timeline.

They should be aware of when the system will switch and what changes to expect in their daily work. Additionally, verify that all users have the necessary hardware and access for QBO (e.g., stable internet, supported web browsers, and user credentials ready).

Being cloud-based, QBO may introduce new access patterns (anywhere access, mobile app usage); factor that into your readiness. A well-prepared team can adapt quickly and serve as a safety net to catch issues early.

• Migration Timeline and Phasing:

Develop a realistic timeline that includes phases rather than a single, all-encompassing switch.

For example, you might plan:

- Phase 1 == where you run a test migration, and users get to familiarize themselves with QBO using dummy data

- Phase 2 == where you do the final migration on a chosen weekend

- Phase 3 == where you run both systems in parallel for a week (with Desktop read-only for reference) while confirming everything in QBO

Not all MSPs will need parallel running. However, building a little buffer time into your timeline helps. Set a target date for the final cutover, but also set intermediate deadlines (by what date the data cleanup will be done, by what date training will be completed, etc.). Include time for unexpected delays.

Ultimately, evaluating readiness ensures you go into the migration with eyes open and a solid plan, which increases the odds of a smooth, successful transition to QuickBooks Online for your MSP.

FlexPoint + QuickBooks Online: Ensuring a Smooth, Automated Transition

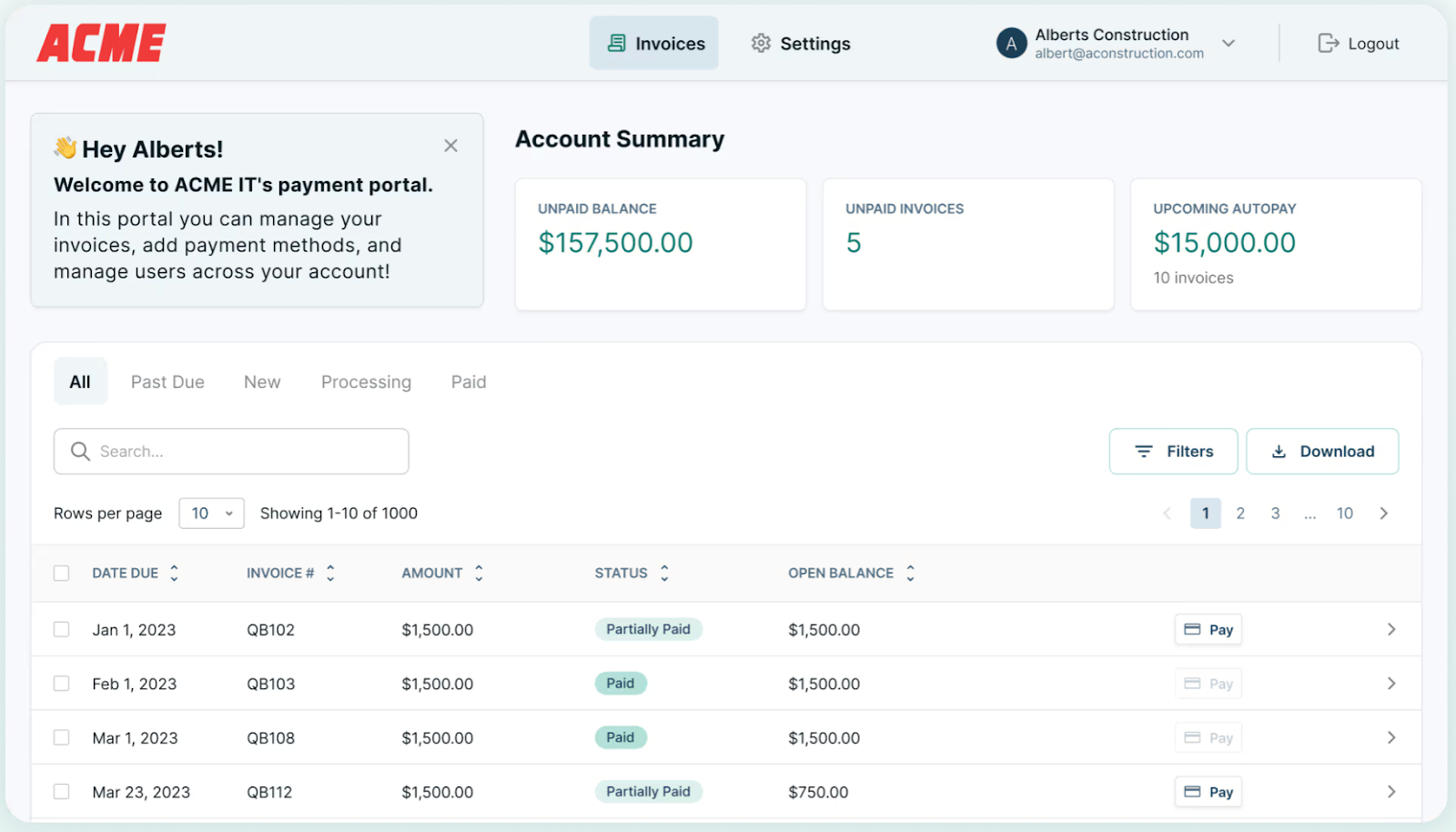

Migrating your accounting platform doesn’t have to mean disrupting your billing and payment operations. FlexPoint, a payment and billing automation platform built for MSPs, works in tandem with both QuickBooks Desktop and QuickBooks Online to keep your financial operations running efficiently throughout the migration process.

NOTE: FlexPoint is not a data migration tool: it won’t move your historical records for you. However, it provides an integrated billing system that ensures you can continue automated invoicing, collections, and reconciliations with minimal interruption, regardless of which QuickBooks version you use.

• Integration with Both Desktop and Online:

This means that if your MSP has been using FlexPoint with QuickBooks Desktop to automate billing, you can connect FlexPoint to QuickBooks Online when you switch. All your ongoing invoices and payment data will sync seamlessly to the new QBO ledger.

During the transition, FlexPoint can be connected to both systems (Desktop and Online) in a coordinated manner to ensure that no transactions are lost.

The integration takes care of pushing invoices generated from your PSA into QuickBooks and pulling payment statuses back into your accounting. This way, your team doesn’t have to manually re-enter data in the new system.

By using a platform like FlexPoint, MSPs maintain continuity: billing processes continue running on autopilot before, during, and after the QuickBooks migration.

• Automated Billing Models:

One of the advantages of FlexPoint is support for diverse MSP billing models. This includes recurring subscriptions, usage-based billing, and one-time services, all automated through a single portal. This automation stays consistent through your migration.

For example, you can keep charging clients monthly or processing usage fees without pause, because FlexPoint handles the payment processing and then updates the records in whichever QuickBooks you have connected.

• Operational Continuity:

With FlexPoint, invoices are issued on schedule, clients can pay via ACH or credit card in a branded portal, and those payments get applied and reconciled in QuickBooks automatically. This reduces the workload on your staff and prevents errors.

Operational continuity is the key benefit. Even as your backend accounting software changes, your cash flow remains uninterrupted.

• Data Sync and Error Reduction:

During a system change, data consistency is a concern. FlexPoint’s integration ensures that the data in your billing system and QuickBooks Online stays consistent with minimal human intervention.

Every invoice created or payment received through FlexPoint is automatically reflected in QuickBooks, preserving data integrity across platforms.

This two-way sync serves as a safeguard against manual errors that often occur during migrations. For example, someone accidentally keyed in the wrong figures during re-entry.

• Scalability:

Once the migration is complete, FlexPoint remains useful. It continues to support your MSP’s growth on QuickBooks Online. QBO is a cloud platform designed for accessibility and basic automation. However, combining it with FlexPoint gives you advanced capabilities tailored for MSPs.

You gain real-time financial visibility, streamlined cash flow management, and the ability to handle increasing transaction volumes without adding headcount.

For instance, as you bring on more clients or add new services, FlexPoint can automatically handle the complex billing rules and sync them to QBO. It also provides features such as a self-service client payment portal and analytics that QBO may not offer on its own.

By leveraging FlexPoint’s integration with QuickBooks, MSPs can confidently transition to QBO knowing their billing and collection processes are supported.

The combination of QuickBooks Online’s accounting and FlexPoint’s MSP-focused automation means you have a robust financial system with no gaps in service.

Conclusion: Confidently Manage Your QuickBooks Migration

Switching from QuickBooks Desktop to QuickBooks Online represents a major transition for MSPs. However, with thorough preparation, the move can be carried out smoothly and with little disruption.

By asking the important questions in advance (about data, features, integrations, team readiness, and contingency plans), no critical aspect is overlooked.

Thorough preparation prevents the common pitfalls of an uninformed migration, such as data loss, billing errors, or service interruptions. Instead, you’ll carry your financial data into QuickBooks Online accurately and have your workflows ready to go on day one.

This move is an opportunity to improve and streamline your financial processes. Take the time to audit and refine how you operate.

Throughout this journey, FlexPoint helps your MSP maintain continuity.

With FlexPoint, your MSP’s invoicing, collections, and payment processing remain automated and uninterrupted, whether you are on QB Desktop or QB Online. This allows you to migrate at your own pace without worrying about cash flow stoppages. You can confidently switch, knowing client billing will proceed smoothly.

Ready to future-proof your MSP’s billing?

Schedule a demo to see how FlexPoint supports your financial operations.

Additional FAQs: QuickBooks Migration for MSPs

{{faq-section}}

.png)