How MSPs Can Offer Installment Payment Plans Without Risking Cash Flow

According to Allianz Trade, 82% of B2B buyers prioritize flexible payment terms when choosing a supplier.

Payment flexibility is often a key factor in comparing MSP proposals. MSPs that offer manageable monthly payments for services usually outperform local competitors that demand full upfront payment, mainly as businesses focus on preserving their cash flow.

Offering installment plans can expand your client base, enhance client conversion, and increase retention. Implementing MSP installment payment plans requires striking a balance between client accessibility and financial stability.

Few MSPs today are offering installment payment plans that allow clients to spread the costs over time, making their services more accessible without sacrificing profitability. While enterprise clients often have substantial IT budgets, installment plans are helpful for clients struggling with significant upfront costs associated with network upgrades, security implementations, or comprehensive onboarding packages.

In this article, we will understand what installment plans are, analyze their benefits and risks, and provide proven strategies for secure implementation. We will examine the proven strategies for MSPs to safely implement installment payment plans, protecting cash flow and maintaining operational efficiency.

We will also discover how automation tools can eliminate manual tracking headaches while ensuring financial control and visibility into receivables.

{{toc}}

What Are Installment Payment Plans for MSPs?

Installment payment plans for MSPs let clients split service or project costs into multiple payments. Instead of paying upfront, clients can spread costs over milestones or months, making services more affordable.

For example, a client signing up for a $12,000 onboarding project can pay $4,000 monthly over three months. This flexibility enables clients to manage their budgets effectively and allows MSPs to win contracts that might otherwise be declined.

Unlike third-party financing options, such as Buy Now, Pay Later (BNPL) services or lending platforms, installment plans give you greater control over the payment process.

MSPs create direct agreements with clients, manage payment terms, and collect invoices independently. It reduces the risk of non-payment and improves customer relationships.

Efficient implementation of installment plan management requires clear agreement terms and payment automation. Contracts should clearly outline payment amounts, due dates, and penalties for late or missed payments.

Automated payment tools streamline the payment process by scheduling recurring payments and real-time status tracking. This software helps reduce payment errors and client disputes while ensuring consistent cash flow with minimal administrative effort.

According to Allianz Trade, 86% of B2B buyers are more satisfied with flexible payment options. Offering well-crafted installment payment plans helps MSPs ensure their financial stability while also building loyalty by addressing clients' financial needs.

4 Benefits of Offering Installment Plans to MSP Clients

Installment payment plans benefit both MSPs and their clients. Clients can pay over time, making services more affordable, while MSPs grow their business and build stronger relationships. These plans address the client's cost concerns without requiring MSPs to lower their prices or offer discounts.

Here are the key benefits of offering installment plans to MSP clients:

1. Improved Client Accessibility

Installment plans help you reach more clients by making high-value services affordable for businesses with limited upfront capital. It opens up new opportunities for your MSP.

For example, a client might delay a $12,000 server replacement for months while saving funds, but readily commit to $2,000 monthly payments over six months. This accessibility is especially valuable for small and medium-sized businesses that need enterprise-grade IT solutions but operate on tight budgets.

2. Higher Conversion Rates

Large upfront project costs often deter clients from considering proposals, even if they need your MSP's services. Flexible payment terms can help overcome objections that delay buying decisions, convert more leads into clients, and maintain your revenue goals.

For example, a client evaluating an $18,000 cybersecurity implementation might wait for weeks for budget approval. However, the same client may immediately approve $3,000 monthly payments spread over six months because the amount fits within their operational budget.

Faster decision-making reduces sales cycles and improves revenue predictability. Additionally, it gives your MSP a competitive edge by offering clients manageable monthly payments, which are slightly lower than the upfront costs proposed by competitors.

3. Client Retention

Installment payment plans require clients to agree to longer-term contracts, allowing them to spread out payments. These agreements reduce the likelihood of clients leaving early and help improve retention rates as clients stay with your MSP for the full term of the plan.

For businesses with cash flow constraints, MSPs offering their existing clients installment payment options for upgrades or emergency services become trusted advisors rather than just service providers. It improves client retention by showing you care about their success, not just your bottom line.

Additionally, offering flexible payment options can lead to referrals and positive reviews, strengthening your reputation as a reliable and client-focused MSP.

4. Predictable Revenue

Unlike traditional project-based billing, installment payments offer a consistent monthly income. Well-structured installment plans with automated billing create predictable revenue streams to support your MSP's growth and stability.

Automated systems eliminate the administrative burden of scheduling recurring charges, tracking payments, and reconciling transactions. It ensures your MSP's cash flow remains consistent, eliminating the need for manual chasing.

Risks and Challenges for MSPs Offering Installment Payment Plans Directly

Offering installment payment plans can help MSPs attract and retain clients, but it also introduces risks, such as delayed cash flow, non-payment, and administrative challenges.

By addressing these issues proactively, MSPs can implement installment plans that drive growth while maintaining financial stability.

Here are a few risks and challenges of installment payment plans:

- Delayed Cash Flow: Installment payments can strain MSPs' cash flow, as revenue is received gradually over time instead of up front. This can impact your ability to cover operational costs or invest in growth. Proper payment planning is essential to avoid financial disruptions when multiple clients opt for extended payment terms. For example, if you sign a $10,000 contract with payments spread over six months, you receive only $1,667.33 per month, which can limit your ability to invest in new tools or staff.

- Non-Payment Risk: Clients with unexpected cash flow issues may miss or default on payments. They can harm your revenue if the outstanding payments increase over time. The costly collection efforts will then outweigh the benefits of flexible payment terms for your MSP. Proper financial vetting is essential to weigh non-payment risks and evaluate financial reliability.

- Administrative Burden: Manually tracking installment payments using spreadsheets is an inefficient process. It leads to missed deadlines, overlooked reminders, and higher administrative costs associated with account reconciliation. Revenue recognition, accounts receivable management, and financial reporting also become complicated when dealing with multiple payment schedules and varying terms. Automation saves time and resources, allowing MSPs to concentrate on core activities, such as service delivery and client support.

- Poor Forecasting Visibility: Installment plans spread revenue over time, making cash flow harder to predict. Without tracking receivables, planning your MSP's expenses, resources, and growth becomes a matter of guesswork. For example, an MSP with ten clients on various payment schedules may struggle to accurately forecast monthly revenue, making budgeting difficult. MSPs must invest in proper tools to gain clear payment visibility, thereby preventing the overextension of resources and missing growth opportunities.

{{ebook-cta}}

6 Best Practices for Implementing Installment Payment Plans as an MSP

MSPs that offer installment payment plans must understand the difference between profitable flexibility and financial chaos. Successfully implementing installment payment plans requires deliberate planning and systematic execution.

Here are the best practices to implement installment plans with minimal risks and maximum benefits for your MSP:

1. Set Clear Terms in Writing

Written agreements form the foundation of successful installment payment plans. Create a standard template with precise details like total cost, payment schedule, due dates, and penalties. Share it with clients early to set expectations. Ensure agreements include consequences for missed payments to avoid disputes and protect both parties.

For example, if a client agrees to a $12,000 server migration with four monthly payments of $3,000. Your written agreement should specify that payments are due on the 15th of each month, with a 5% late fee applied after 10 days, and service suspension after 30 days of non-payment. This clarity prevents clients from assuming flexible timing and provides you with legal options for collection.

The documentation should cover project milestones and terms for continuing services. Clients need to understand that installment payments ensure uninterrupted services if payments are made on time.

Clearly outline what happens if payments stop, including whether system access is maintained during delays and how services are restored after payment. This clarity prevents misunderstandings and simplifies the collection process.

2. Use Automated Invoicing and Payment Scheduling

Automated invoicing eliminates the administrative burden and human errors associated with manual invoicing and installment tracking. Automated systems handle invoice generation, send reminders, and process recurring charges according to predefined schedules. They ensure consistent payments while freeing your team to focus on delivering services.

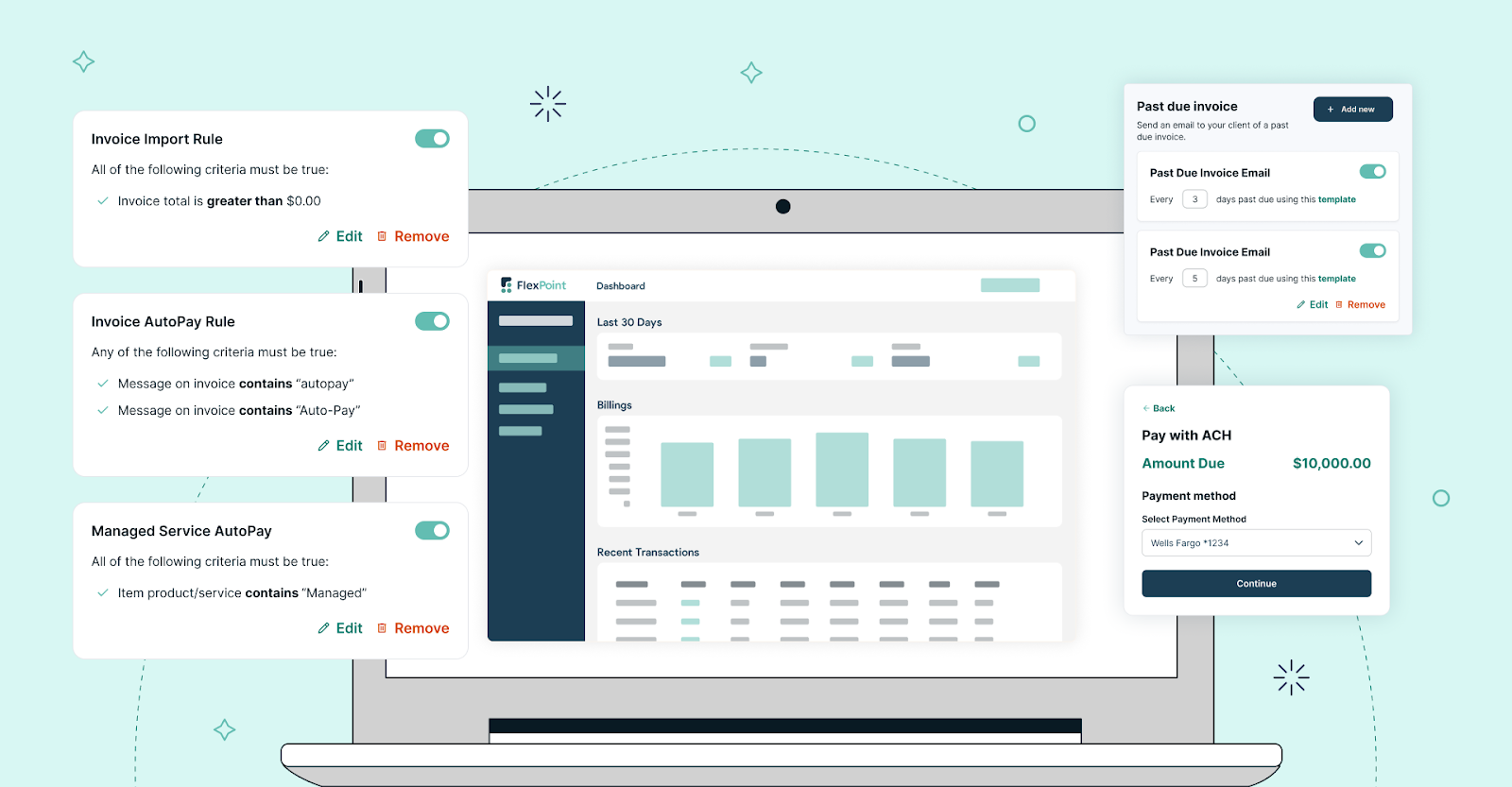

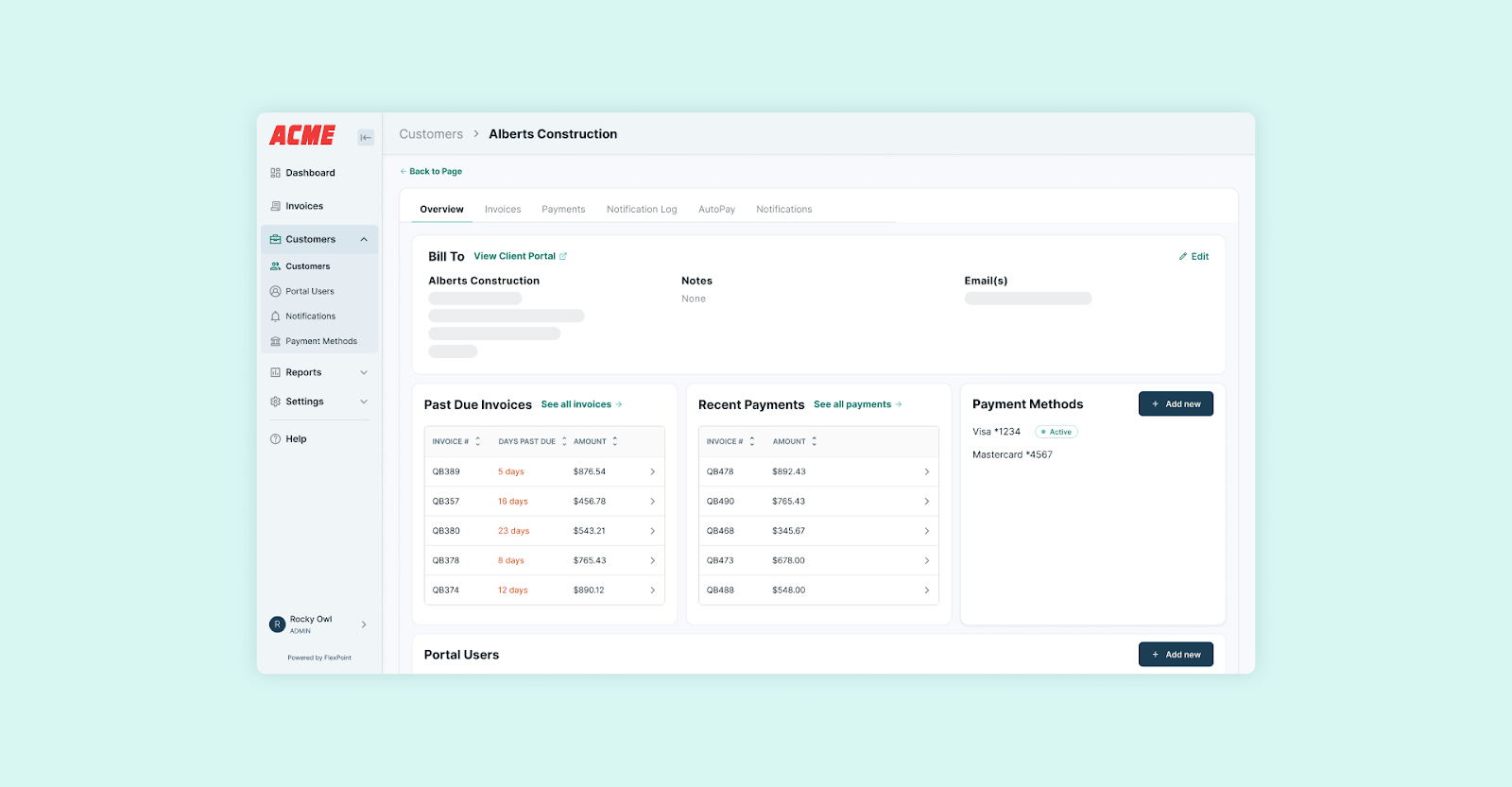

Modern payment platforms such as FlexPoint enable MSPs to establish recurring payment schedules that automatically charge clients using their preferred payment methods and on predetermined dates. The platform also triggers immediate notifications for failed payments, enabling quick intervention before minor issues escalate into major problems.

Automated systems enhance professionalism by ensuring consistent client communication through timely invoices, reminders for upcoming payments, and instant payment confirmations. They build trust, reduce payment surprises, and provide audit trails for accurate financial reporting and easier tax preparation.

3. Perform Credit or Payment History Checks

Evaluating clients before approving installment plans is crucial to managing risk. Conducting credit checks or reviewing payment histories helps identify reliable clients, thereby protecting your cash flow while maintaining client trust.

Review payment history and payment behavior patterns to assess the reliability of existing clients. Consistent on-time payments over the past six months indicate low risk, while late payments or past collection issues suggest a higher risk. Use historical analysis insights to implement stricter terms for high-risk clients.

New clients or those requesting high-value plans require additional review to ensure payment reliability and prevent potential losses. Request business credit reports, bank references, or financial statements for significant installment agreements. You may also require personal guarantees from business owners for installment agreements exceeding specific thresholds to improve payment security.

4. Limit Installment Use to Strategic Scenarios

Define clear use cases for installment plans in your strategy and highlight them during sales discussions for relevant projects. Emphasize how they make high-value services more accessible and affordable. By being selective, you ensure installment plans drive growth without overextending resources.

Reserve installment payment arrangements for high-value services, such as onboarding projects, hardware purchases, or significant upgrades. It helps maximize impact while controlling risk.

Avoid offering installment options for routine monthly services or small projects where the administrative overhead exceeds the benefits.

Limiting installment plans simplifies administration. Splitting every client invoice into installments makes tracking difficult and increases the risk of errors. MSPs must avoid installment plans for service-based work as these do not include tangible assets to secure the arrangement.

5. Track Receivables with Forecasting Tools

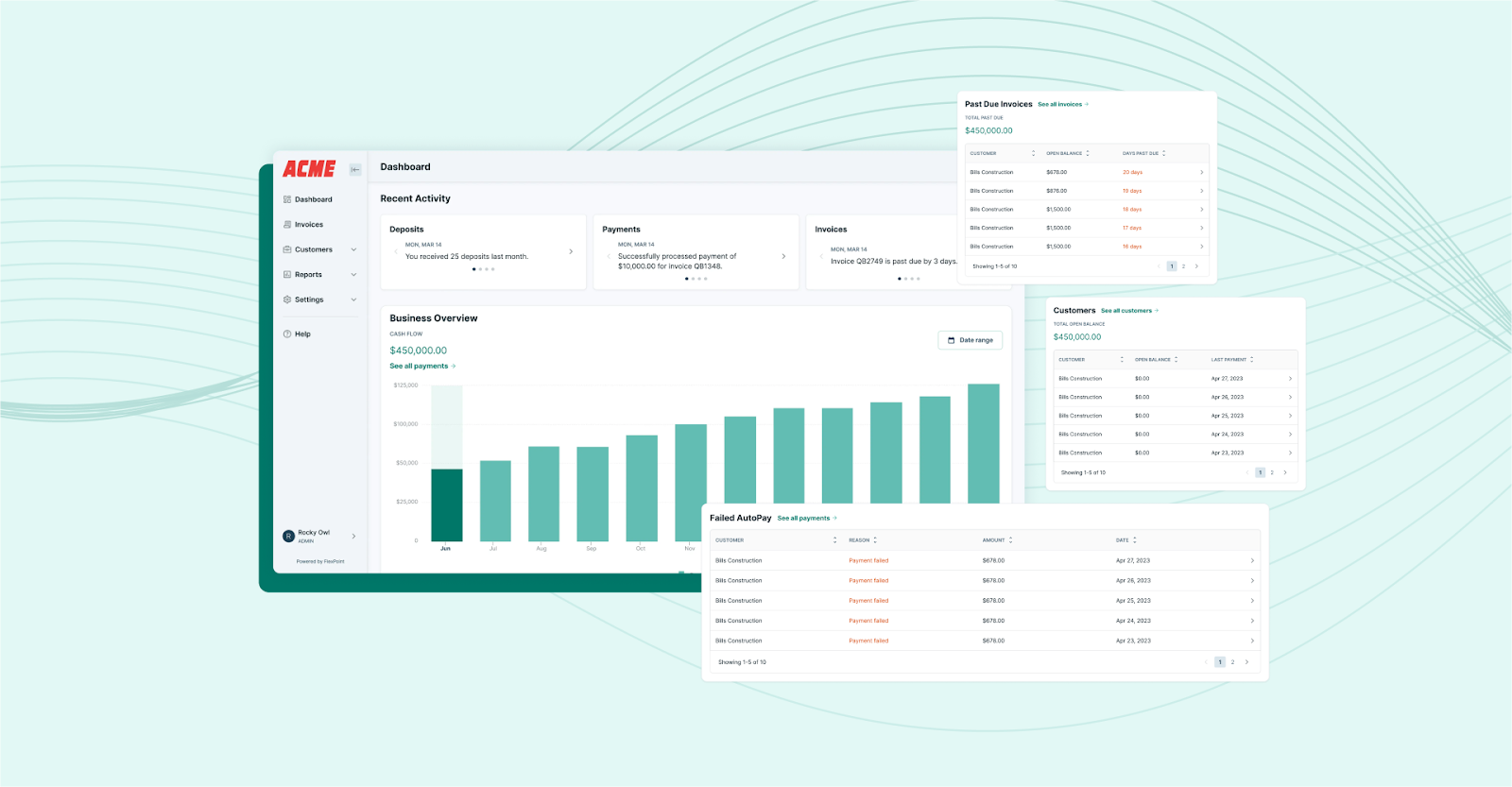

Tracking receivables is essential for managing cash flow and identifying payment issues promptly. MSPs must invest in modern financial tools that offer dashboards displaying upcoming payments, overdue amounts, and projected revenue based on existing installment agreements. These tools provide visibility, enabling proactive cash flow management and informed business decisions.

Monitoring future receivables is critical to managing cash flow with installment plans. For instance, if 10 clients owe $2,000 each monthly, a forecasting tool shows $20,000 in expected monthly revenue, allowing you to plan for expenses such as staff salaries, hardware purchases, or software renewals.

Integrate a forecasting tool with your billing system to monitor client payment status and aggregate data across all installment agreements. Track upcoming payments, regular payment delays, and failed transactions to enable quick follow-ups and identify clients needing assistance. Use cash flow reports to adjust your strategy, such as pausing new installment offers if payment collections are slow.

6. Set Internal Guardrails

Internal controls help prevent installment payment plans from straining your MSP’s cash flow or creating unmanageable financial risks. Set limits on active installment clients, minimum project thresholds, and maximum exposure percentages to manage your risk. These measures ensure that installment plans are beneficial for your MSP, rather than becoming liabilities.

Guardrails help prioritize high-value opportunities. You must establish the caps based on your business size and cash flow needs. For instance, if you are a fast-growing MSP, you might cap installment payment plans at five clients, while an established MSP may consider up to 10 installment clients.

Review and adjust guardrails quarterly to ensure they align with your business growth. Adjust limits based on your financial position, client mix, and risk tolerance to maintain relevance as your business grows.

Installment payment plans can enhance client satisfaction and support your MSP's growth when they align with client needs and fulfill your growth objectives.

How FlexPoint Helps MSPs Offer Installment Plans Without Risking Cash Flow

In the last two sections, we’ve discussed the challenges that MSPs face when offering installment plans, with the main one being unpredictable cash flow.

Additionally, implementing installment plans on their own is a cumbersome project for most MSPs.

For instance, ascertaining credit risk, managing forecasting, and other tasks can increase the administrative and financial burden for an MSP.

- What if there is a way to offer installment plans without the risk and administrative burden?

- What if there is a way to provide clients with the ability to spread out payments while you can collect the funds upfront?

- What if there is a way to not worry about credit ratings, payment ability, etc.?

This is precisely where FlexPoint comes into the picture.

FlexPoint is a payment automation platform designed for MSPs. The platform tackles the challenges of installment payment plans with its FlexLine Financing feature.

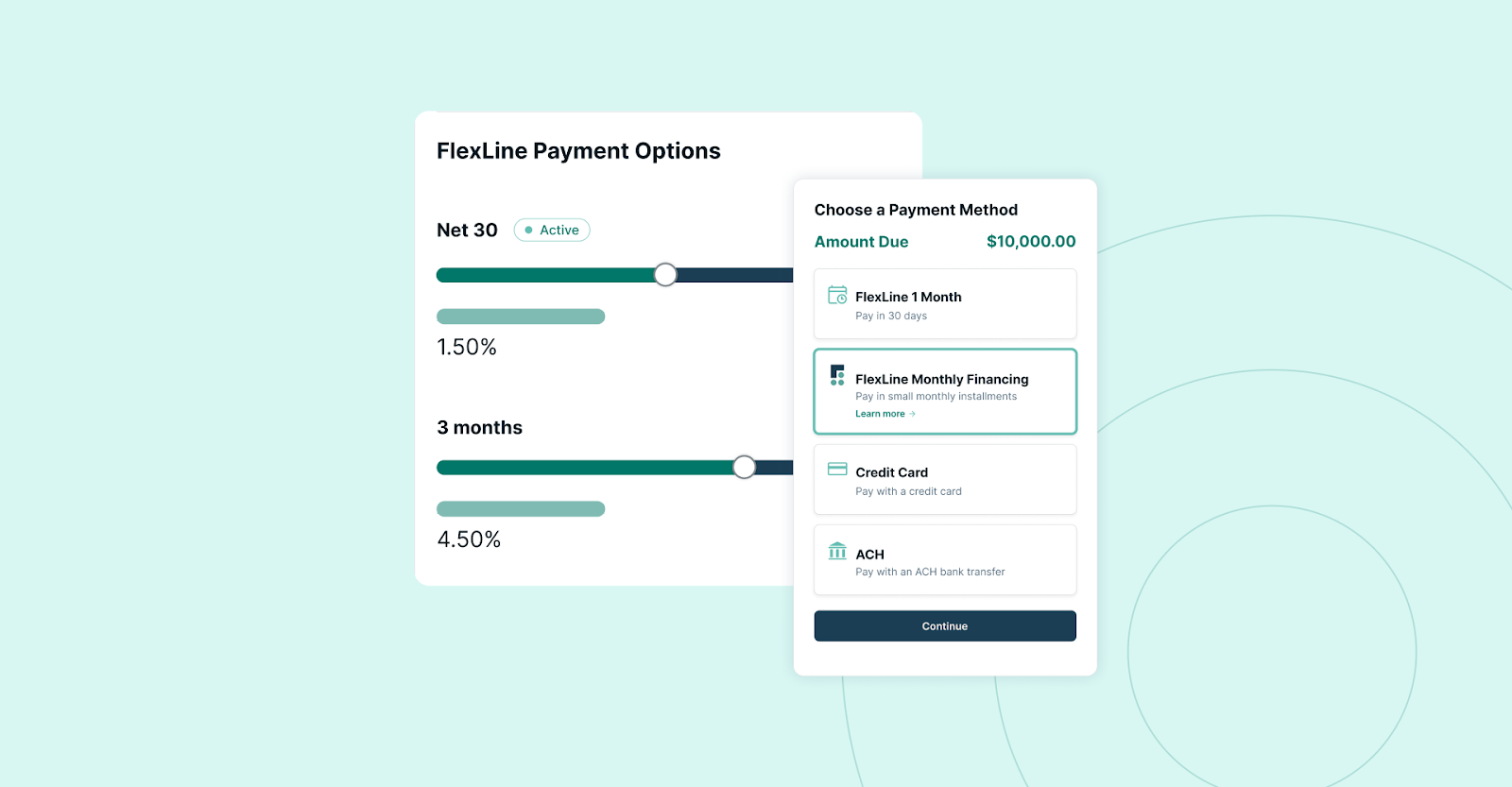

FlexPoint helps MSPs maintain financial control by allowing MSP clients to choose their own preferred method of financing (up to 12 months) when they are ready to make payments.

The financing is handled by FlexPoint, meaning the installment plans are collected by FlexPoint according to the pre-defined schedule chosen by the client. Meanwhile, the MSP receives the full amount upfront, thereby eliminating the need to collect periodic payments from the client.

In short, the platform streamlines installment plan management into a predictable revenue process for MSPs. FlexPoint eliminates the risk of delayed payments and simplifies MSP installment payment plans.

FlexPoint offers the following key features to ensure that MSPs can provide flexible payment options to clients without compromising cash flow:

Automated Payment Scheduling for Installments:

FlexPoint streamlines installment plan execution by enabling MSP clients to configure payment terms directly within the platform.

With FlexLine Financing, clients can finance invoices over $10,000, spreading payments over time rather than paying the full amount upfront. FlexPoint automatically generates and sends invoices on schedule.

Real-Time Forecasting:

FlexPoint’s real-time dashboard tracks revenue and invoice statuses, providing clear visibility into future cash flow.

The platform’s analytics also flag payment delays, enabling proactive planning and management. The platform offers real-time visibility to help MSPs avoid financial surprises.

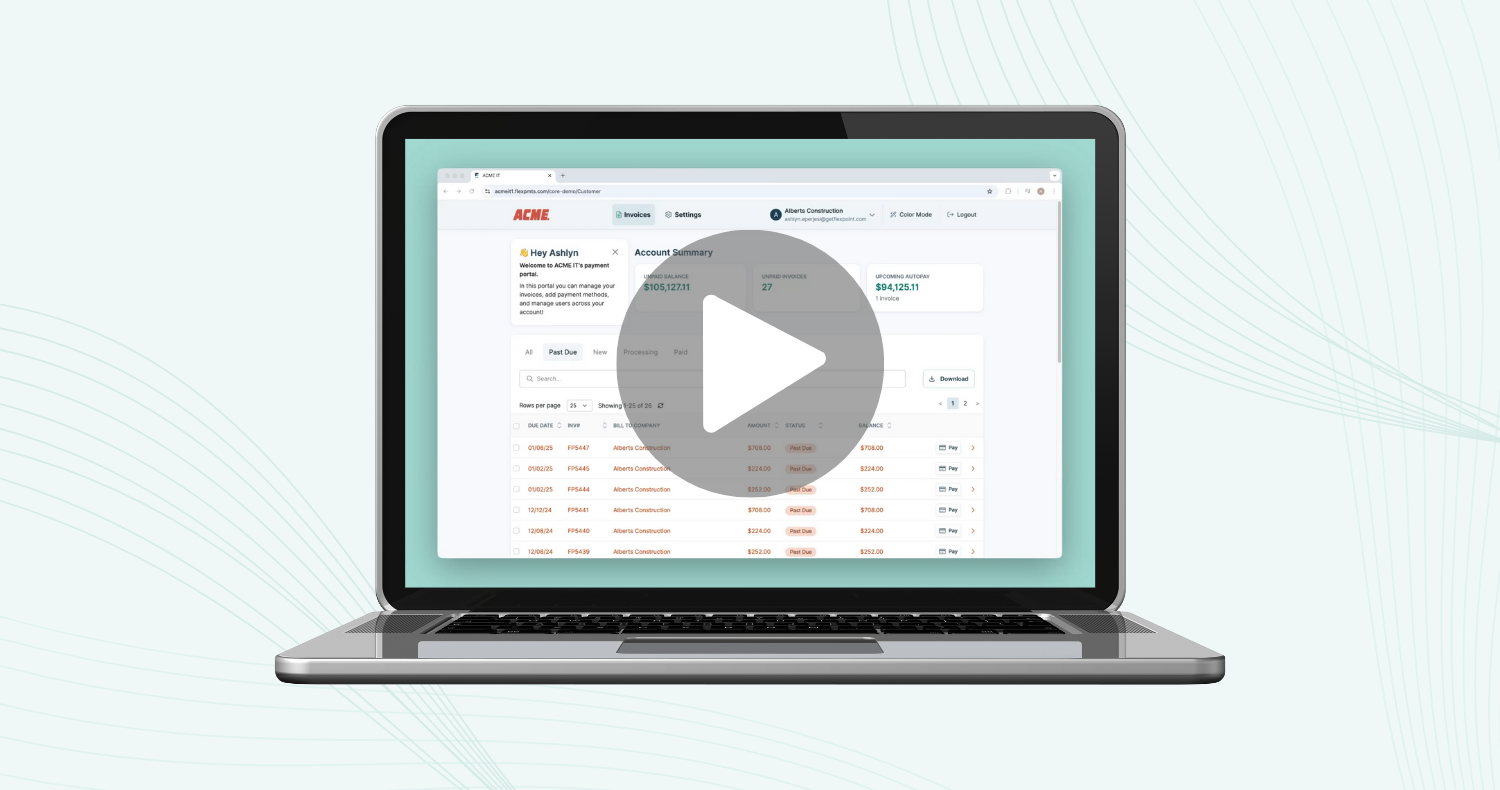

Client Payment Portals:

FlexPoint’s branded client portal enables clients to view their invoices, upcoming payment dates, payment amounts, and transaction history in real-time.

Clients can apply for FlexLine Financing directly within the portal, streamlining the process of opting for installment plans without added complexity.

The portal enhances client trust, convenience, and retention by facilitating secure payments via ACH or credit card with ease.

Conclusion: Make IT Services Accessible Without Compromising Financial Stability

Installment payment plans provide MSPs with a powerful way to meet client needs, attract new business, and grow revenue without reducing prices. However, to offer installment plans themselves requires MSPs to implement them carefully and employ the right financial strategies to avoid cash flow disruptions and maintain economic stability.

Clear payment terms, client vetting, credit risk assessment, and installment payment automation are key to managing payments effectively. Written agreements reduce disputes, and credit checks minimize risks; This is precisely where tools like FlexPoint help streamline approval, funding, and collection of installment payments for MSPs. Features like FlexLine Financing, client portals, and real-time alerts ensure timely collections and early issue detection..

This is precisely where tools like FlexPoint help streamline approval, funding, and collection of installment payments for MSPs. Features like FlexLine Financing, client portals, and real-time alerts ensure timely collections and early issue detection.

For MSPs seeking to differentiate themselves in competitive markets, installment payment plans with FlexPoint’s FlexLine Financing offer a client-friendly growth strategy. It improves accessibility, boosts conversion rates, and enhances client retention, delivering clear business value.

Want to offer flexible payment options without hurting your cash flow?

FlexPoint makes it easy to create, manage, and automate installment plans for your MSP.

Schedule a demo to see how FlexPoint helps you grow revenue while maintaining financial security.

{{demo-cta}}

Additional FAQs: MSP Installment Payment Plans

{{faq-section}}

.jpg)

.avif)