.png)

For MSPs, selecting the right QuickBooks Online (QBO) subscription is about more than just picking an accounting software. It's about building a financial infrastructure that powers efficient billing, accurate reporting, and scalable growth.

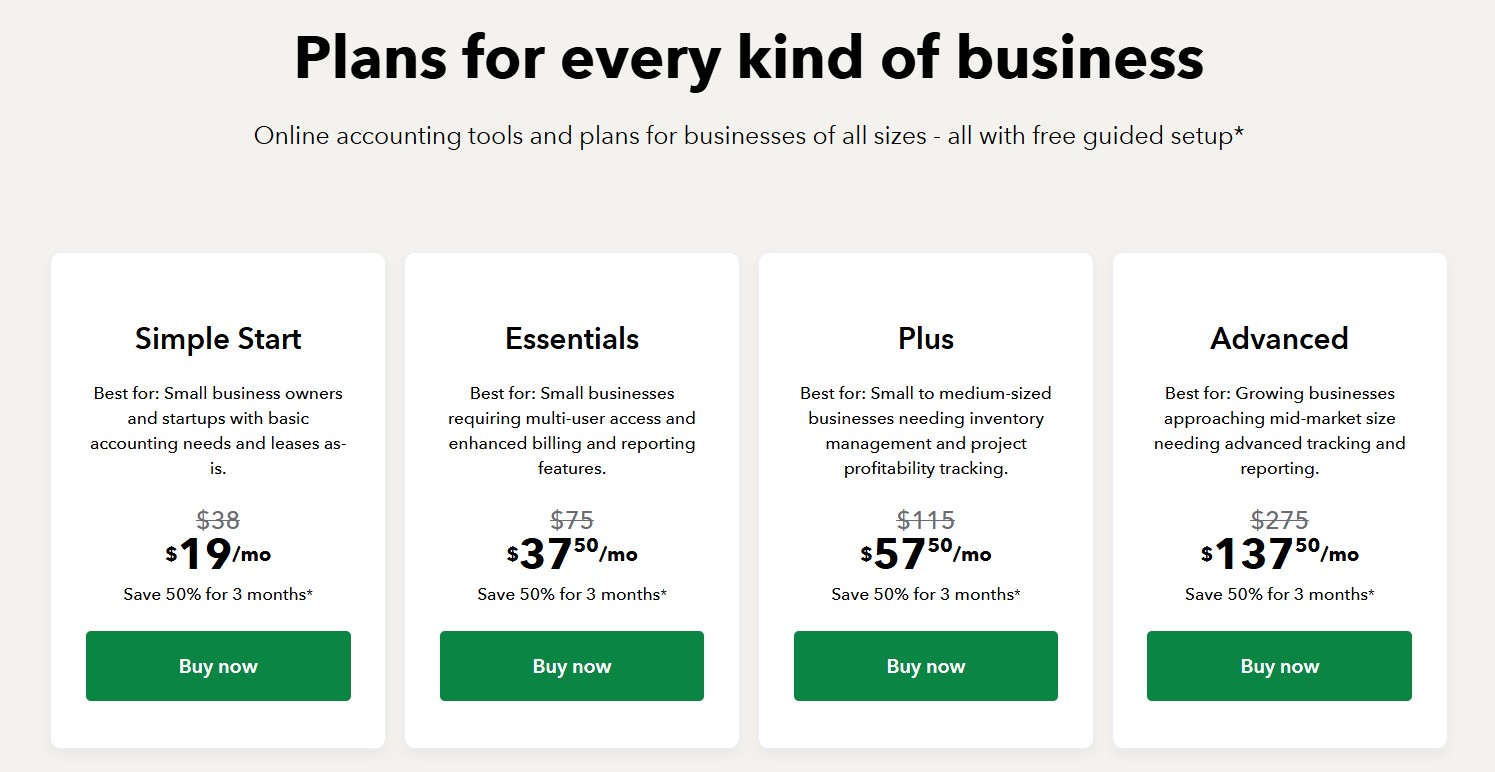

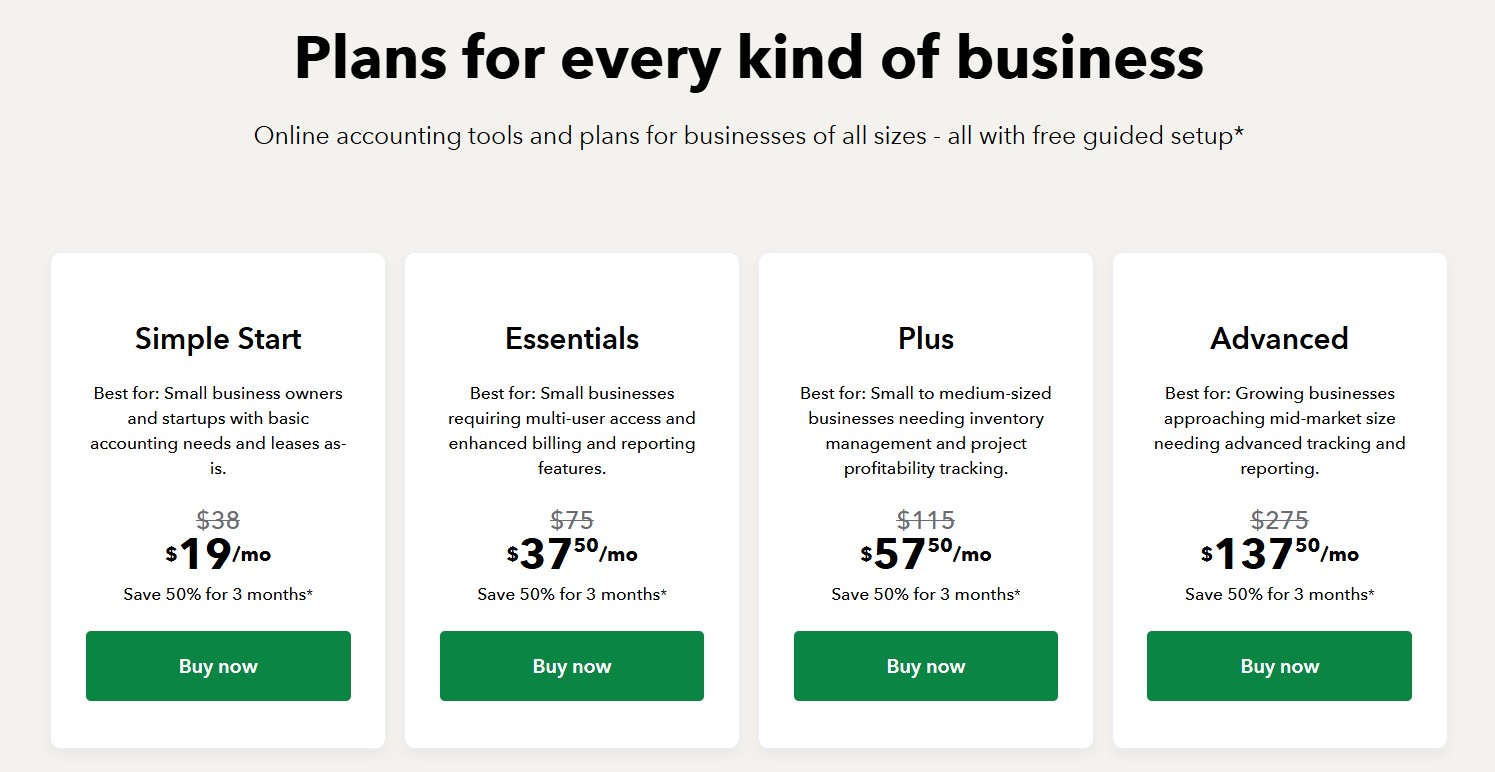

QBO offers multiple subscription tiers: Simple Start for solopreneurs/small business owners, Essentials and Plus for growing MSPs, and Advanced for enterprises with complex needs.

Choosing the wrong subscription level can lead to either outgrowing your tools too soon or overpaying for functionality you don't yet need.

In this article, we’ll guide MSPs in comparing QuickBooks Online plans by outlining the tiers, pricing, and key features for each stage of growth. We’ll also discuss how MSPs can evaluate and choose the right subscription level based on their business situation and accounting/bookkeeping needs.

{{toc}}

QuickBooks Online Plans Overview: What MSPs Need to Know

QuickBooks Online structures its offerings across four primary subscription tiers, each targeting specific business profiles and operational complexity.

Understanding these distinctions helps MSPs identify the starting point for evaluation.

Simple Start Plan

- Simple Start is built for solopreneurs or very small MSPs with minimal accounting complexity. The plan enables MSPs to handle essential tasks such as sending invoices, tracking income and expenses, and generating basic reports.

- Price: $38/month

- Best for: Early-stage MSPs managing a handful of clients with straightforward billing needs.

Essentials Plan

- Essentials expands the functionality with multi-user access (up to 3 users) and adds bill management and time tracking features. The plan is a good fit for small MSPs with growing teams that need shared accounting access and more organized accounts payable.

- Price: $75/month

- Best for: MSPs transitioning from manual accounting who need better control over bills, time entries, and collaboration.

Plus Plan

- Plus introduces project profitability tracking, inventory management, and up to 5 user accounts, making it ideal for MSPs managing equipment, licenses, or recurring service projects.

- Price: $115/month

- Best for: Mid-sized MSPs needing deeper insight into costs, margins, and client profitability.

Advanced Plan

- Advanced is QuickBooks Online's most powerful tier, designed for established MSPs with complex accounting, larger teams, and high transaction volumes. The plan includes advanced reporting, workflow automation, and dedicated support for enterprise-level operations.

- Price: $275/month

- Best for: Mature MSPs needing scalable accounting with deep automation and data visibility.

Features and Limitations of Each QBO Plan: Summary Table

Detailed Comparison: Features and Pricing of QuickBooks Online Plans

Selecting the right QuickBooks Online plan requires understanding exactly what each tier delivers and where feature gaps emerge.

Here's a comprehensive side-by-side comparison of subscription options for MSPs.

Pricing Structure (2025 Current Rates) for QuickBooks Online

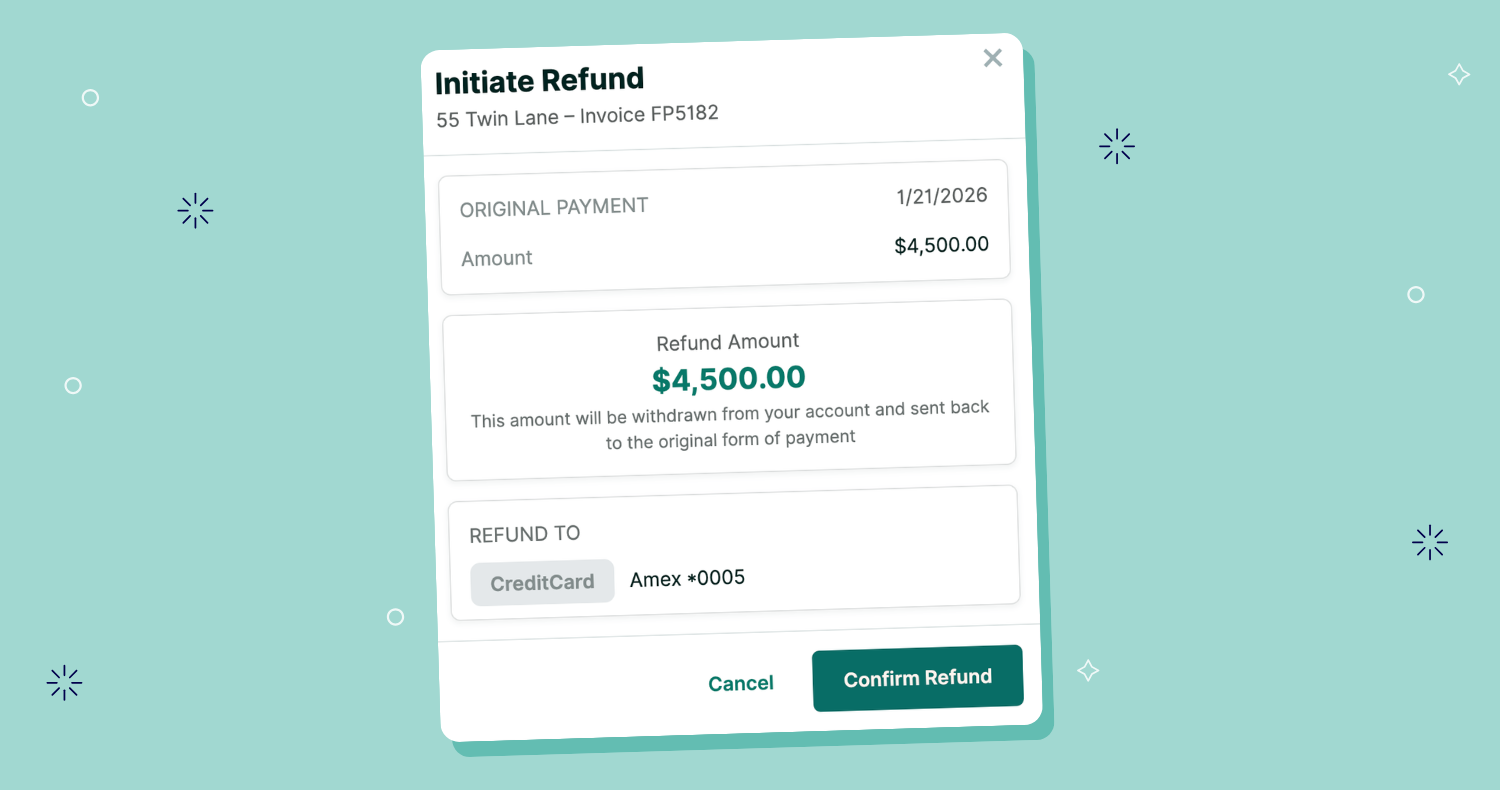

Note: QuickBooks frequently offers promotional discounts (typically 50% off for 3 months) for new subscribers.

Promotional rates eventually expire and revert to standard monthly pricing.

Feature Comparison : QuickBooks Online Plans

Core Accounting Features

Enhanced Capabilities

Reporting and Analytics

Support and Integrations

Scalability Considerations

- Simple Start: The single-user limit makes this unsuitable for most MSPs beyond the solopreneur phase. No bill management or time tracking significantly limits operational utility for service businesses.

- Essentials: 3-user access supports small teams (owner, bookkeeper, admin). Bill management and time tracking unlock MSP-critical functionality, making this the minimum viable tier for most service providers.

- Plus: Five-user access accommodates growing teams. As MSPs mature, project profitability tracking becomes essential, enabling detailed analysis of client and service line profitability. Inventory management supports equipment tracking.

- Advanced: The 25-user limit and unlimited chart of accounts support enterprise-scale operations. Custom permissions, workflow automation, and real-time dashboards provide the sophistication that growing MSPs eventually require.

Suitability for Different MSP Profiles

Note: Cheaper QBO plans may lack essential features, so MSPs must balance price with long-term needs.

Upgrading mid-year creates workflow disruption. Most MSPs benefit from choosing a tier one level higher than their current needs to accommodate 12-18 months of growth.

How to Choose the Right QuickBooks Online Plan for Your MSP

Selecting the ideal accounting software is paramount for managing your MSP's financial health.

While QBO serves as a critical accounting tool, choosing the right subscription tier is essential for effective financial management. It requires a strategic evaluation based on your operational complexity and growth trajectory.

This step-by-step framework focuses on key factors to ensure your QBO plan is a long-term asset.

1. Assess Business Size and User Needs

Selecting the right QuickBooks Online plan for your MSP begins with understanding your business size and user needs. Determine how many team members require access, what roles they play, and what level of permission each should have.

For smaller teams or owner-managed MSPs, basic access may be sufficient. Growing organizations with multiple technicians or finance staff, however, will benefit from plans that offer multi-user support and role-based controls.

2. Define Workflow and Automation Requirements

Consider how your business bills clients, whether through recurring contracts, usage-based billing, or project-based services.

Then identify the level of automation and reporting you need. Evaluate how well each QuickBooks Online plan integrates with your PSA tools, and whether it can handle reconciliation and data synchronization automatically.

MSPs that rely heavily on detailed financial insights and automation will require higher-tier solutions to maintain efficient operations.

3. Project Future Growth and Scalability

It's equally important to project your future growth. Select a QuickBooks online plan that not only suits your current operations but also scales with your expanding client base.

Higher-tier plans, such as QuickBooks Online Plus or Advanced, allow you to add users and access more detailed reports. They also help automate complex workflows without the need to switch platforms later.

Investing in scalability early prevents disruptions as your business evolves.

4. Compare the Total Cost of Ownership (TCO)

Finally, compare the total cost of ownership, not just the monthly subscription fee, along with the time and resources saved through automation and reduced manual work.

The right plan should deliver efficiency and financial clarity, freeing your team to focus on client satisfaction and service delivery rather than administration.

When selecting your QuickBooks Online plan, prioritize long-term flexibility and fit over the lowest price. The best choice is one that supports your MSP's operations today while laying a solid foundation for future growth and automation.

FlexPoint + QuickBooks Online: Enhance Any Plan With Automated Billing

FlexPoint transforms any QuickBooks Online plan into a comprehensive, automated billing and reconciliation system specifically designed for MSPs.

Whether you use Simple Start, Essentials, Plus, or Advanced, FlexPoint unifies your PSA, payments, and accounting data into a single, streamlined, cloud-based financial hub.

- Universal Compatibility: FlexPoint integrates seamlessly across all QuickBooks Online tiers. The platform automates billing, collections, and reconciliation without disrupting your existing setup. As your MSP grows or upgrades plans, your billing workflows remain consistent, accurate, and efficient.

- Streamlined Billing Workflows: From recurring retainers to complex usage-based or project-based billing, FlexPoint handles it all automatically. Invoices, payments, and deposits sync in real time with QuickBooks Online, eliminating manual entry, reducing errors, and accelerating cash flow.

- Integration With PSA Tools: FlexPoint integrates with leading PSA platforms, including ConnectWise PSA, Autotask, SuperOps, and HaloPSA. This ensures service tickets, time entries, and agreements flow directly into QuickBooks Online. This alignment ensures that financial and operational data are in sync.

- Branded Client Portal: Provide clients with a professional, branded payment experience. Through FlexPoint's client portal, customers can view invoices, enable AutoPay, update payment methods, and download statements, simplifying collections and improving transparency.

- Flexible Payment Options: Support a variety of payment methods, including ACH (Same-Day ACH), credit cards, and installment or financing options. This flexibility helps clients pay faster and ensures a predictable cash flow.

- Real-Time Reconciliation & Insights: Automated reconciliation and live dashboards provide immediate visibility into invoices, payments, and cash flow. With FlexPoint + QuickBooks Online, you can make confident financial decisions backed by real-time data accuracy.

- Scalable and Future-Ready: Whether you're managing 10 or 100 clients, FlexPoint scales effortlessly with your QuickBooks Online plan. The platform automates high-volume billing and reconciliation, supporting growth without adding administrative strain.

FlexPoint empowers MSPs to maximize the value of any QuickBooks Online subscription. It simplifies billing, improves cash flow, and delivers complete financial visibility across every client and service line.

Conclusion: Make the Most of Your QuickBooks Online Subscription

Choosing the right accounting solution is more than just picking software. It's about building a foundation for your MSP to scale with confidence.

As your MSP business grows, you'll need systems that deliver financial accuracy, optimize cash flow, and erase the manual effort that holds teams back.

Across any QuickBooks Online plan you select, FlexPoint brings the automation layer your MSP demands. With its direct integration with QuickBooks, FlexPoint handles invoicing, payment collection, real-time surcharge and fee calculations, and reconciliation.

FlexPoint automates core financial tasks, including invoicing, billing, and payment processing. This helps MSPs achieve greater efficiency and success with any QuickBooks Online subscription plan.

Excellent Networks, a Texas-based MSP, for instance, was struggling with inefficient payment collection. They relied primarily on mailed checks, which sometimes got lost, and on manually processing credit cards in QuickBooks, which incurred high fees.

This manual multitasking, combined with the lack of a streamlined invoicing system, led President Mark Luna to seek a tool to improve invoicing.

After switching to FlexPoint, Mark found the onboarding process simple, requiring just a few clicks to set up, log in, and sync invoices.

The FlexPoint integration with QuickBooks Online was seamless, automatically syncing approved invoices, depositing payments, and reconciling transactions in real time.

The results: Excellent Networks now processes payments 80% faster. Mark saves 24 hours per year on manual billing work.

Excellent Networks isn't alone; MSPs across the country utilize FlexPoint to simplify billing, expedite payments, and save valuable time each month.

Ready to get more from QuickBooks Online?

Schedule a demo to see how FlexPoint streamlines your MSP's operations.

Additional FAQs: Comparing QuickBooks Online Plans for MSPs

{{faq-section}}

.png)