.png)

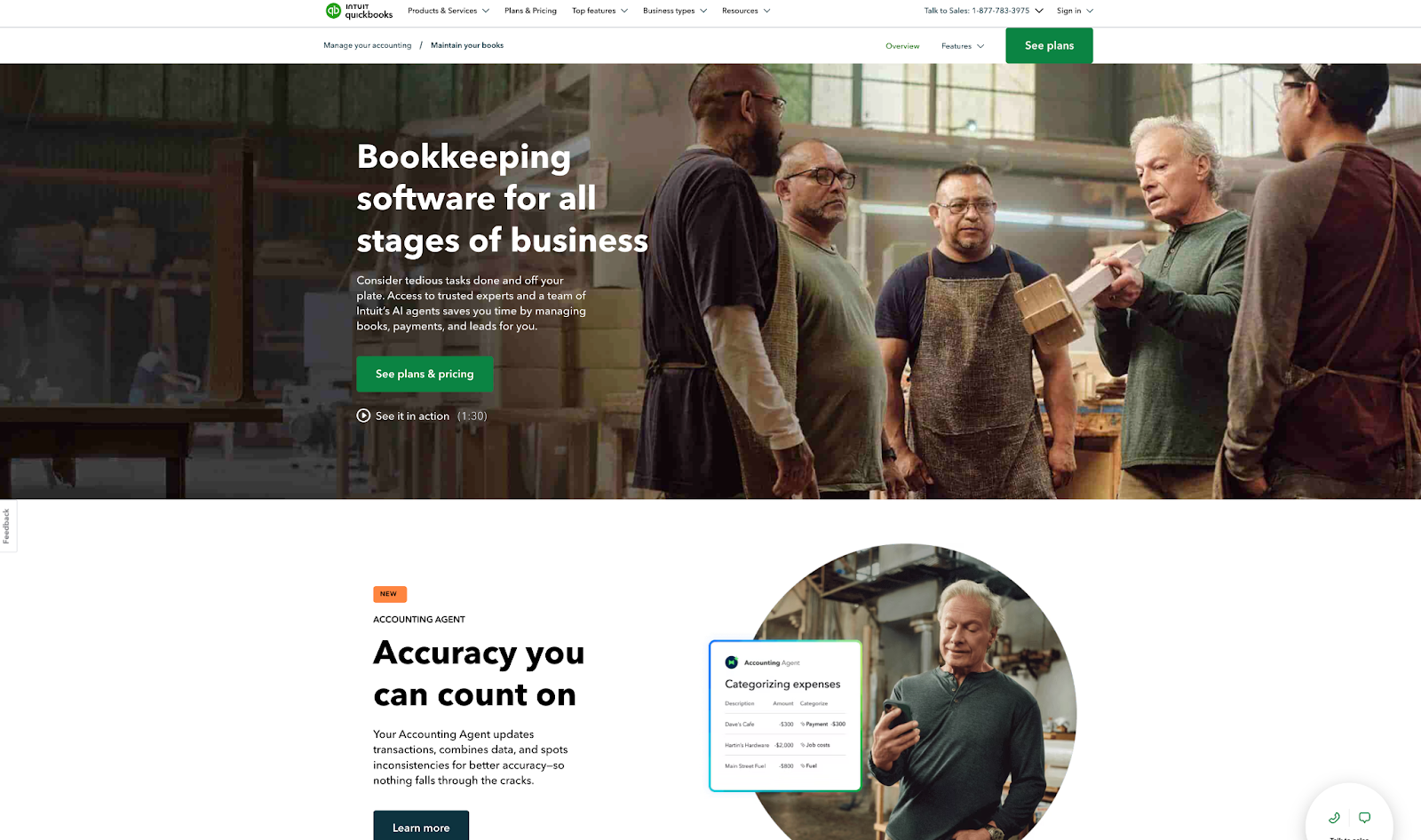

QuickBooks Desktop support is officially ending after May 31, 2026. This marks a significant change for MSPs that have relied on the software for billing and accounting purposes. The software won’t suddenly stop working on the cutoff date. However, continuing to use QuickBooks Desktop without ongoing support and updates poses growing risks for MSPs.

Without regular updates or patches, security vulnerabilities won’t be fixed, and integrations may break over time, potentially disrupting how MSPs invoice clients and collect payments.

In this article, we explain what the end of QuickBooks Desktop support means, key deadlines to be aware of, and how MSPs can prepare for a smooth transition.

We will also cover actionable steps for migration and highlight how leveraging a solution like FlexPoint’s QuickBooks Online integration can help maintain seamless billing operations throughout the transition.

With the proactive planning strategies outlined in this article, MPSs can move forward without panic and even improve their billing process in the long run.

{{toc}}

Key Deadlines & What “Support Ending” Actually Means

What does “support ending” mean for QuickBooks Desktop? In short, Intuit will stop providing updates, security patches, and official assistance for certain QuickBooks Desktop products after specific dates.

This means that no new features or fixes will be added to those versions. It is worth noting that QuickBooks Desktop Enterprise is the only desktop edition that Intuit will continue to offer for now. However, even its long-term future is uncertain as Intuit shifts focus to cloud solutions.

To clarify the timeline, here are the key milestones for QuickBooks Desktop discontinuation:

After the designated end-of-support date for your QuickBooks Desktop version, several things will occur:

- No more security patches or fixes: Intuit will stop issuing updates. Any newly discovered bugs or security holes in QuickBooks Desktop will remain unpatched in unsupported versions of the software. This could expose sensitive financial data to risks if vulnerabilities are later found.

- Disconnected online services: Features that rely on Intuit’s online services will be discontinued. Payroll updates, direct bank feeds, online backup, credit card processing, and other add-ons will no longer function unless you upgrade to a supported product.

- Loss of Technical Support: You will no longer be able to contact Intuit for help on the older Desktop version in 2027. Live customer support from Intuit will cease for unsupported versions of the software.

- Possible registration issues: Intuit will not allow new activations or license validations for discontinued versions in 2027. That means if you try to reinstall QuickBooks Desktop on a new computer after support ends, you may encounter difficulties registering it or obtaining product keys from Intuit.

- Software remains operational (with caveats): Importantly, QuickBooks Desktop software will continue to run on your computer after support ends, and your company file data will still be accessible. However, it will run in a static state. No further updates, no fixes, and reduced compatibility as other software evolves.

Next, we’ll look at what continuing to run QuickBooks Desktop in an unsupported state could mean for an MSP’s operations.

How This Impacts MSP Billing, Accounting, and Compliance

Running an unsupported QuickBooks Desktop version can have serious consequences for an MSP’s billing and financial operations.

If QuickBooks Desktop stops working smoothly with your other systems, it can disrupt your cash flow and even put you at risk for compliance violations.

Let’s discuss the key areas of impact:

1. Billing Disruptions:

An MSP’s billing process often involves recurring invoices, automatic payments, and integrations with tools such as Professional Services Automation (PSA) software.

When QuickBooks Desktop is no longer updated, you risk missing or failing billing cycles. For example, if your PSA (such as ConnectWise PSA or Autotask) syncs invoices to QuickBooks Desktop, an unsupported version might eventually become incompatible with the PSA’s updates.

This could result in invoices not generating or not being sent to clients on schedule. Clients may not receive timely billing, or you may end up with duplicate invoices if synchronization errors occur.

Additionally, features such as QuickBooks Payment links or client payment portals may stop working.

This will lead to failed client payments or delays in collecting revenue. These breakdowns directly hit your cash flow and can make your revenue appear lower or irregular in financial reports.

2. Data Security Risks:

Once QuickBooks Desktop stops receiving security patches, any new vulnerability found by hackers can be exploited. Unsupported software is a known security risk. Attackers target outdated systems because they know the weaknesses won’t be fixed.

According to a 2019 survey by the Ponemon Institute, 60% of breach victims were compromised via known vulnerabilities they hadn’t patched. This statistic highlights that if you don’t keep software updated, you’re vulnerable to cyberattacks.

An unpatched QuickBooks Desktop can become an entry point for malware or ransomware, particularly since it stores sensitive financial and client data.

The fallout from a data breach can be devastating, including regulatory fines, legal liability, and loss of client trust.

3. Broken Integrations:

MSPs often integrate QuickBooks Desktop with other software, such as PSA systems, CRM, payment gateways, and time-tracking tools. These integrations rely on QuickBooks Desktop being supported and up to date.

After support ends, APIs and connectors may stop syncing properly. For instance, the Intuit Web Connector used by many integrations might not work with newer versions of Windows or with services that expect a supported QuickBooks environment.

If your payment processor or client portal is linked to QuickBooks, an unsupported version might start rejecting those connections or throwing errors.

Automation workflows could fail silently, leading to incomplete records. You might find that services such as merchant credit card processing through QuickBooks Desktop get disabled, forcing you to reconcile or process payments manually.

4. Compliance Issues:

Many MSPs must adhere to standards for financial reporting, data security, or industry-specific regulations (for example, when handling healthcare or credit card data). Unsupported software is a glaring compliance risk to auditors.

Regulatory standards, such as SOC 2, HIPAA, SAQ-A, or PCI DSS, require that systems containing sensitive data be kept secure and regularly updated to ensure compliance. If you continue running QuickBooks Desktop past its end-of-support in 2027, you may be falling short of those requirements.

A compliance audit could lead to findings or even penalties. Moreover, cyber insurance policies are increasingly including clauses that exclude coverage if a breach involves outdated software. This means that if your QuickBooks is hacked or fails due to being outdated, your insurance may not cover the damages.

Beyond regulatory compliance, even general accounting principles could come into play. For instance, auditors might question the integrity of financial data coming from a system that isn’t vendor-supported.

5. Productivity Loss:

When software starts failing, your team’s efficiency suffers. Suppose your finance department and technical teams have to troubleshoot invoice errors every month or manually import data that used to sync automatically.

Instead of focusing on strategic tasks, such as analyzing financial performance or improving client service, your staff might be stuck fixing problems caused by an outdated QuickBooks.

Fixing these problems often includes:

- Reinstalling software on older machines (since new OS versions might not support the old QuickBooks)

- Recovering data from backup when files are corrupted

- Double-entering information into multiple systems because integration broke down

Lost productivity is essentially a hidden cost; you may need to use overtime or hire extra staff to handle tasks that were previously automated. Over time, this inefficiency erodes profit margins and employee morale.

Consider an MSP that bills dozens of clients monthly via recurring contracts. If QuickBooks Desktop’s integration with its PSA fails, the billing coordinator or accounting team may need to manually extract data from the PSA and create invoices individually.

The result could be late invoices, mistakes in amounts, or even services not billed at all.

Clients may become upset by invoicing errors, which can affect your professional image and client satisfaction scores.

These scenarios underscore that delaying the transition away from QuickBooks Desktop is a threat to your revenue, client trust, and legal standing.

Every MSP should have a plan to transition away from QuickBooks Desktop to mitigate these risks.

The next section will explore the primary options available to MSPs and provide guidance on selecting the best path forward.

Exploring Your Options: QuickBooks Online, Enterprise, or Other Solutions

With QuickBooks Desktop being phased out, MSPs essentially have three paths to consider:

- Migrate to QuickBooks Online

- Upgrade to QuickBooks Desktop Enterprise

- Switch to a different accounting platform

Each accounting software option has its pros and cons, and the right choice depends on your business’s specific needs.

Let’s break down these alternatives:

1. QuickBooks Online (QBO):

QuickBooks Online is Intuit’s native cloud-based accounting software and its recommended replacement for Desktop.

Because it’s cloud-based, you never have to worry about installing updates; QBO is always up-to-date with the latest features and security patches. This continuous update model ensures you automatically get improvements and remain compliant with security standards.

QBO also integrates easily with many other cloud tools. For MSPs, this means popular PSA software, payment processing platforms, and other SaaS tools often have ready-made integrations or apps for QBO.

For example, ConnectWise PSA, Autotask, and other MSP systems can sync with QuickBooks Online to transfer invoice and payment data.

Additionally, QuickBooks Online supports robust automation through third-party services and APIs. These automated features include automatic bank feeds and scheduled invoicing.

On the user side, QBO’s interface is modern, and Intuit provides plenty of tutorials.

That said, QuickBooks Online has a few limitations to acknowledge. The software typically caps the number of users based on your subscription tier (up to 25 users for the highest plan), whereas Desktop Enterprise can support more (up to 30 or even more with add-ons).

If your MSP has a large accounting team or extremely high transaction volumes, you may need to consider whether QBO Advanced (the top-tier version) is sufficient.

There are also some advanced accounting features in Desktop (such as job costing, custom reporting, or complex inventory tracking) that might work differently or require third-party add-ons in QBO. However, Intuit has been steadily closing the feature gap over the years.

For most MSPs (who primarily need general ledger, invoicing, expense tracking, and integrations), QuickBooks Online will meet the requirements and then some.

Intuit has even made the migration process more convenient: it’s now possible to bring over all your historical QuickBooks Desktop data into QBO.

This includes:

- Invoices

- Bills

- Recurring transaction templates

Many migrations can be completed in a matter of hours with the provided tools, resulting in minimal downtime if planned appropriately.

2. QuickBooks Desktop Enterprise:

If you prefer to stay with a desktop-based solution (or if your MSP’s needs exceed what QBO offers), QuickBooks Desktop Enterprise is an option.

Enterprise is essentially Intuit’s top-tier desktop product with more horsepower: it handles larger data files, supports up to 40 users, and includes advanced features such as enhanced reporting, inventory management, and permissions control.

Some MSPs might consider Enterprise if they require those capabilities or if they’re not ready to move to cloud software.

Enterprise will continue to be sold and supported by Intuit for the foreseeable future, even as Pro and Premier are discontinued. This means that if you upgrade to Enterprise, you’ll still receive updates and can potentially stick with a desktop environment for a while longer.

However, choosing Enterprise comes with potential caveats.

To begin, Enterprise is significantly more expensive than Pro/Premier and is offered on a subscription basis (typically annual). It is recommended to only invest in the software if you genuinely need its advanced features; otherwise, you’re paying a premium for capacity you won’t use.

Second, Enterprise is not a long-term escape from Intuit’s cloud push. As of September 2025, QuickBooks hasn’t announced an end-of-life for Enterprise. However, the momentum of the industry suggests that even QB Enterprise could face changes down the road.

That said, QuickBooks Desktop Enterprise does now offer the flexibility of cloud hosting. With cloud hosting services, your MSP can enjoy the benefits of cloud hosting while leveraging the power of QuickBooks Desktop Enterprise.

However, as Victor Lopez(FlexPoint) and Angie Hasenbank (Hasenbank Accounting) explain in a recent webinar, it tends to be faster and less work to use QuickBooks Online’s robust API and cloud hosting than QuickBooks Desktop remote access.

In terms of integration, Enterprise is similar to Desktop Pro/Premier. The software can integrate with tools via the same methods (and it can certainly integrate with MSP payment platforms such as FlexPoint as well). However, it doesn’t inherently add new integration capabilities beyond what you had with Desktop.

Enterprise is a powerful but traditional solution: the software keeps you on desktop accounting with more features and capacity; however, not everyone will find that justified.

3. Other Accounting Software (Xero, Zoho Books, FreshBooks, Sage, etc.):

Aside from Intuit’s ecosystem, there are alternative accounting platforms that some MSPs might evaluate:

- Xero, a cloud-based platform, is praised for its clean interface, unlimited users, and global adoption. The platform integrates with many third-party apps, though not all MSP-specific tools connect seamlessly.

- Zoho Books also serves small businesses. The platform is well-suited if you’re already part of the Zoho ecosystem. However, its MSP community is smaller than QuickBooks’.

- FreshBooks is a simple and invoicing-focused option. It tends to be better suited for freelancers than MSPs with complex billing.

- Sage Intacct offers both cloud and desktop options, with Sage Intacct designed for enterprise-scale needs. While powerful, it’s often more than most MSPs require.

Overall, QuickBooks Online remains the go-to choice for MSPs due to its extensive ecosystem, deep integrations with PSA tools, and robust community support. These qualities make it a more practical fit for day-to-day MSP accounting and billing than most alternatives.

How to Choose the Best QuickBooks Desktop Alternative for Your MSP?

When considering these alternatives, think about integration and MSP-specific functionality.

Here are a few guiding considerations to help MSPs decide on the right path:

- Do you need advanced features for a larger operation? For larger MSPs with complex needs, such as multi-entity consolidation, inventory, or job costing, QuickBooks Enterprise is a strong option. The software supports heavier workloads and offers advanced features, including over 200 reports and role-based security, without requiring a comprehensive ERP system.

However, consider that QuickBooks Online Advanced has been expanding its capabilities and might handle more than you expect.

Unless you truly need something like the 30+ user local network or ultra-large file sizes, most MSPs will find QBO Advanced or mid-market solutions sufficient.

- What about integration with PSA and billing tools? QuickBooks Online tends to integrate well with modern MSP tools (and is directly supported by integration platforms such as FlexPoint, which can connect your PSA, payments, and QuickBooks together).

QB Desktop Enterprise can still be integrated with other systems (e.g., via Web Connector or third-party sync tools). However, it’s not “future-proof” in the way a cloud API-driven solution is.

If seamless integration and minimal manual work are your goals, leveraging QuickBooks Online with a specialized MSP billing integration will likely be the smoothest route.

- What about long-term strategic alignment? Consider where Intuit and the industry are heading. The accounting software landscape is clearly moving to the cloud. By switching to QuickBooks Online, you’re aligning with that trend and ensuring your system will get the bulk of development attention and improvements.

For many MSPs, after weighing these factors, QuickBooks Online emerges as the most future-ready choice. The software meets the needs of most small and mid-sized businesses, is accessible from anywhere, and offers rich integration support.

Learn more about the critical differences between QuickBooks Desktop and Online in this FlexPoint webinar.

Alternatives exist (as discussed above). However, moving away from Intuit often means more adjustments. If considering them, test how well they handle MSP workflows, especially recurring IT billing and PSA invoice data.

Ultimately, whichever route you choose, the next step will be planning the migration carefully, which we’ll cover in the following section.

QBO Migration Made Simple: A Transition Checklist for MSPs

With a clear plan to migrate from QBD to QBO, you can make the transition without disrupting your business.

Below is a step-by-step migration checklist tailored for MSPs, ensuring you cover all the important bases:

1. Review Current Setup:

Start by auditing how QuickBooks Desktop is currently used in your MSP.

- Map out all workflows, integrations, and dependencies. For instance, list the processes that feed data into QuickBooks (e.g., time entries from PSA, invoice line items from a billing system) and those that retrieve data from QuickBooks (e.g., financial reports, tax filings).

- Identify all the third-party integrations and custom scripts involved. It’s important to understand these connections so you can recreate or replace them in the new system.

- Take stock of user access as well. Who in your organization uses QuickBooks Desktop and for what tasks?

This review will serve as the foundation for your migration game plan.

2. Check Renewal Dates and Support Timelines:

Don’t let critical deadlines sneak up on you.

Note the end-of-support date for your particular QuickBooks Desktop version (as discussed earlier) and any subscription renewal dates. If your licenses or add-on services are set to expire soon, that’s a natural target date to complete the migration.

3. Define Future Needs:

Based on your evaluation in the previous section, decide which accounting solution you are migrating to.

For example:

- Is it QuickBooks Online? If so, determine which QBO plan fits your needs (Simple Start, Essentials, Plus, or Advanced). Ensure it supports all your requirements (e.g., required features, number of users, etc.).

- If you are opting for QuickBooks Enterprise, plan the purchase/upgrade and any necessary hardware or hosting.

- If you've chosen another accounting platform (such as Xero), now is the time to sign up and become familiar with it. Outline any new integrations or tools you will need.

4. Run a Pilot Migration:

Create a trial company in QBO to practice the migration process. This pilot can reveal any issues, such as data that doesn’t import neatly (for example, complex transactions or custom fields that require special handling).

If something doesn’t line up, you have time to address it (maybe adjusting the data or the process).

Additionally, testing the migration gives you an estimate of how long the actual switch will take.

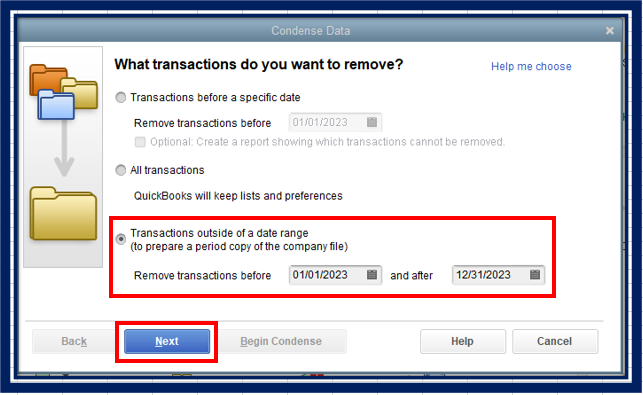

5. Clean and Back up Data:

Before you move a single byte of data, perform a complete backup of your QuickBooks Desktop company file.

Save it in a safe location (or multiple locations). This backup is your safety net in case anything goes wrong or if you need to refer to historical details that don’t import perfectly.

Next, take the opportunity to clean up your data in QuickBooks Desktop.

Clear out old clutter, such as inactive clients, outdated items or services, and erroneous transactions. Consistency-check your records (ensure invoices and payments are correctly matched, for example).

Fix any data file integrity issues using QuickBooks’ built-in utilities. The cleaner your data, the smoother the migration tools will run.

6. Plan the Migration Timeline:

Once you are comfortable with the test, set a date for the official migration. Choose a timing that minimizes impact. This might be right after a billing cycle or at the end of a financial period (end of month/quarter), before new invoices are sent out. Avoid doing it during your busiest week.

Leading up to the cutover, communicate with your team about a possible blackout period during which QuickBooks data may be read-only or where you’ll ask them not to input new transactions until the new system is live.

7. Train Your Finance Team:

Arrange training sessions for your finance team (and any other users, such as service managers who might view reports or dashboards).

Show them how to perform their everyday tasks in the new system, such as creating invoices, receiving payments, and running profit and loss (P&L) reports. Emphasize the improvements.

For example, if moving to QBO, highlight that they can now access it from home or that bank transactions download automatically. Training can help mitigate the productivity dip that often accompanies the introduction of new software.

Inform other departments if they are impacted and provide documentation or quick reference guides if possible.

8. Engage Migration or Integration Experts:

If you encounter complexities (such as having many custom workflows or being unsure about migrating multi-currency data), consider seeking outside help.

This could involve hiring a QuickBooks ProAdvisor or consultant specializing in migrations, or reaching out to the support team of your integration partner (for example, the FlexPoint team if you use their integration, or your PSA vendor) for guidance.

Experts have done these migrations multiple times and can help avoid pitfalls. Don’t hesitate to use the available resources, mainly to ensure your billing integrations continue to run correctly.

Following this checklist will help you make a thorough and organized transition.

Next, we’ll look at how using FlexPoint can ensure that even during this transition, your billing and payment processes remain automated and error-free.

Future-Proof Your Billing with FlexPoint + QuickBooks Online

One of the biggest concerns MSPs have about migrating accounting systems is: “Will my billing break during the transition?”

With FlexPoint, the answer is no.

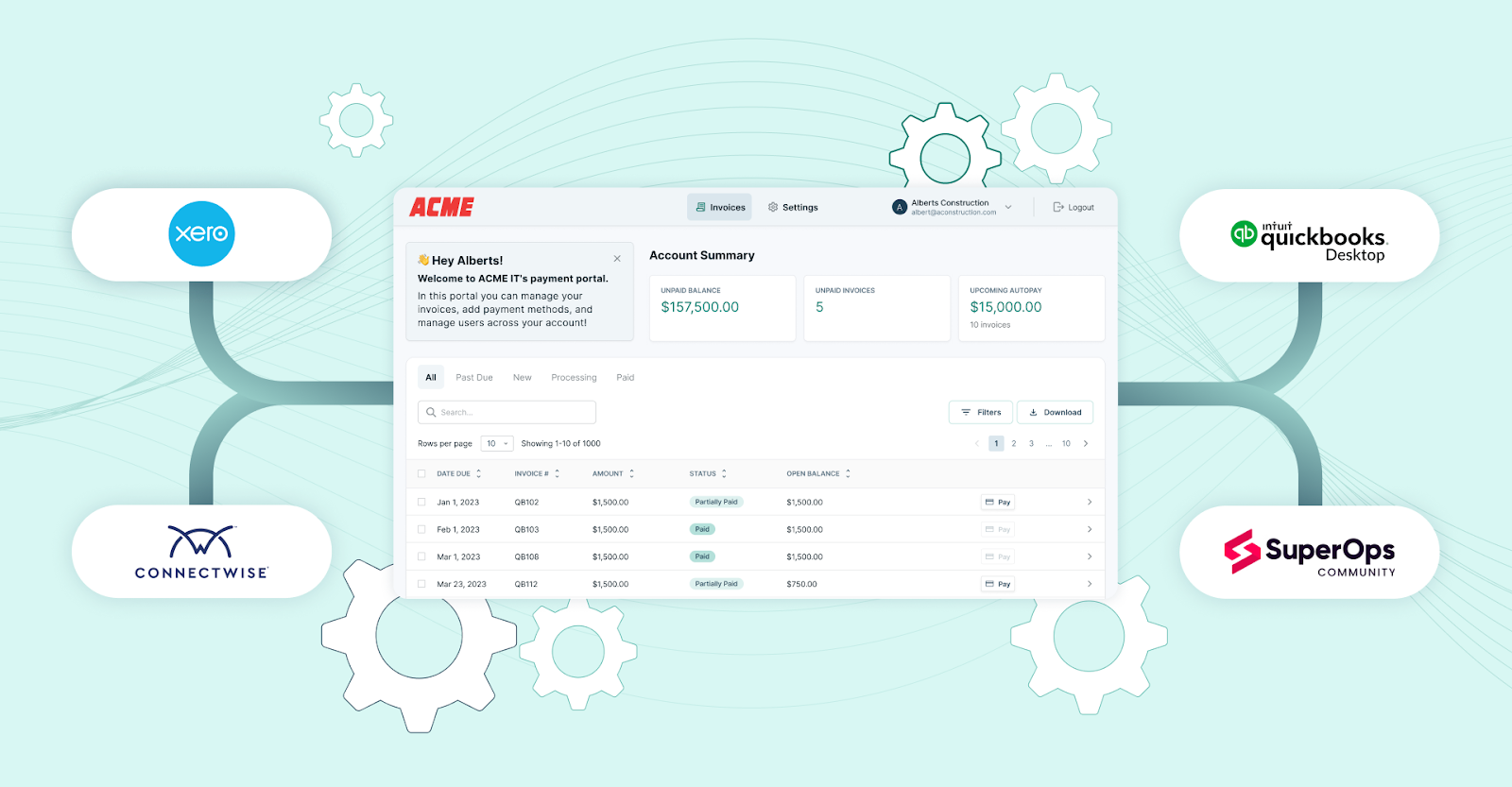

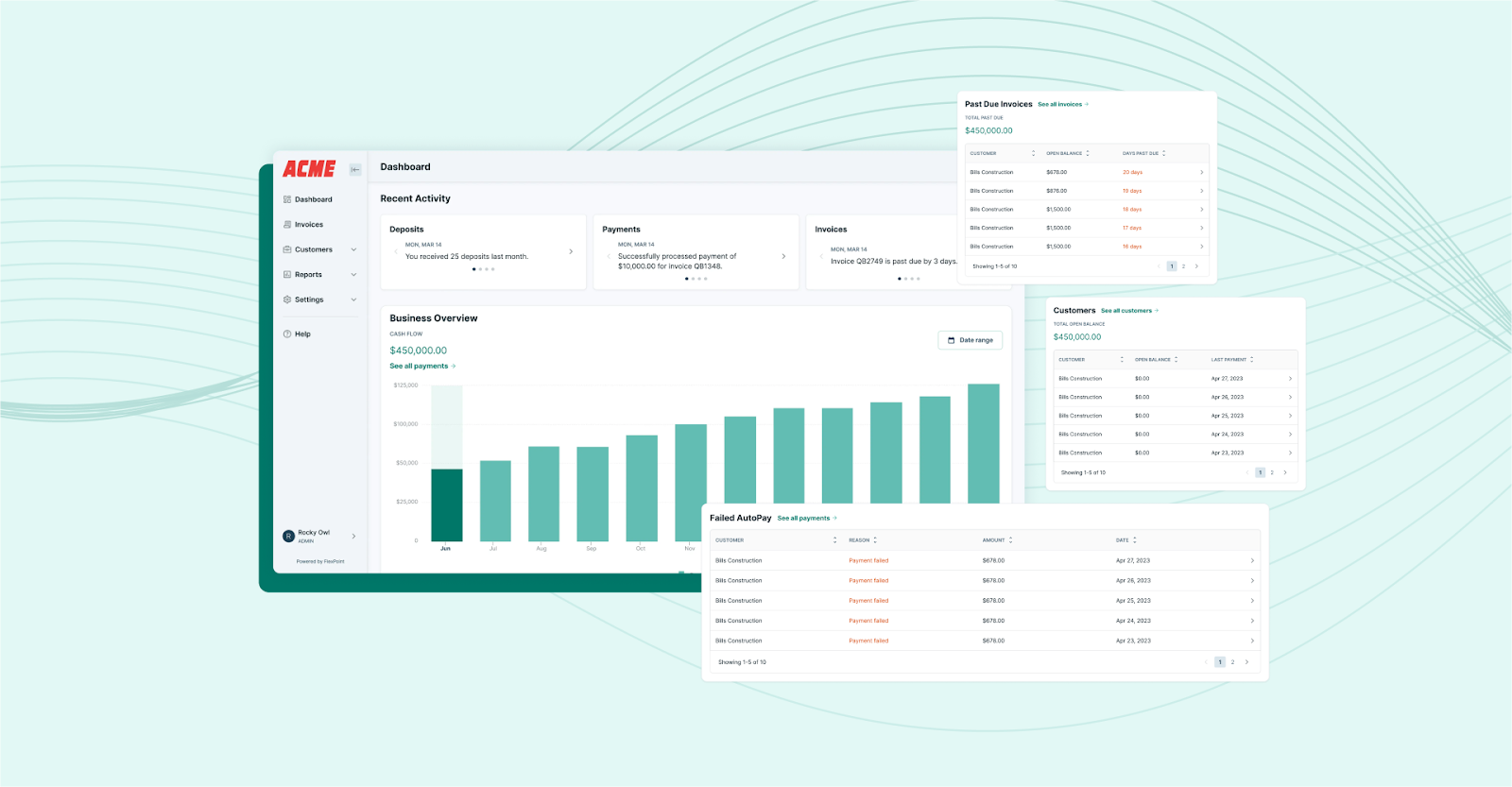

FlexPoint is an MSP-focused billing and payment automation platform that integrates with both QuickBooks Desktop and QuickBooks Online, as well as other MSP-specific software and tools.

By using FlexPoint, you can maintain smooth billing operations before, during, and after the switch.

Here’s how FlexPoint helps future-proof your billing operations:

• Dual Compatibility for a Seamless Transition:

FlexPoint is designed to work with multiple QuickBooks platforms. The platform can connect to your existing QuickBooks Desktop setup and to your new QuickBooks Online one as well.

This dual integration compatibility means you could even run FlexPoint with QuickBooks Desktop today, and then switch FlexPoint’s connection to QuickBooks Online when you migrate, without rebuilding your billing processes.

In practice, this means no downtime: you can collect payments via FlexPoint’s branded payment portal or generate invoices through FlexPoint’s automation, which will post to whichever QuickBooks account you have connected.

Your clients won’t notice any change: recurring invoices will still go out on schedule and online payments will still get processed, even while your back-end accounting is transitioning.

• Automated Billing and Invoicing Continue Uninterrupted:

FlexPoint specializes in recurring and subscription billing for MSP services. The platform automates tasks such as sending monthly service invoices, processing usage-based billing (e.g., for extra hours or devices), and applying late fees or discounts according to established rules and regulations.

This billing automation will continue regardless of whether it’s linked to QBD or QBO on the back end. So, as you migrate, there’s no need to revert to manual invoice creation or worry that you’ll miss a bill.

FlexPoint ensures every contract and service you have with clients gets billed accurately and on time. The platform even handles tasks such as proration or mid-cycle changes to a contract.

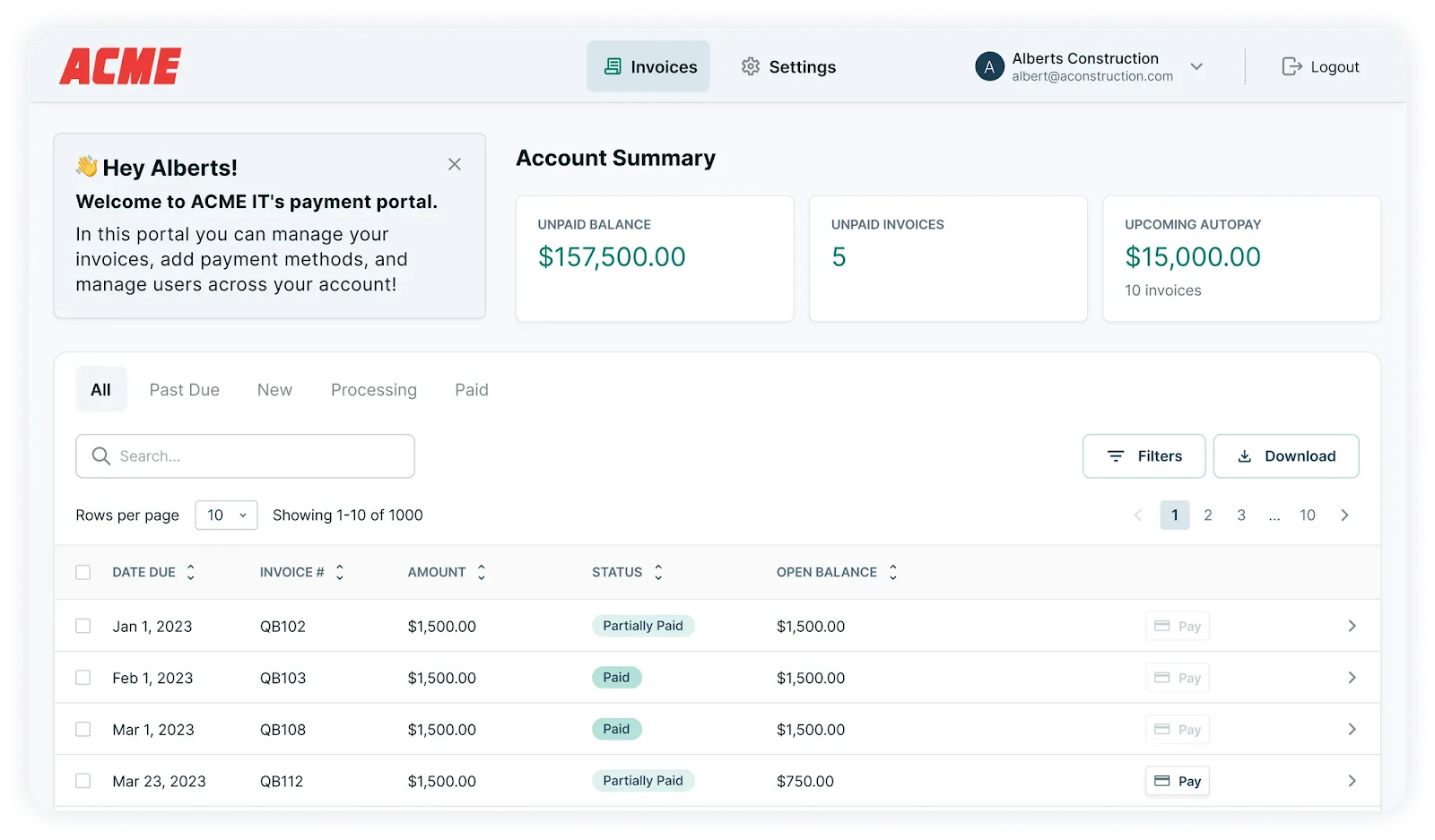

• Integrated Payment Processing and Real-time Reconciliation:

One of the key advantages of FlexPoint is its payment integration. The platform allows clients to pay invoices online (via credit card, ACH, etc.) through branded payment portals, and it automatically records those payments.

During a migration, this is invaluable. Every payment your clients make is captured and synced, regardless of whether you are using QuickBooks or not. If you’re still finishing the cutover to QBO, FlexPoint can hold and later sync transactions once QBO is live.

FlexPoint performs real-time reconciliation: when an invoice is paid via FlexPoint, the platform marks it as paid in QuickBooks and handles deposit grouping and reconciliation in your accounts.

All the hard work is done for you, maintaining accurate records in whichever QuickBooks is connected.

• Scalability and Cloud Benefits After Migration:

Once you have transitioned fully to QuickBooks Online with FlexPoint integrated, you unlock new efficiencies.

With both QuickBooks and FlexPoint in the cloud, your entire order-to-cash process is online and accessible anywhere. FlexPoint provides analytics and dashboards geared for MSPs. For example, you can see recurring revenue trends, payment statuses, and cash flow forecasts at a glance.

The platform is purpose-built to give MSP owners and finance managers better visibility into billing health.

Moreover, because FlexPoint integrates deeply with both your PSA software (such as ConnectWise PSA, Autotask, SuperOps, and HaloPSA), MSP-specific tools (Quoter and Rewst), and QuickBooks, you achieve a unified and automated workflow.

In summary, leveraging a solution such as FlexPoint alongside QuickBooks Online is a smart strategy for MSPs. The platform ensures that billing, the lifeblood of your business, remains automated, accurate, and uninterrupted, regardless of any issues with your accounting software.

Conclusion: Smoothly Move Beyond Desktop Support with FlexPoint Billing

The end of QuickBooks Desktop support is a pivotal moment for MSPs. However, the move doesn’t have to be a distressing one. With proper preparation, you can turn this change into an opportunity to modernize and streamline your billing and accounting processes.

The key is to be proactive rather than reactive. MSPs who act now to migrate off QuickBooks Desktop will safeguard their client relationships (no billing surprises or errors), protect sensitive financial data, and ensure they remain in good standing with any compliance requirements.

By the time QuickBooks Desktop becomes entirely obsolete, your MSP will have already transitioned to a more advanced system.

Throughout this process, FlexPoint stands out as a reliable ally.

While others might scramble with spreadsheets and manual workarounds during their transition, MSPs using FlexPoint can continue to enjoy automated invoicing, easy payment collection, and accurate reconciliations.

The end of QuickBooks Desktop support presents an opportunity to upgrade your MSP's billing and finance processes.

Don’t wait until QuickBooks Desktop support ends.

Schedule a demo to see how FlexPoint supports your transition to QuickBooks Online.

Additional FAQs: QuickBooks Desktop Support Ending

{{faq-section}}

.png)